Process Improvement and Automation Support the Mission at Trez Capital 🚀

Case Studies

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Summary

As a leading North American real estate lending firm, investment management, loan accounting, and loan disbursements are at the core of Trez Capital’s operations. The firm distributes capital based on very specific criteria. But with over 300 investments in one quarter alone, they process numerous payment requests and deal with documents in varied data formats.

Trez was relying on manual processes and email for document handling of mission critical workflow which offered an opportunity to enhance security and reduce disbursement cycle times, thereby improving efficiency and customer satisfaction.

Challenge

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Solution

Together with Trez, we delivered redesigned and improved approval processes, implemented a centralized payment platform using Microsoft Power Apps and Automate for streamlined management, and established robust data dashboards for real-time insights.

Impact

With this project, Trez addressed the opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Our Vision for Streamlined Payment Processes

Working with Trez team members, we developed a vision for the future of payment disbursement for real estate investment firms. We are focused on solutions that prioritize user-friendliness, easy customization and configuration, automated workflows, and seamless collaboration with external parties.

Blanc Labs delivered a quality solution in a short period of time. They worked closely with our team and were able to adapt to our changing timelines. They have been very supportive in the post-deployment process too. I wouldn’t hesitate to recommend Blanc Labs.

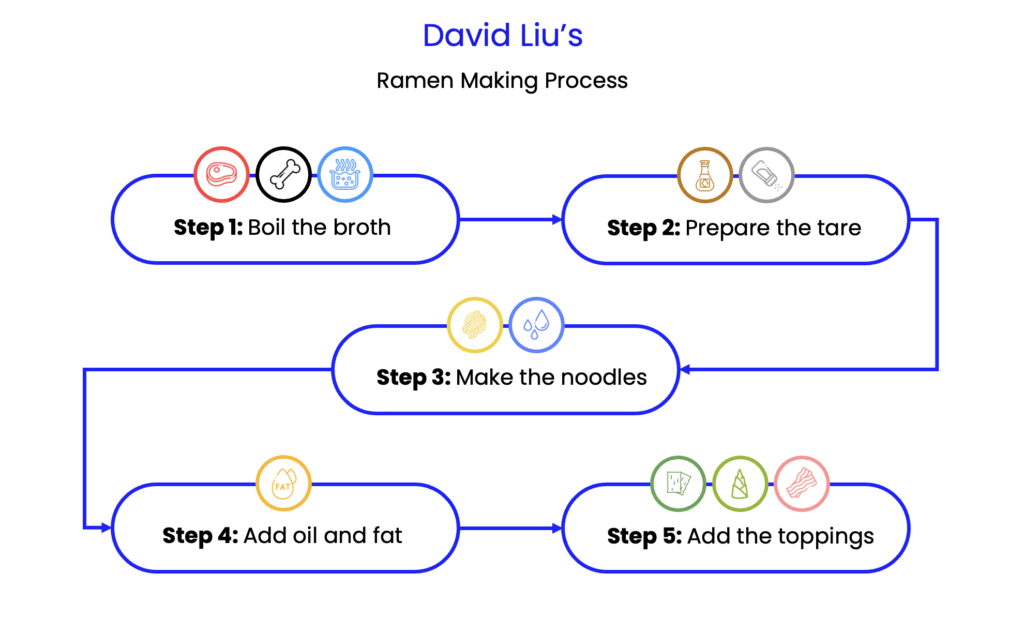

Redesigning the Payments Approval Process

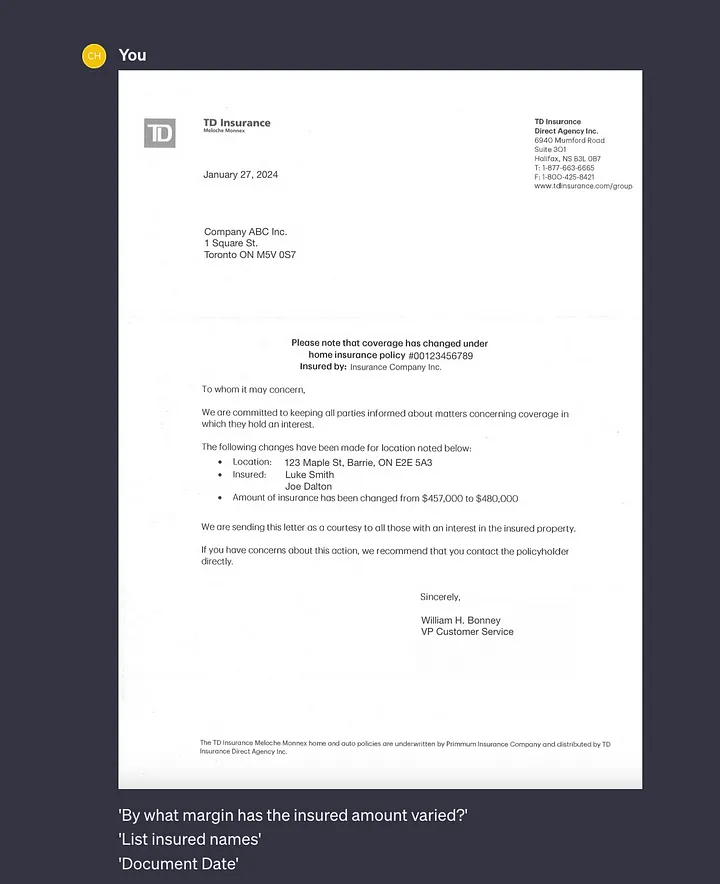

The solution involved a comprehensive redesign of the approval process, starting with interviews with senior stakeholders to understand their views on the current process and its operational impact. We then created various payment scenarios, considering factors like amount, bank, and wire templates, to assess the effectiveness of multilevel approvals.

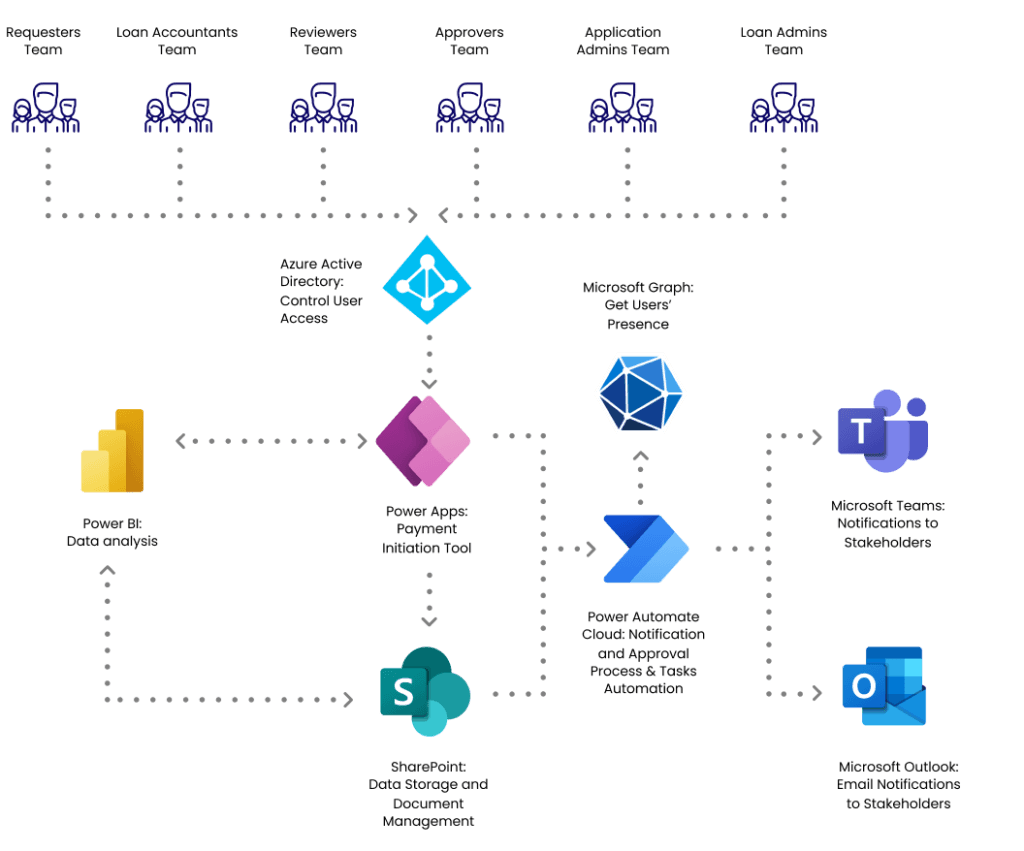

Aligning with Trez’s Enterprise Technology Strategy and Solution Approach

As a leading Microsoft partner to Financial Services firms, Blanc Labs used cutting-edge enterprise tools such as Power Automate, Power Apps and Power BI to deliver streamlined business processes, enhance workflow efficiency, and reduce manual interventions in the new loan payments solution for Trez.

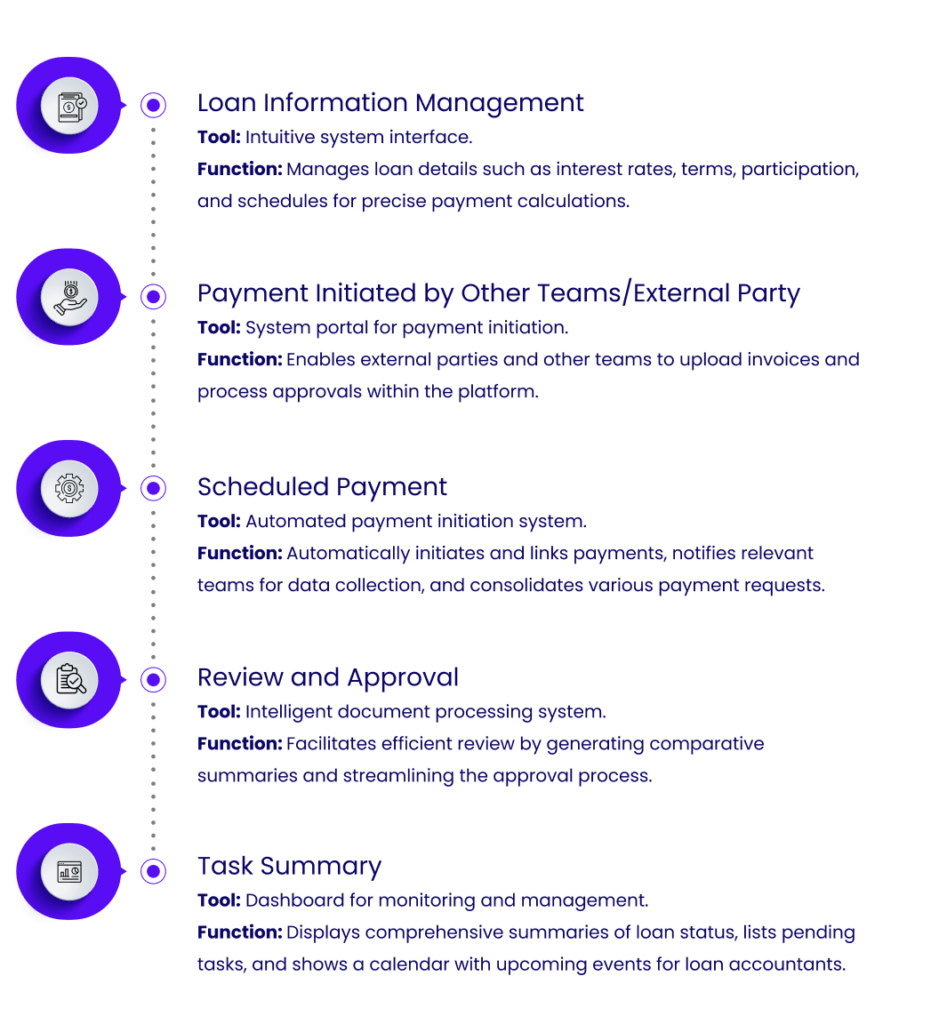

The Trez Capital Payments solution utilizes Microsoft Power Apps and Power Automate to create a centralized platform that simplifies the management of payment requests, approvals, and communication. Microsoft Power Apps enables rapid application development through a low-code/no-code environment, focusing on functionalities like loan information management, and request and approval workflows.

Microsoft Power Apps provides a rapid low-code/no-code solution for application development, encompassing key functionalities such as loan information management, request and approval creation, and settings configuration.

High Level Payments Solution Architecture

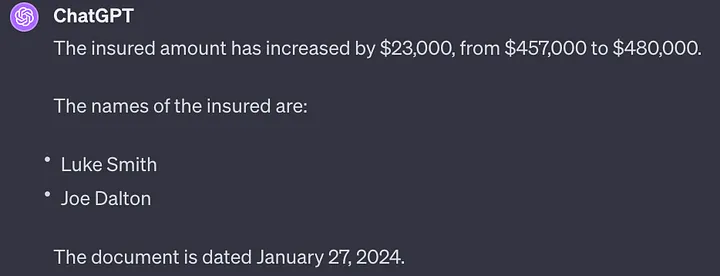

Adopting a Data Driven Approach to Continuous Improvement

For enhanced performance management, we’ve implemented a robust dashboard using Microsoft PowerBI, empowering Trez Capital with comprehensive insights into their processes and performance

The dashboard showcases a range of Key Performance Indicators (KPIs) derived from activity data within the tool. These include generic transactional metrics such as the number of requests processed per day and the total amount of payments processed per day. In addition to these, the dashboard provides process quality KPIs like the cycle time for processing payments and the percentage of payments circled back to initiators.

Process Improvement and Automation Support with Blanc Labs

Latest Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Finding the right API Management Platform

5 Factors to Evaluate Open Banking Readiness in Canada

Open Banking in Canada: How Banks and Customers Can Benefit

4 Ways APIs Can Improve Your Bank

Challenges in Digital Lending

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Finding the right API Management Platform

5 Factors to Evaluate Open Banking Readiness in Canada

Open Banking in Canada: How Banks and Customers Can Benefit

4 Ways APIs Can Improve Your Bank

Challenges in Digital Lending

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

“We relied on Blanc Labs’ expertise and experience to advise us on the internal resources needed to complete the work and to set a pace that would be manageable. The team is extremely knowledgeable from a programming/technical perspective. The technical documentation was very detailed and will be very useful as we grow our internal RPA programming expertise.”

“We relied on Blanc Labs’ expertise and experience to advise us on the internal resources needed to complete the work and to set a pace that would be manageable. The team is extremely knowledgeable from a programming/technical perspective. The technical documentation was very detailed and will be very useful as we grow our internal RPA programming expertise.”