Lending Software Development Services

Blanc Labs offers a comprehensive range of technology development and strategy services specifically designed to enhance lending operations.

Modernize Your Lending Operations

Our lending software development services are geared toward financial institutions that want to drive better results with their loan management software and processes.

By automating key aspects of the loan management lifecycle, we enhance the capabilities of banks, FI’s and credit unions to deliver an exceptional customer experience while improving employee productivity.

Explore our services to see how you can gain a competitive edge in the market.

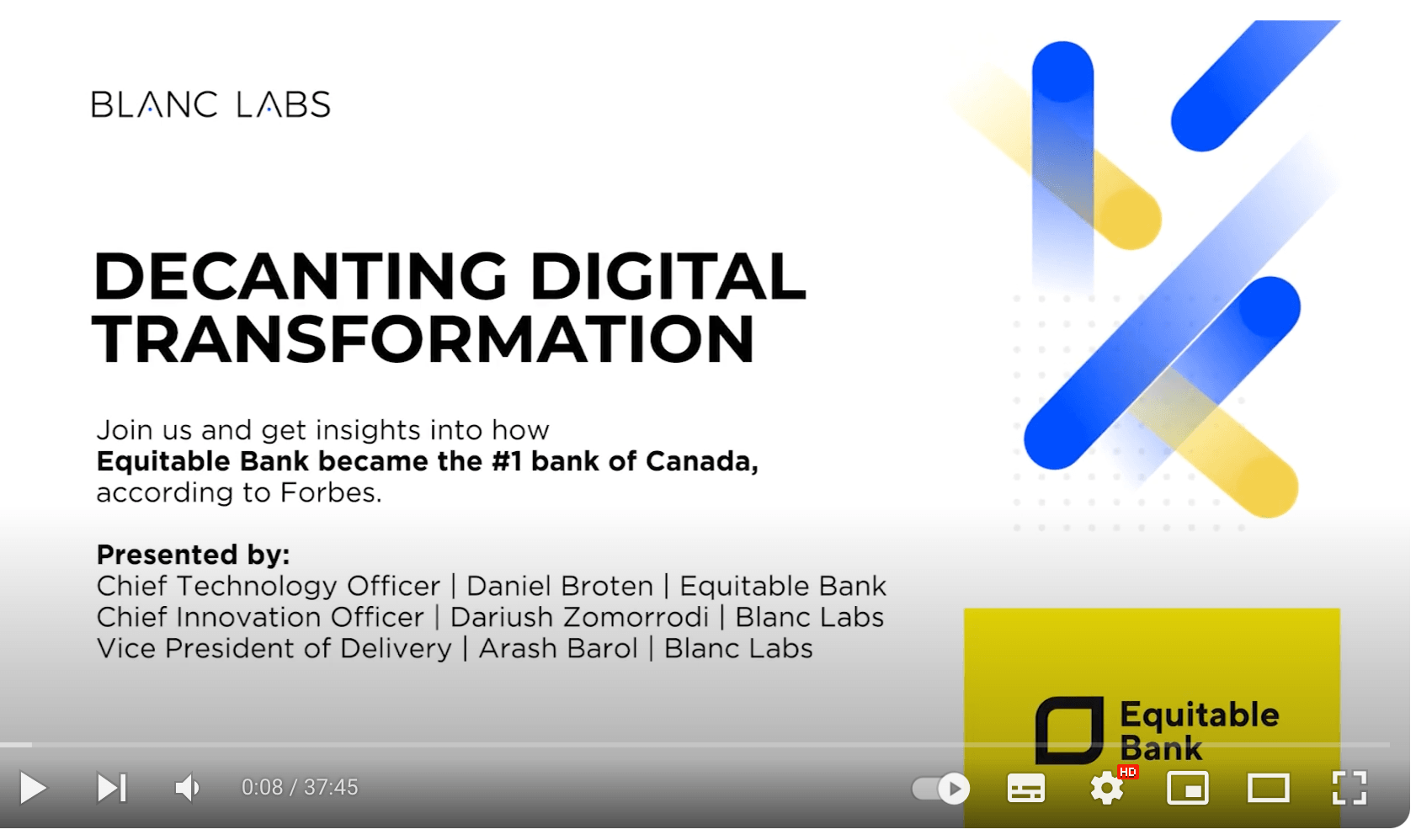

An Advanced Credit Risk Platform for EQ Bank

An Advanced Credit Risk Platform for EQ Bank

Blanc Labs spearheaded the development of EQ Bank’s Credit Risk Platform, driving their digital transformation initiatives. EQ Bank recognized the need for an enhanced commercial lending credit risk platform that would revolutionize their data governance, underwriting, decision processes, and overall client and employee experience.

As a trusted partner, Blanc Labs customized a solution that catered to EQ Bank’s unique requirements, resulting in a state-of-the-art platform that empowers them to optimize their operations and deliver exceptional services to their clients and employees.

Lending Transformation Outcomes

Our Lending Solutions

We are experts at implementing systematic controls for risk rating throughout the underwriting process and other credit events for residential mortgages, commercial lending, and the alternative lending industry. Our solutions are designed with compliance guidelines such as Basel II regulations and AIRB in mind.

We streamline operations while ensuring data lineage and integrity across channels by reducing the need for re-keying crucial data across various systems and tools through the loan lifecycle.

We develop and integrate mortgage lending software that addresses the entire loan life-cycle, including origination, underwriting, portfolio management, and claims management.

A particular area of focus is around simplifying and automating the mortgage underwriting processes as a competitive differentiator. By using automation, intelligent document processing, and document management solutions to augment and enhance a client’s lending technology and process, we are able to deliver a more seamless experience for the customer, better employee productivity, and reduced operational costs.

We specialize in embedding API-driven digital lending solutions within user journeys. Our seamless backend integrations support the entire process, from loan origination to settlement, ensuring safe scalability.

Our lending solution can provide you with real-time data and valuable insights for regulatory compliance and user behavior analysis. We customize lending management workflows with flexible rules and parameters to meet your specific needs.

Blanc Labs offers comprehensive core lending modernization services, empowering financial institutions to upgrade their legacy systems and embrace cutting-edge technologies.

Our expertise includes revamping loan origination, underwriting, and servicing processes, enhancing operational efficiency, mitigating risks, and delivering personalized customer experiences.

We are experts in developing CRE lending software solutions, providing a range of benefits for lenders, underwriters, and risk managers. For lenders, our software enables faster deal evaluation through centralized data, robust analytics, and streamlined workflows for screening processes like comp analysis, loan sizing, and valuation.

Underwriters can evaluate deals more efficiently and accurately with our standardized and automated workflows for PD/LGD calculations, NOI analysis, scenario analysis, and credit scoring. Risk managers can embed risk management controls earlier in the lending process by integrating compliance data and risk scores.

Our specialized lending services include property valuation tools, automated advisory services, legal maintenance instruments, debt collection software, credit risk estimators, P2P lending solutions, loan comparison and monitoring software, loan calculators, payment gateway APIs, DeFi lending and borrowing solutions, credit scoring software, and invoice financing development.

With our expertise and diverse set of offerings, we cater to the unique needs of organizations, whether they are banks, credit unions, or fintechs.

Our Lending Software Development Approach

We prioritize customer-specific data at the heart of our solution. Our approach includes building a flexible and extensible data model that fully supports the unique needs of our customers.

Before constructing a solution, we meticulously capture our client’s risk calculation requirements. This ensures that our solution is tailored precisely to meet their specific needs and effectively address their risk assessment challenges.

We employ process mining and mapping techniques to understand in-house processes and data flows which allows us to work with clients to re-engineer workflows while prioritizing compliance and efficiency. Our solutions are designed with flexibility in mind, allowing for the integration of new workflows and calculation methods to meet future business needs. This ensures the adaptability and scalability of lending automation platforms as your organization evolves and expands.

During the integration phase, we prioritize creating flexibility in our solutions to integrate with Systems of Record and software applications, such as nCino, Portfolio Plus and Enterprise CRM tools like Microsoft Dynamics and Salesforce. This ensures a smooth and efficient integration process, allowing for streamlined data flow and enhanced functionality across multiple platforms.

We employ an agile methodology to expedite product delivery, allowing us to achieve early wins and rapid progress. By embracing an iterative and flexible approach, we ensure efficient development cycles, quick feedback loops, and timely delivery of valuable solutions to our clients.

Opportunities in Lending

Opportunities in Lending

Process Mapping, Mining, and Engineering

Lending is a process and data driven industry. In many cases, there are a number of overlapping commonalities in how organizations originate, underwrite and manage their loan portfolio but each company has unique nuances that are proprietary. Our teams are experts at engaging with in-house teams to comprehensively map lending workflows. From there, we adopt measurement techniques and map data flows to identify opportunities for process engineering to take advantage of new tools and automated workflows to ensure more accurate and reliable data throughout the loan lifecycle.

Accelerate Time to Market

Drive faster time to market and keep up with digital native competitors. Streamline underwriting and loan processing timelines by leveraging 3rd party data sources, aggregation, and data formatting in your loan origination software. Accelerate data analysis and reporting while minimizing errors and ensuring auditability. Improve the time to approval from borrower application to final approval, ensuring an efficient lending process.

Enable Better Business Outcomes

Establish the capability and capacity to achieve technology-enabled business outcomes. We have helped a number of lending clients create a comprehensive transformation roadmap, conduct thorough business casing, and generate momentum for successful implementations. We specialize in helping lenders realize and effectively demonstrate the true value derived from your investments in digital transformation.

Improve Productivity

We are passionate about automating labor-intensive and error-prone tasks, such as paper-heavy, redundant, unscalable, and time-consuming processes. We aim to eliminate manual and multiple data entries and reconciliations and reduce the effort it takes to manage internal and external reporting requirements. The desired outcomes are to free up operations personnel to focus on more productive work. Avoid unnecessary fees and interest charges, resulting in cost savings and improved operational performance.

Lending Industry Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

How to Automate Loan Origination Systems

Challenges in Digital Lending

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

How to Automate Loan Origination Systems

Challenges in Digital Lending

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

How to Automate Loan Origination Systems

Challenges in Digital Lending

FAQS

What is lending software?

Lending software powered by machine learning and integrated financial advisory systems enables lenders to optimize operations, enhance risk management, and deliver exceptional customer experiences by analyzing data, assessing credit risk, and providing tailored financial advice.

What is digital lending software?

Digital lending software is a specialized IT solution that facilitates and streamlines the lending process through digital channels. It offers end-to-end digital solutions for online loan applications, processing, and management while providing automated workflows and improved customer experiences.

What is commercial lending software?

Commercial lending software is a specialized tool designed to automate the lending process for financial institutions. With features like loan calculators, it streamlines management of commercial loans, ensuring efficiency, compliance, and informed decision-making, ultimately enhancing service quality.