Canadian IT services firms offer a strategic opportunity for US Banks and FIs

January 29, 2024

In today’s challenging environment, U.S. bank IT departments are under unprecedented pressure to deliver more with limited resources. Cost-effective Canadian nearshore IT support, especially from technology-rich regions like Toronto, are emerging as a compelling opportunity for U.S. banks seeking to transform their technology infrastructure and enhance operational efficiency.

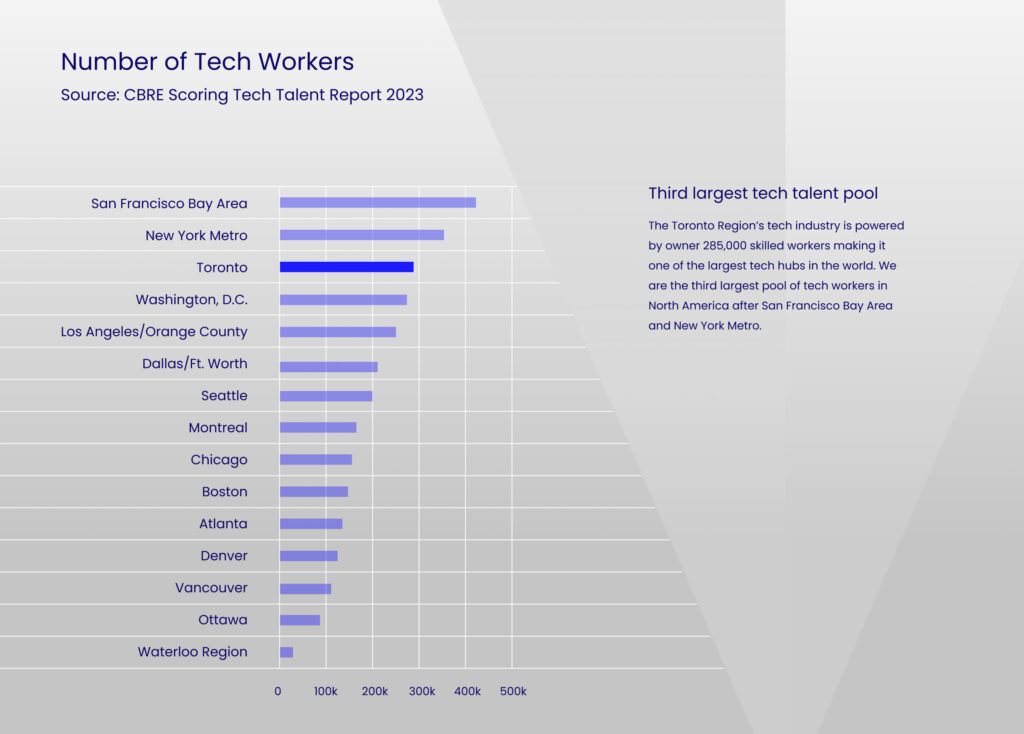

Toronto: Access to World-Class Technology Talent

Toronto is recognized globally as a Canadian center for technology and fintech companies. This world-class and fast growing city with 6.5 million citizens in 2023 is a dynamic and creative urban environment that at this point has become a self-sustaining financial technology hub, making it an ideal partner for U.S. banks seeking talent to drive their transformation roadmaps further and faster.

The region is home to top-tier universities like the University of Toronto, Waterloo and York University are renowned for their research and technology programs, providing a steady stream of skilled graduates and fostering a culture of innovation. Additionally, Toronto hosts the MaRS Discovery District, one of the world’s largest urban innovation hubs. MaRS provides a platform for tech start-ups and entrepreneurs, further solidifying Toronto’s status as a leader in technological development and innovation.

Proximity and Time Zone Alignment

Toronto’s geographical proximity, where almost any major U.S. city can be easily reached with a short, direct flight, offers significant benefits, including time zone alignment for real-time collaboration and agile project management. This is particularly advantageous compared to offshoring and other options. The ease of travel not only strengthens business relationships but also ensures effective communication and alignment, which are critical for the success of complex IT projects.

Cost-Effectiveness

Choosing Toronto for nearshore IT support allows U.S. banks to maintain high service standards while managing operational costs. The significant savings, often ranging from 30-50%, are a result of the current exchange rate differences between the U.S. and Canada, coupled with the inherent efficiencies in project management and execution. These financial benefits can be redirected towards other areas of growth and innovation.

Regulatory and Cultural Alignment

The U.S. and Canada share many regulatory and cultural similarities, which simplifies compliance standards and business practice alignment. This is vital for U.S. banks to minimize legal and operational risks in the highly regulated banking sector.

Customized and Scalable Solutions

Nearshore IT support in Toronto offers tailored, scalable solutions to meet specific banking needs. This flexibility ensures IT services adapt to the bank’s growth and changing priorities, promoting long-term sustainability. Moreover, these solutions are market-proven and highly relevant for U.S. banks, having been successfully implemented and delivering tangible results in similar banking environments.

Enhanced Security

Canadian nearshore IT support provides enhanced security, ensuring compliance with North American data protection laws. This safeguards sensitive information and customer data. Look for a SOC2 certification, which signifies a firm that can adapt to the stringent security requirements, a crucial aspect for U.S. banks in safeguarding their operations and customer information.

Looking for a Canadian tech partner? Let us help.

For U.S. banks striving to stay ahead in innovation, cost-effective Canadian nearshore IT support is a compelling strategic choice. Partnering with Toronto-based firms, such as Blanc Labs, maximizes these benefits, leading to improved efficiencies, fostering innovation, and enhancing customer satisfaction, significantly contributing to the bank’s success.

Author

Les Riedl, Managing Principal of 10XBizDEV, is dedicated to connecting US Banks with innovative, best-in-class solutions and services that contribute to their success. His extensive experience as CEO and board member in fintech and financial services consulting provides valuable insights into the sector’s evolving challenges and opportunities. As US advisor for Blanc Labs, Les is instrumental in introducing their world-class capabilities to the American market.

Related Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Blanc Labs Achieves SOC 2 Type 2 Certification

Banking Automation: The Complete Guide

The Transformative Power of Banking Automation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Blanc Labs Achieves SOC 2 Type 2 Certification

Banking Automation: The Complete Guide

The Transformative Power of Banking Automation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.