Banks are process-driven organizations. Processes ensure accuracy and consistency across the organization. They are also repetitive. Over the past decade, the transition to digital systems has helped speed up and minimize repetitive tasks. But to prepare yourself for your customers’ growing expectations, increase scalability, and stay competitive, you need a complete banking automation solution.

Systems powered by artificial intelligence (AI) and robotic process automation (RPA) can help automate repetitive tasks, minimize human error, detect fraud, and more, at scale. You can deploy these technologies across various functions, from customer service to marketing.

Many, if not all banks and credit unions, have introduced some form of automation into their operations. According to McKinsey, the potential value of AI and analytics for global banking could reach as high as $1 trillion.

If you are curious about how you can become an AI-first bank, this guide explains how you can use banking automation to transform and prepare your processes for the future.

What is Banking Automation?

Banking automation involves automating tasks that previously required manual effort.

For example, banks have conventionally required staff to check KYC documents manually. However, banking automation helps automatically scan and store KYC documents without manual intervention.

Cost saving is generally one of RPA’s biggest advantages.

According to a Gartner report, 80% of finance leaders have implemented or plan to implement RPA initiatives.

The report highlights how RPA can lower your costs considerably in various ways. For example, RPA costs roughly a third of an offshore employee and a fifth of an onshore employee.

You can make automation solutions even more intelligent by using RPA capabilities with technologies like AI, machine learning (ML), and natural language processing (NLP). According to a McKinsey study, AI offers 50% incremental value over other analytics techniques for the banking industry.

With that in mind, let’s look closely at RPA and how it works.

Generative AI and Banking Automation

The latest trend in banking automation is the use of Generative AI.

According to Insider Intelligence’s ChatGPT and Generative AI in Banking report, generative AI will have the greatest impact on data-rich sectors such as:

- Retail banking and wealth: Generative AI can create more accurate NLP models and help automated systems process KYC documents and open accounts faster.

- SMB banking: Generative AI can help interpret non-numeric data, like business plans, more effectively.

- Commercial banking: Generative AI will enable customers to get answers about financial performance in complex scenarios.

- Investing banking and capital markets: Banks could use generative AI to stress test balance sheets with complex and illiquid assets.

Banks are already using generative AI for financial reporting analysis & insight generation. According to Deloitte, some emerging banking areas where generative AI will play a key role include fraud simulation & detection and tax and compliance audit & scenario testing.

What is RPA?

Robotic process automation, or RPA, is a technology that performs actions generally performed by humans manually or with digital tools.

Say you have a customer onboarding form in your banking software. You must fill it out each time a customer opens an account. You’re manually performing a task using a digital tool.

RPA can perform this task without human effort. The difference? RPA does it more accurately and tirelessly—software robots don’t need eight hours of sleep or coffee breaks.

You can implement RPA quickly, even on legacy systems that lack APIs or virtual desktop infrastructures (VDIs).

Implementing RPA can help improve employee satisfaction and productivity by eliminating the need to work on repetitive tasks.

You can use RPA in banking operations for various purposes.

For example, Credigy, a multinational financial organization, has an extensive due diligence process for consumer loans.

The process was prone to errors and time-consuming. The company decided to implement RPA and automate the entire process, saving their staff and business partners plenty of time to focus on other, more valuable opportunities.

The Need for Automation in Banking Operations

Banks need automation to:

- Deliver better customer experiences

- Increase online security

- Improve decision making

- Empowering employees

Below, are more reasons for your bank to automate operations.

To Deliver Faster, Personalized Customer Experiences

New-gen customers want banks that can provide fast financial services online.

The 2021 Digital Banking Consumer Survey from PwC found that 20%-25% of consumers prefer to open a new account digitally but can’t.

Thanks to the pandemic, the shift to digital has picked up pace. A digital portal for banking is almost a non-negotiable requirement for most bank customers.

In fact, 70% of Bank of America clients engage with the bank digitally. The bank’s newsroom reported that a whopping 7 million Bank of America customers used Erica, its chatbot, for the first time during the pandemic.

A chatbot can provide personalized support to your customers. A level 3 AI chatbot can collect the required information from prospects that inquire about your bank’s services and offer personalized solutions.

A chatbot is a great way for customers to get answers, but it’s also an excellent way to minimize traffic for your support desk.

To Improve Cybersecurity

Cybersecurity is expensive but is also the #1 risk for global banks according to EY. The survey found that cyber controls are the top priority for boosting operation resilience according to 65% of Chief Risk Officers (CROs) who responded to the survey.

Using automation to create a cybersecurity framework and identity protection protocols can help differentiate your bank and potentially increase revenue. You can get more business from high-value individual accounts and accounts of large companies that expect banks to have a top-notch security framework.

Automating cybersecurity helps take remedial actions faster. For example, the automated system can freeze compromised accounts in seconds and help fast-track fraud investigations.

Of course, you don’t need to implement that automation system overnight. With cloud computing, you can start cybersecurity automation with a few priority accounts and scale over time.

For Better Decision Making

AI and ML algorithms can use data to provide deep insights into your client’s preferences, needs, and behavior patterns.

These insights can improve decision-making across the board. For example, using these insights in your marketing strategy can help hyper-target marketing campaigns and improve returns.

Moreover, these insights help deliver greater value to customers. By making faster and smarter decisions, you’ll be able to respond to customers’ fast-evolving needs with speed and precision.

As a McKinsey article explains, banks that use ML to decide in real-time the best way to engage with customers can increase value in the following ways:

- Stronger customer acquisition: Automation and advanced analytics help improve customer experience. They help personalize marketing across the customer acquisition journey, which can improve conversions.

- Higher customer lifetime value: You can increase lifetime value by consistently engaging with customers to strengthen relationships across products and services.

- Lower operating costs: Banks can reduce costs by fully automating document processing, review, and decision-making.

- Lower credit risk: Banks can screen customers by analyzing behavior patterns that signal higher default or fraud risk.

To Empower Employees

As you digitize banking processes, you’ll need to train employees. Reskilling employees allows them to use automation technologies effectively, making their job easier.

Your employees will have more time to focus on more strategic tasks by automating the mundane ones. This results in increased employee satisfaction and retention and allows them to focus on things that contribute to your topline — such as building customer relationships, innovating processes, and brainstorming ways to address customers’ most pressing issues.

Challenges Faced by Banks Today

Here are some key challenges that banks face today and how automation can help address them:

Inefficient Manual Processes

Manual processes are time and resource-intensive.

According to the 2021 AML Banking Survey, relying on manual processes hampers a financial organization’s revenue-generating ability and exposes them to unnecessary risk.

The simplest banking processes (like opening a new account) require multiple staff members to invest time. Moreover, the process generates paperwork you’ll need to store for compliance.

While you complete the account opening process, the customer is on standby, waiting to start using their account.

The slow service doesn’t exactly make a great impression. Customers want to be able to start using their accounts faster. If you’re too slow, they’ll find a bank that offers faster service.

Automation helps shorten the time between account application and access. But that’s just one of the processes that automation can speed up.

Technologies like RPA and AI can help fast-track processes across departments, including accounting, customer support, and marketing.

Automation Without Integration

Banks often implement multiple solutions to automate processes. However, often, these systems don’t integrate with other systems.

For end-to-end automation, each process must relay the output to another system so the following process can use it as input.

For example, you can automate KYC verification. But after verification, you also need to store these records in a database and link them with a new customer account. For this, your internal systems need to be integrated.

Connecting banking systems requires APIs. Think of APIs as translators. They help two software solutions communicate with each other. A system can relay output to another system through an API, enabling end-to-end process automation.

Increase in Competition

Canadians want more competition in banking. The competition in banking will become fiercer over the next few years as the regulations become more accommodating of innovative fintech firms and open banking is introduced.

An increase in competition will give customers more power. They’ll demand better service, 24×7 availability, and faster response times.

You’ll need automation to achieve these objectives and make yourself stand out in the crowd.

Benefits of Automation in Banking

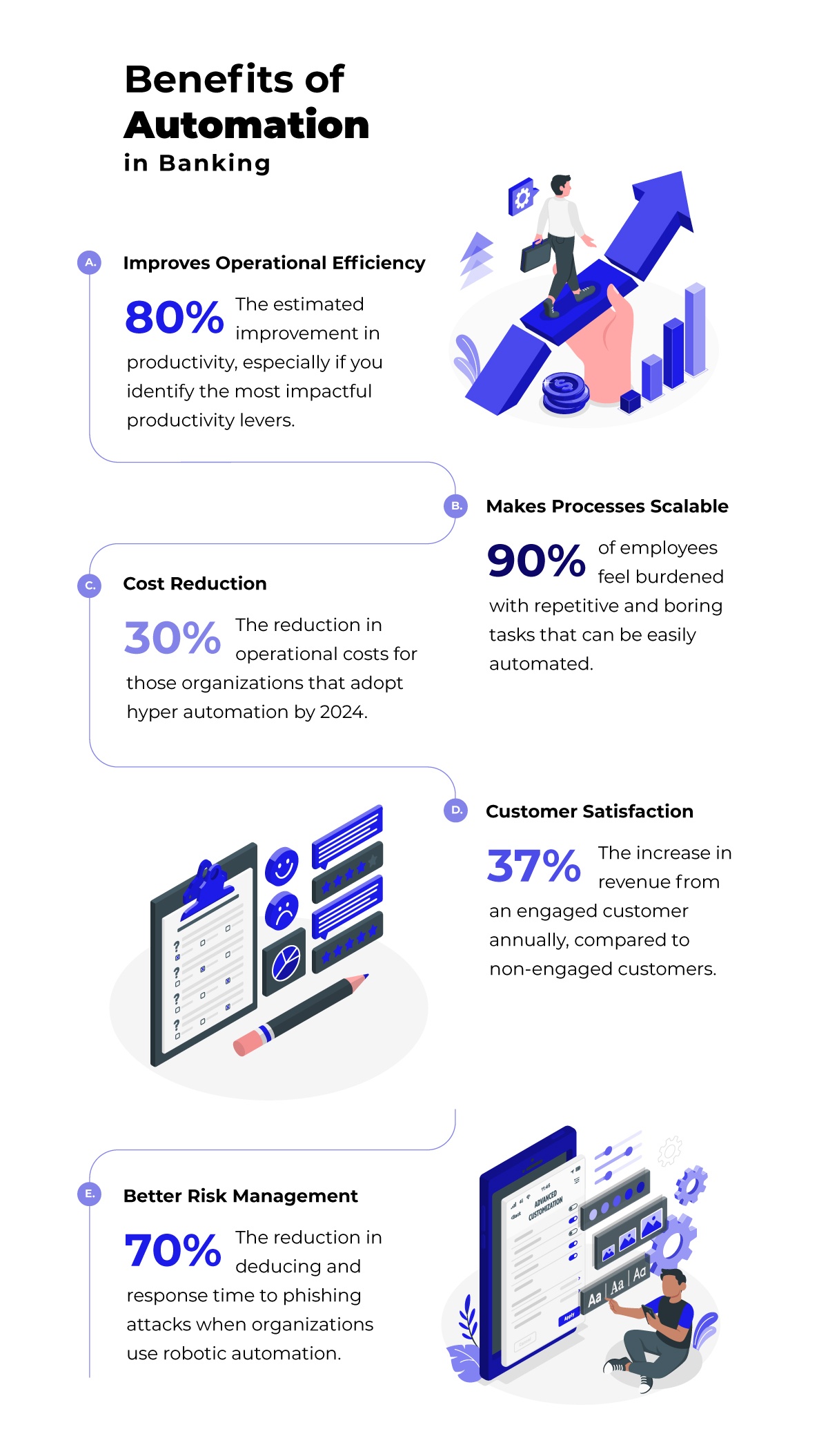

Once you invest in automation, you can expect to derive the following benefits:

Improves Operational Efficiency

An error-free automation system can supercharge operational efficiency.

You’ll have to spend little to no time performing or monitoring the process. Moreover, you’ll notice fewer errors since the risk of human error is minimal when you’re using an automated system.

Implementing automation allows you to operate legacy and new systems more resiliently by automating across your system infrastructure. This increases efficiency, consistency, and speed.

Makes Processes Scalable

Banks noticed how automation could be an excellent investment during the pandemic. As explained in a World Economic Forum (WEF) article:

“Through the combination of a distinct data element with robotics process automation, it is possible to generate client documentation from management tools and archives at a high frequency. Due to its scalability, high volumes can be managed more efficiently.”

The article provides the example of Swiss banks. During the pandemic, Swiss banks like UBS used credit robots to support the credit processing staff in approving requests. The support from robots helped UBS process over 24,000 applications in 24-hour operating mode.

In addition to RPA, banks can also use technologies like optical character recognition (OCR) and intelligent document processing (IDP) to digitize physical mail and distribute it to remote teams.

Cost Reduction

Automation helps reduce costs on multiple fronts:

a. Stationery

80% of banks still favor some form of print statements. The cost of paper used for these statements can translate to a significant amount. Automation and digitization can eliminate the need to spend paper and store physical documents.

b. Human error

Human error can require reworks and cause delays in processing customer requests. Errors can result in direct losses (like a lost sale) and indirect losses (like a lost reputation). Minimizing errors can help reduce the cost associated with human error.

c. Increased employee satisfaction

You’ll spend less per unit with more productive employees. Automation can help improve employee satisfaction levels by allowing them to focus on their core duties.

For example, a sales rep might want to grow by exploring new sales techniques and planning campaigns. They can focus on these tasks once you automate processes like preparing quotes and sales reports.

Working on non-value-adding tasks like preparing a quote can make employees feel disengaged. When you automate these tasks, employees find work more fulfilling and are generally happier since they can focus on what they do best.

Happiness makes people around 12% more productive, according to a recent study by the University of Warwick.

As Professor Sgroi explains, “The driving force seems to be that happier workers use the time they have more effectively, increasing the pace at which they can work without sacrificing quality.”

Customer Satisfaction

Automation can help meet customer expectations in various ways.

Speed is one of the most difficult expectations to meet for banks. You want to offer faster service but must also complete due diligence processes to stay compliant. That’s where automation helps.

61% of customers feel a quick resolution is vital to customer service. As a bank, you need to be able to answer your customers’ questions fast.

How fast? Ideally, in real-time.

A level 3 AI chatbot can help provide real-time, personalized responses to your customers’ questions.

In addition to real-time support, modern customers also demand fast service. For example, customers should be able to open a bank account fast once they submit the documents. You can achieve this by automating document processing and KYC verification.

Better Risk Management

Automation can help minimize operational, compliance, and fraud risk.

Since little to no manual effort is involved in an automated system, your operations will almost always run error-free.

You can also automate compliance processes. For example, you can add validation checkpoints to ensure the system catches any data irregularities before you submit the data to a regulatory authority.

Automation can help minimize fraud risk too. Using AI and ML can help flag suspicious activities and trigger alerts. As this study by Deloitte explains:

“Machine learning can also analyze big data more efficiently, build statistical models quickly, and react to new suspicious behaviors faster.”

Using traditional methods (like RPA) for fraud detection requires creating manual rules. RPA works well in a structured data environment. But given the high volume of complex data in banking, you’ll need ML systems for fraud detection.

Blanc Labs’ Banking Automation Solutions

Blanc Labs helps banks, credit unions, and Fintechs automate their processes. We tailor-make automation tools and systems based on your needs. Our systems take work off your plate and supercharge process efficiency.

Our team deploys technologies like RPA, AI, and ML to automate your processes. We integrate these systems (and your existing systems) to allow frictionless data exchange.

Book a discovery call to learn more about how automation can drive efficiency and gains at your bank.