Consulting Services

Business Process Improvement

BPI offers a data-driven approach to understanding how your people, processes, and technologies can evolve to meet the needs of your business.

What is Business Process Improvement?

Business Process Improvement (BPI) is a systematic and continuous approach that focuses on identifying, analyzing, and enhancing existing organizational processes to achieve better outcomes, streamline operations, and drive overall performance improvements.

Business Process Improvement is about fine-tuning the way things are done to create smoother workflows and better outcomes. This approach focuses on improving quality and efficiency, ensuring customers are happy, and costs are in check. It’s not just about the bottom line; it’s also about making sure the people involved in the process feel valued and satisfied. By working on these goals, Business Process Improvement aims to create a more effective and enjoyable way of getting things done in any organization.

Blanc Labs’ approach to improving business processes is to make things better step-by-step through small, continuous improvements while also being open to big changes when needed. We use data to guide our decisions, finding ways to grow and improve based on what the numbers show. We understand that improvement is an ongoing journey, and that transformation takes place over time. Our approach ensures that businesses can continuously enhance their processes in a practical and effective way that works for their unique situation.

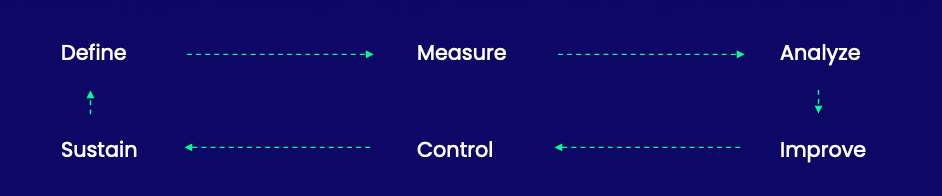

Adopt a Continuous Improvement Approach

We use BPI to discover as-is processes and provide a fact-based approach to prioritizing transformation initiatives and measuring outcomes.

Why is Business Process Improvement important?

Savings achieved through Business Process Redesign

Efficiency gained with Manual Process Automation

Savings achieved through implementation of Process Optimization Strategy

Our Business Process Improvement Approach

Identify the most suitable process area by assessing process volumes, maturity, system connection, current challenges and business priorities.

Conduct stakeholder interviews and task shadowing to grasp manual activities, pain points and wish listsrnrnSimultaneously, data is extracted from relevant IT systems to capture system activities in detail.

Visualize current process flow and uncover insights into process bottlenecks, inefficiencies, and opportunities for enhancement.

Capitalize on the insights gained from the analysis

by recommending tailored solution to address identified bottlenecks and inefficiencies

Guide and facilitate the solution implementation

to support a seamless transition towards enhanced operational efficiency

Process Automation ROI Calculator

Enter your data to get a detailed report on how much time and money you can save through process improvement and automation.

BPI Ecosystem Partners

Related Services

Intelligent Document Processing

Start with our BPI framework and transition to advanced document handling with our Intelligent Document Processing Solutions. Elevate your data management for smarter, quicker business decisions.

Enterprise Automation

Kickstart you journey with our BPI approach, identifying repetitive, manual, and rule-based tasks to unleash the power of automation. Dive into our Enterprise Automation Platform Development for a revolutionary stride in operational efficiency and productivity.

Low Code Platforms

Leveraging BPI insights as a foundation, teams can accelerate solution development with powerful Low Code tools. Empower rapid application creation and deployment, enhancing your digital capabilities and user experiences.

Latest Insights

How Open Banking Will Empower Small Businesses in Canada

With 85% of business owners seeking faster access to capital in today’s challenging economy, Open Banking offers a way out. This guide explores how it addresses issues like high inflation and slow lending processes, aiding small businesses in navigating the evolving landscape.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

How to Automate Loan Origination Systems

Banking Automation: The Complete Guide

What Is Composable Banking and Why Should I Care?

Top Use Cases of Intelligent Document Processing

How Open Banking Will Empower Small Businesses in Canada

With 85% of business owners seeking faster access to capital in today’s challenging economy, Open Banking offers a way out. This guide explores how it addresses issues like high inflation and slow lending processes, aiding small businesses in navigating the evolving landscape.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

How to Automate Loan Origination Systems

Banking Automation: The Complete Guide

What Is Composable Banking and Why Should I Care?

Top Use Cases of Intelligent Document Processing

How Open Banking Will Empower Small Businesses in Canada

With 85% of business owners seeking faster access to capital in today’s challenging economy, Open Banking offers a way out. This guide explores how it addresses issues like high inflation and slow lending processes, aiding small businesses in navigating the evolving landscape.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.