Business Process Improvement vs Business Process Reengineering

Your business’s ability to change goes a long way toward contributing to long-term success. But how do you decide whether to make small changes over the long term or if a situation calls for a radical change?

To determine this, you must understand business process improvement (BPI) and reengineering (BPR). In this guide, we explain the meaning of BPI and BPR and when to use them.

What is Business Process Improvement?

Business process improvement is an ongoing process where you make small, continuous improvements to make processes more efficient.

BPI is like fine-tuning your car’s engine to make it run smoother and faster. You start by examining the engine’s current condition. Then you find areas that could use some maintenance and perform that maintenance to improve efficiency. Of course, BPI requires careful planning and execution, so it’s always smart to have a BPI specialist by your side.

Continuous improvement and data-driven decisions are key aspects of BPI. Instead of blindly chasing market trends and investing in expensive tech, you start with introspection. You use analytics to validate the need for change. And you make small changes over time to minimize disruption.

What is Business Process Reengineering?

Business process reengineering is a comprehensive process redesign exercise that helps a business improve efficiency and overall performance significantly.

Business Process Reengineering is the radical redesign of business processes to achieve dramatic improvements in productivity, cycle times, quality, and employee and customer satisfaction.

Bain & Company

There are times when your business might need a radical change, such as:

- When you want to build a competitive advantage

- To prepare for rapid growth

- After a merger or acquisition

- Organizations restructuring

Of course, this is an inclusive list. You might choose to reengineer a process to improve productivity, comply with new regulatory requirements, or introduce new technology. However, BPR is a far more extensive process than BPI. It requires effective change management and stakeholder engagement.

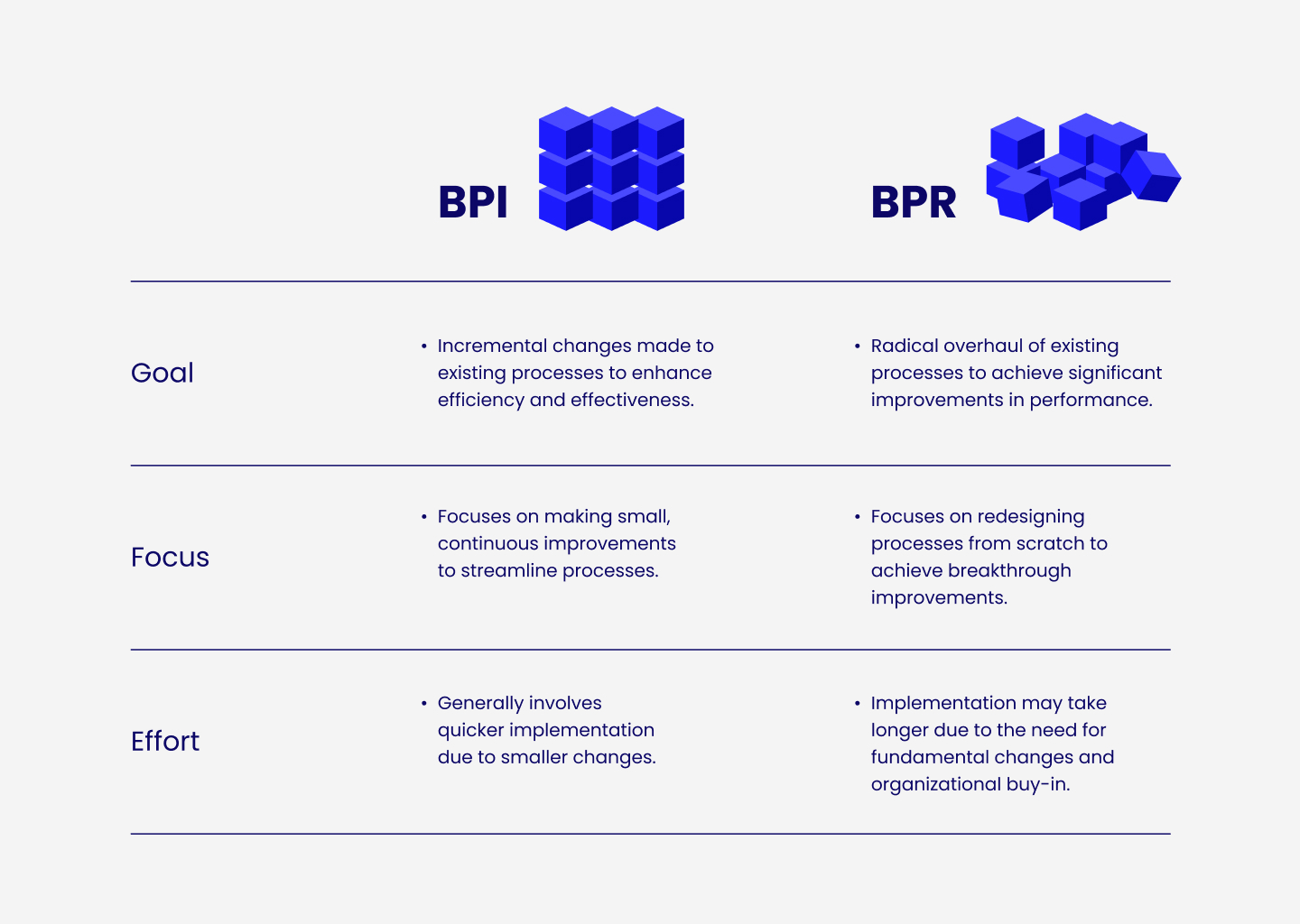

BPI vs. BPR

While BPI and BPR share some common objectives — improved efficiency and optimal resource utilization — they differ in some key areas. Here are three key aspects where BPI and BPR differ:

Level of Change

BPI is about continuously asking yourself, “How can we make this better?” even when there’s no urgency to change a process. The focus is to identify inefficiencies, bottlenecks, and areas of waste within your current processes. For example, if you’re an online retailer, BPI could involve streamlining your order fulfillment process to reduce delivery times or using a more robust CRM to improve client relationships.

BPR involves a complete overhaul. It’s like tearing down an entire house and building it from scratch. Suppose you’re a retail company that wants to improve delivery times. But instead of optimizing the order fulfillment process, you redesign the entire supply chain, from sourcing to delivery.

Be careful, though. Companies often overwhelm themselves by overestimating their capacity for change. It’s hard to determine if a process redesign is viable without understanding your capacity for change. As David Michels and Kevin Murphy explain in their HBR article:

The current business landscape is evolving so rapidly and unpredictably that executives are full of questions about change. How much? They want to know. How fast? How sustainable? And sometimes, just how? In our experience companies can’t hope to answer these questions unless they understand their own capacity for change.

Harvard Business Review

Time Frame

Implementing BPI takes less time than implementing BPR. Think of BPI as a series of quick wins. You zoom into your process, find areas for improvement, make changes, and repeat. The exact time frame may differ based on the adjustments you want to make and could take weeks or months.

BPR is a marathon, not a race. It requires redesigning the process from scratch. A successful redesign might involve significant investments in technology and training. This requires careful consideration and meticulous execution. Naturally, redesigning and executing can take a long time, typically months or even years.

Risk and Disruption

There’s a significant divergence between BPI and BPR regarding risk and divergence. Since BPI involves making small changes, the level of disruption and risk is relatively lower.

Employees are less likely to resist these small changes because BPI builds on existing structures and practices. Plus, the changes are implemented gradually, so the transition is smoother and causes minimal disruption to your business’s day-to-day operations.

On the other hand, BPR involves challenging deeply ingrained practices and questioning conventions. Employees might have to step out of their comfort zone to execute changes of that magnitude, so there’s greater risk and disruption. Before you move forward with BPR, ensure that you and your team are prepared for that change.

We believe that most firms do not proactively manage change risk in a way that’s commensurate with the benefits of success and the costs of failure. Effectively managing change risk is a necessary ‘muscle’ to reduce, preempt, mitigate, and manage the challenges that come with (intents of) transformation, without bringing decision paralysis or stifling innovation in the organization.

‘Managing Change Risk’, Oliver Wyman

BPI vs. BPR: What Will Work Best for You?

Choosing between BPI and BPR is a crucial strategic decision. There are multiple factors to consider, such as:

Need for Change

What’s the current state of the process and its inefficiencies? Fundamentally flawed or outdated processes call for BPR. Eliminating fundamental flaws or updating your entire process with incremental changes can take a long time — not practical. However, BPI is a more suitable choice when the process is relatively sound but has some areas of inefficiency.

Suppose you’re a software development company. You’re struggling with lengthy approval cycles, siloed communication, and inconsistent quality standards because of an outdated development process. This warrants a complete process overhaul — you can’t afford to compromise on quality for long, can you?

Alignment With Strategy

Does the process align with your strategic goals? If a process no longer meets your business’s evolving needs or is preventing you from achieving your goals, it’s time to reengineer the process. Conversely, if your process is fundamentally aligned with your strategic objectives, but requires optimization to improve efficiency and customer satisfaction, BPI is the way to go.

For example, BPR is a better choice for an ecommerce company that wants to differentiate itself through personalized customer experiences and finds its current sales process rigid and transactional. But BPI makes more sense if the process is already customer-centric and requires additional personalization.

Risk Appetite

Assess your risk appetite before reengineering a process — can your business accept the disruption that comes with dismantling a key process and reimplementing it? For example, if a small manufacturer plans to transition from traditional batch production to lean manufacturing, the cost of implementing the new process and the halted production can translate to a major cost for the business.

Available Resources

BPI is less resource-intensive than BPR. Even when you’re running low on cash or don’t have the expertise to implement a radical shift in your process, you can make small improvements to your process over time.

We also explore technology best practices to make your Open Banking adoption journey a success.

We also explore technology best practices to make your Open Banking adoption journey a success.