Blanc Labs and Altitude Consulting dug deep into successful models of adoption of challenger banks and found five key areas that will make or break your open banking strategy.

Gain access to our findings for advancing in the open banking race while regulators are working hard to finalize the remaining details.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

November 29, 2023When we attended the CLA Lenders Summit a few weeks ago, it seemed like everyone was ready to sign the death certificate for Open Banking in Canada. Very little, if any, material progress had been communicated on behalf of the government to create a regulatory framework or policy mandate to make good on the promise or timelines defined by an Advisory Committee on Open Banking Report which became the mandate of Abraham Tachjian, who was appointed as Canada’s Open Banking lead, by the Liberal government in 2022.

Aside from a snazzy rebrand of the open banking moniker, the policy statement on Consumer-Driven Banking outlined the goal of “adopting legislation and fully implementing the necessary governance framework by 2025”. It would seem from the update, part of the government’s motivation for moving ahead with consumer-driven banking is a focus on the affordability crises facing many Canadians. The Consumer-Driven Banking policy statement was listed under the header of “Making Life More Affordable” in the economic update. The update for Canada now seems to be following a similar path to how policy is being shaped and implemented in the US.

Our Take:

As long-term believers in the benefits of Open Banking, we are thrilled to learn of the renewed commitment to making consumer-directed banking a reality in Canada. While there is still a lot of work to be done as well as the additional hurdle of new legislation being tabled during an election cycle, we are committed to the potential benefits of Consumer Directed Banking for banking customers and the significant opportunity for innovation and collaboration in the Canadian financial services sector.

You can read the full Fall Economic Statement here but if you are short on time, ChatGPT did a pretty good job of summarizing the statement in bullets, below.

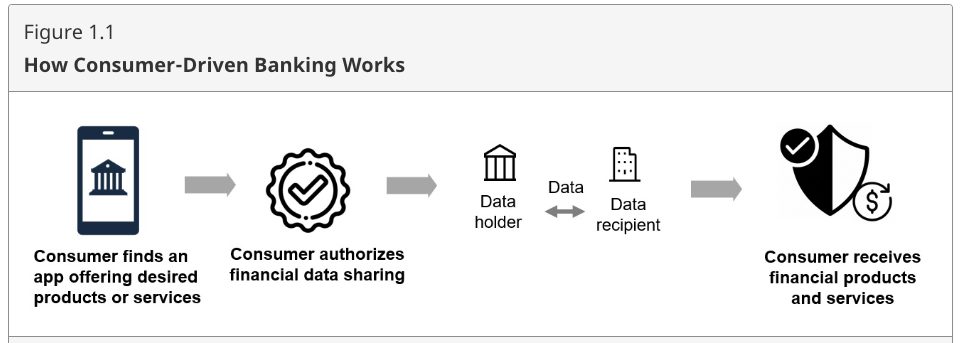

Introduction to Consumer-Driven Banking:

-

- Allows secure transfer of financial data via API.

- Aims to replace unsecure screen-scraping.

- Enables access to data-driven financial services.

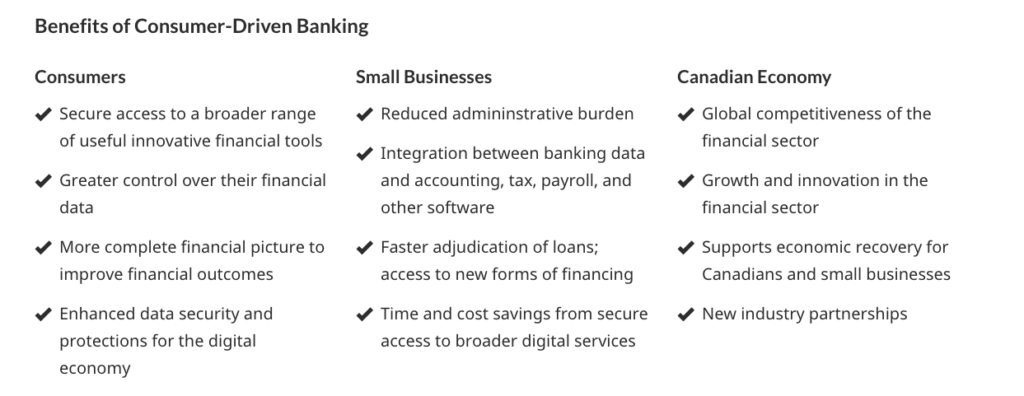

Benefits of Consumer-driven Banking:

-

- Consumers gain secure access to innovative financial tools.

- Greater control over financial data for improved outcomes.

- Small businesses experience reduced administrative burden.

Policy Objectives:

-

- Safety and soundness of the financial sector.

- Consumer financial well-being and protection.

- Economic growth and international competitiveness.

Core Framework Elements:

-

- Governance: Oversight and management of the system.

- Scope: Types of data, participants, and expansion pace.

- Accreditation: Requirements for participating in data sharing.

- Common Rules: Privacy, security, and liability guidelines.

- Technical Standards: Establishment and oversight of data flow.

Course of Action (Legislation in 2024):

-

- Phased approach to scope, oversight, and screen-scraping elimination.

- Key elements codified in legislation.

- Mandate to a government-led entity for supervision and enforcement.

Governance (Effective Oversight):

-

- Government-led entity to supervise and enforce the framework.

- Model for provincial entities to “opt-in” to governance.

- Strong governance framework to ensure compliance.

Scope (Phased Implementation):

-

- Initial phase includes federally-regulated financial institutions.

- Opt-in option for credit unions and third parties.

- Reciprocal access for all entities to promote data portability.

Accreditation (Trusted Data Sharing):

-

- Formal framework for entities collecting consumer data.

- Regular reporting for accreditation maintenance.

- Exemption for federally-regulated banks and credit unions.

Common Rules (Transparent Foundation):

-

- Privacy, security, and liability obligations.

- Compliance as a condition for data access.

- Complements existing legislation.

Privacy (Protection Measures):

-

- Participants must comply with legislative frameworks.

- Specific privacy rules for financial data sharing.

- Consent dashboards for real-time consumer control.

Liability (Clear Structure):

-

- Statutory contractual relationship between participants.

- Liability moves with the data and rests with the party at fault.

- Internal policies and procedures for complaint handling.

Security (Protecting Consumer Data):

-

- Clear security requirements for accredited entities.

- Oversight of security standards in legislation.

- Ongoing reporting obligations for data protection.

Single Technical Standard:

-

- Mandate for a single technical standard.

- Legislation to outline principles and oversight.

Next Steps for consumer-driven banking:

-

- Department of Finance aims to implement the framework by 2025.

- Ongoing engagement with industry stakeholders.

- Legislative framework development and phased implementation.

Related Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

5 Benefits of Open Banking APIs

Blanc Labs and Axway partner up to provide integrated open banking solutions for all

5 Factors to Evaluate Open Banking Readiness in Canada

4 Ways APIs Can Improve Your Bank

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

5 Benefits of Open Banking APIs

Blanc Labs and Axway partner up to provide integrated open banking solutions for all

5 Factors to Evaluate Open Banking Readiness in Canada

4 Ways APIs Can Improve Your Bank

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.