Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

February 5, 2024

Capitalizing on the Open Banking Opportunity

This whitepaper provides a practical path to adopting open banking for banks and financial services institutions. It describes the steps that successful early adopters have taken in the process of forming their open banking strategy and executing on it, while balancing the risks and unknowns in markets where regulatory direction was still being formed.

This whitepaper covers:

- Understanding Open Banking: What is it and What is the Opportunity

- Building a Business Case for Open Banking Enablement

- Governance Models

- Technology Strategies for Open Banking

- The Ecosystem Approach for Financial Services

Many of our clients understand that consumer directed finance represents a significant shift in how value will be created and distributed between FI’s and consumers. Knowing how to get started can be daunting and this whitepaper contains recommendations for a “no regrets” approach to make progress when clear guidelines are not yet defined.

The open banking opportunity:

Download the full whitepaper for:

Winning the Open Banking Race whitepaper – Feb 2024

Landing page web created in Feb 2024

https://blanclabs.com/insights/winning-the-open-banking-race-consumer-driven-financeWinning the Open Banking Race whitepaper LP Web

Get in touch

Latest Insights

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

Finding the right API Management Platform

5 Factors to Evaluate Open Banking Readiness in Canada

Open Banking in Canada: How Banks and Customers Can Benefit

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

Finding the right API Management Platform

5 Factors to Evaluate Open Banking Readiness in Canada

Open Banking in Canada: How Banks and Customers Can Benefit

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

Finding the right API Management Platform

5 Factors to Evaluate Open Banking Readiness in Canada

Open Banking in Canada: How Banks and Customers Can Benefit

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

January 29, 2024

In today’s challenging environment, U.S. bank IT departments are under unprecedented pressure to deliver more with limited resources. Cost-effective Canadian nearshore IT support, especially from technology-rich regions like Toronto, are emerging as a compelling opportunity for U.S. banks seeking to transform their technology infrastructure and enhance operational efficiency.

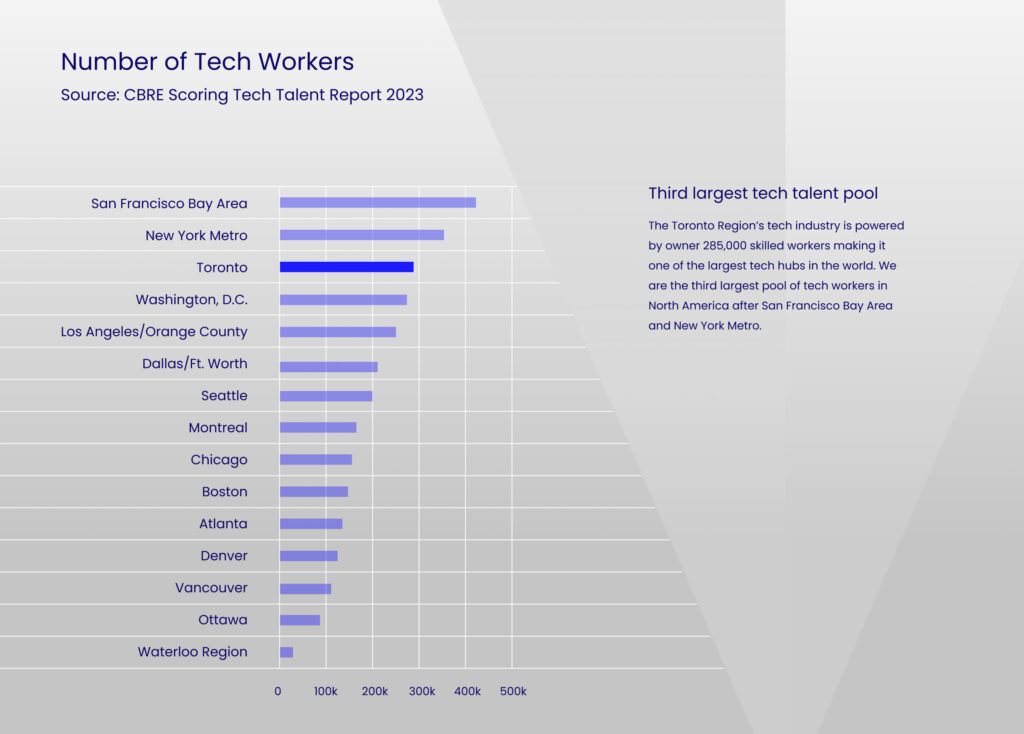

Toronto: Access to World-Class Technology Talent

Toronto is recognized globally as a Canadian center for technology and fintech companies. This world-class and fast growing city with 6.5 million citizens in 2023 is a dynamic and creative urban environment that at this point has become a self-sustaining financial technology hub, making it an ideal partner for U.S. banks seeking talent to drive their transformation roadmaps further and faster.

The region is home to top-tier universities like the University of Toronto, Waterloo and York University are renowned for their research and technology programs, providing a steady stream of skilled graduates and fostering a culture of innovation. Additionally, Toronto hosts the MaRS Discovery District, one of the world’s largest urban innovation hubs. MaRS provides a platform for tech start-ups and entrepreneurs, further solidifying Toronto’s status as a leader in technological development and innovation.

Proximity and Time Zone Alignment

Toronto’s geographical proximity, where almost any major U.S. city can be easily reached with a short, direct flight, offers significant benefits, including time zone alignment for real-time collaboration and agile project management. This is particularly advantageous compared to offshoring and other options. The ease of travel not only strengthens business relationships but also ensures effective communication and alignment, which are critical for the success of complex IT projects.

Cost-Effectiveness

Choosing Toronto for nearshore IT support allows U.S. banks to maintain high service standards while managing operational costs. The significant savings, often ranging from 30-50%, are a result of the current exchange rate differences between the U.S. and Canada, coupled with the inherent efficiencies in project management and execution. These financial benefits can be redirected towards other areas of growth and innovation.

Regulatory and Cultural Alignment

The U.S. and Canada share many regulatory and cultural similarities, which simplifies compliance standards and business practice alignment. This is vital for U.S. banks to minimize legal and operational risks in the highly regulated banking sector.

Customized and Scalable Solutions

Nearshore IT support in Toronto offers tailored, scalable solutions to meet specific banking needs. This flexibility ensures IT services adapt to the bank’s growth and changing priorities, promoting long-term sustainability. Moreover, these solutions are market-proven and highly relevant for U.S. banks, having been successfully implemented and delivering tangible results in similar banking environments.

Enhanced Security

Canadian nearshore IT support provides enhanced security, ensuring compliance with North American data protection laws. This safeguards sensitive information and customer data. Look for a SOC2 certification, which signifies a firm that can adapt to the stringent security requirements, a crucial aspect for U.S. banks in safeguarding their operations and customer information.

Looking for a Canadian tech partner? Let us help.

For U.S. banks striving to stay ahead in innovation, cost-effective Canadian nearshore IT support is a compelling strategic choice. Partnering with Toronto-based firms, such as Blanc Labs, maximizes these benefits, leading to improved efficiencies, fostering innovation, and enhancing customer satisfaction, significantly contributing to the bank’s success.

Author

Les Riedl, Managing Principal of 10XBizDEV, is dedicated to connecting US Banks with innovative, best-in-class solutions and services that contribute to their success. His extensive experience as CEO and board member in fintech and financial services consulting provides valuable insights into the sector’s evolving challenges and opportunities. As US advisor for Blanc Labs, Les is instrumental in introducing their world-class capabilities to the American market.

Related Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Blanc Labs Achieves SOC 2 Type 2 Certification

Banking Automation: The Complete Guide

The Transformative Power of Banking Automation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Blanc Labs Achieves SOC 2 Type 2 Certification

Banking Automation: The Complete Guide

The Transformative Power of Banking Automation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Blanc Labs Achieves SOC 2 Type 2 Certification

Banking Automation: The Complete Guide

The Transformative Power of Banking Automation

These are not your grandmother’s models: the impact of LLM’s on Document Processing

These are not your grandmother’s models: the impact of LLM’s on Document Processing

January 22, 2024

Document Processing before LLMs

Document processing primarily relies on rule-based systems and keyword matching, which can be effective for structured or even semi-structured documents with predictable formats. However, this approach often struggles with unstructured data, where variability and complexity are high. In contrast, Large Language Models (LLMs) bring a transformative approach to document understanding. They leverage advanced natural language processing (NLP) techniques, enabling them to comprehend context, semantics, and nuanced language variations in documents.

In the ever-evolving world of data science and enterprise automation, the explosive growth of unstructured data generated by companies has been a major challenge for data scientists. To give you a sense of scale, recent studies show we’re likely to witness a surge from 33 zettabytes in 2018 to a predicted 175 zettabytes by 2025. Furthermore, according to Gartner, unstructured data currently represents an estimated 80 to 90 percent of all new enterprise data. Unstructured data can include conversations through e-mail or text messages, but also social media posts, blogs, video, audio, call logs, reviews, customer feedback, and replies in questionnaires. This trend spotlights an urgent need for more sophisticated tools to create value from this burgeoning data deluge.

Our team has over 5 years working with various OCR and NLP technologies, including having developed and training models in-house. Don’t get me wrong, IDP tech has come an extremely long way and the tools have gotten tremendously powerful. Libraries such as Amazon Textract (among many others) provide ML engineers a powerful suite of tools to accelerate the speed and quality of applying intelligent document processing to automation scenarios.

However, there are still limitations to how IDP can be adopted to a range of automation scenarios that we encounter in enterprise environments.

Think of traditional models document processing tech as a diligent yet somewhat myopic librarian, meticulously following rules but often missing the bigger picture. In contrast, Large Language Models (LLMs) are like Sherlock Holmes — insightful, context-aware, omnipresent, and adept at deciphering the most cryptic of texts.

This results in several key benefits and improvements:

Enhanced Comprehension

Traditional Method: Typically relies on keyword spotting and pattern recognition. For example, extracting dates or specific terms from structured forms.

LLMs Approach: Goes beyond mere pattern recognition. It interprets language nuances and intent, essential in contexts like financial and legal document analysis where the meaning of clauses and data can be complex.

Flexibility with Unstructured Data

Traditional Method: Struggles with documents like unstructured emails or reports, often leading to high error rates or the need for manual intervention.

LLMs Approach: Excel in handling unstructured formats. For instance, in customer service, LLMs can analyze and respond to diverse customer queries that vary in structure and content, easily extract information from employment letters or mortgage commitment statements.

Dealing with unstructured data, which includes everything from casual emails to social media chatter, videos, and customer feedback, is not a trivial matter. This kind of data resists neat categorization and defies traditional database structures, posing significant challenges in analysis and comprehension. Here’s where Large Language Models show their mettle, adeptly navigating this complex, non-uniform data and unlocking valuable insights that conventional methods might miss.

Adaptive Learning

Traditional Method: Updating rule-based systems for new formats or languages is time-consuming and resource-intensive.

LLMs Approach: Can continuously learn from new data, adapting to changes in language usage or document formats without extensive manual reprogramming.

Error Reduction

Traditional Method: Prone to errors in cases of ambiguous or context-heavy information, resulting in lower reliability.

LLMs Approach: Their deep contextual understanding leads to more accurate data extraction and interpretation, crucial in high-stakes industries like legal, financial and healthcare.

A Practical Example

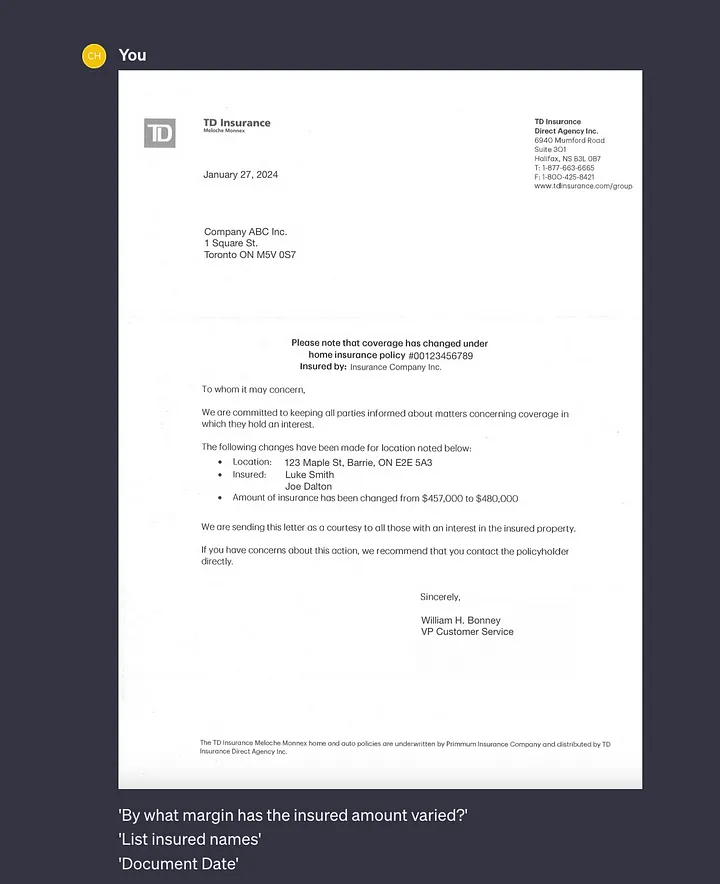

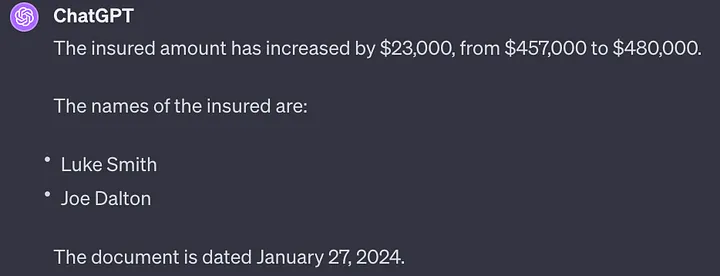

ChatGPT 4, without any specific fine tuning or pre-training is able to easily extract information from a document it has never seen before. It understands the context and you can simply query in a natural way for data points that you are interested in:

*

* Note: we take data privacy and PII seriously (see below) and created “spoof” documents for the purposes of this demonstration.

For instance, by asking direct questions such as ‘What is the policy end date?’ or ‘By what margin has the insured amount varied?’, it promptly delivers precise information with perfect accuracy.

This scenario offers the opportunity to further explore solutions that leverage the unique capabilities of LLM’s for the purposes of intelligent document processing and automation.

Generative AI-Powered Extraction and Comparison of Insurance Policy Documents

In the previous section, we delved into the capabilities of Language Learning Models (LLMs) in streamlining the extraction of key information from various document types. To demonstrate this further, we now present a practical application of our system.

The first part of the demonstration involves uploading the initial insurance policy, which acts as our benchmark document. Watch how the system seamlessly processes this document, effortlessly extracting critical details such as the policy number, coverage specifics, the insured party’s information, and other essential data.

Next, we upload a second document representing a modification in the policy. It not only extracts pertinent information from the new document but also conducts an intelligent comparison with the original policy. Notice how the system highlights the changes in the date and insurance limit. This comparative analysis is vital to ensure comprehensive and accurate updates of all modifications and their implications.

To enhance the efficiency of such systems, integration with existing databases and cloud storage services is key. Utilizing APIs, these systems can automatically retrieve documents from various sources such as cloud storage (like AWS S3, Google Cloud Storage), internal databases, or even directly from email attachments. This integration enables real-time processing and updates, ensuring that the latest documents are always analyzed and compared.

The Role of Retrieval-Augmented Generation (RAG) in LLMs

For more context specific answers and solutions, Retrieval-Augmented Generation represents a significant advancement in the capabilities of LLMs. It’s another step forward on this never-ending roller coaster!

- Enhanced Accuracy and Relevance: RAG combines the generative power of LLMs with information retrieval, pulling in relevant data or documents to provide contextually accurate responses. This is particularly beneficial for financial analysis and reporting, where accuracy is paramount.

- Dynamic Data Integration: Unlike traditional LLMs, RAG can integrate real-time data, offering dynamic responses to financial queries. This is essential in finance, where market conditions and regulatory environments are constantly evolving.

- Customized Financial Advice: RAG’s ability to retrieve and process vast amounts of data allows for highly personalized financial advice, tailored to individual customer profiles and market conditions.

- Improved Compliance and Risk Management: In the regulatory-heavy landscape of financial services and healthcare industries, RAG can efficiently process and cross-reference internal and external data sources including detailed regulations and requirements. We believe that there is a huge opportunity to automate regulatory, risk, and compliance checklists to reduce complex manual efforts that exist in regulated industries.

Potential limitations of deploying LLM’s for document processing (at scale)

While LLMs are highly likely to revolutionize document processing with, it is important to consider potential limitations as well. LLMs are like a double-edged sword, powerful in processing vast amounts of data but requiring careful handling to address privacy concerns and manage computing resources.

- Privacy and Personal Identifiable Information (PII): LLMs are capable of processing vast amounts of data, including confidential or proprietary information as well as PII data. Organizations must work within data security frameworks and engineer solutions that have data security at the core of how they are designed and deployed. As a SOC2 Certified company, this is an area of key focus for our teams and we have implemented robust data handling and processing protocols to ensure that all PII is managed securely and in compliance with privacy regulations.

- Computing Power and Cost: The potential impact offered by powerful LLMs to read and extract data from large volumes of unstructured data is reliant on the on substantial computing power required to run these models. We are still in the early stages of enterprise adoption of generative AI technologies and the economics of leveraging these toolsets at an enterprise scale are fairly dynamic. We expect a lot to change over the next few years but in the meantime, we are actively working with clients to understand the business drivers of using LLM’s to automate processes. With our deep background in intelligent document processing we’ve become experts at crafting solutions that optimize model efficiency without compromising performance. We employ techniques like model pruning, efficient data processing pipelines, and cloud-based solutions that balance computational demands with cost-effectiveness.

Conclusion

LLMs and RAG are the vibrant threads bringing new patterns of efficiency, accuracy, and innovation. We’ve journeyed from the meticulous yet narrow pathways of traditional methods to the expansive highways of AI-driven solutions. This evolution isn’t just a step forward; it’s a quantum leap into a future where data isn’t just processed but understood, where advice isn’t just given but tailored, and where compliance isn’t just followed but mastered.

The advancements in unstructured data analytics signal a critical shift in our approach to data. It’s not just about the volume; it’s about the untapped potential that lies within. This raises a compelling question: how can we leverage unstructured data to gain a deeper understanding of our customers, societal trends, and the world at large? The key lies in harmonizing cutting-edge AI tools like Large Language Models with human insight, transforming this wave of data into insightful and actionable knowledge.

References:

- “What is intelligent document processing?” Microsoft

- “OpenAI Research”. OpenAI

- “What is Retrieval-Augmented Generation?” Amazon.

- “Retrieval-Augmented Generation for Knowledge-Intensive NLP Tasks.” IBM.

Harness the power of AI

At Blanc Labs, we specialize in tailoring AI solutions to the specific needs of the Canadian financial and healthcare sector. Our expertise in AI, automation & digital product development positions us to assist in harnessing the power of LLMs and other AI technologies. We provide customized solutions for intelligent document processing, intelligent automation, and enhancing customer experiences, ensuring compliance with industry standards and regulations.

Explore how Blanc Labs can assist your organization in navigating and succeeding in the digital era.

Author

Luciano Lera Bossi is a skilled Engineer with 15+ years of success in tech, specializing in Intelligent Automation, Low Code/No Code and Agile Project Management. He enables effective communication between technical and business stakeholders, resulting in seamless project outcomes.

Related Insights

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

January 18, 2024

Generative AI and Automation: Are you implementing them effectively?

The emergence of exponential technologies like Generative AI has sparked enthusiasm among companies and executives, who see the potential for enhancing operations and adding significant value to their businesses. In a PWC survey¹, 86% of U.S. executives projected AI’s transition into a ‘mainstream technology’ within their companies in 2021. Moreover, 25% of businesses utilizing AI anticipate revenue growth.

However, as highlighted by Gartner², a concerning 85% of AI projects ultimately fail to meet their expected business value. Among the numerous factors contributing to these shortcomings, common culprits include misaligned expectations, inadequate planning, and limited comprehension of the technology and its practical applications. When all these factors are considered, they collectively underscore a single underlying issue: an inadequate understanding of the process.

The Cost of No Change

Every business, regardless of its size or industry, operates within a complex web of processes. These processes, when left unoptimized, can lead to chaos, inefficiency, and missed opportunities. Employees may find themselves bogged down in manual tasks, information silos, and redundant workflows. Meanwhile, customers may experience reduced satisfaction due to prolonged or unclear processes and excessive touchpoints, potentially leading to attrition. This chaos not only hampers productivity but can also erode customer satisfaction and profitability.

¹ PricewaterhouseCoopers, “PWC 2022 AI Business Survey”, online: PwC

²“Gartner says nearly half of CIOs are planning to deploy artificial intelligence”, (13 February 2018), online: Gartner

Array’s research³ reveals alarming realities within organizations:

Financial Costs:

Inefficiencies cost 20-30% of revenue.

Time Costs:

Employees lose 26% of their day to avoidable chores.

Recruitment Costs:

Each employee costs $4,129 and 42 days to be trained.

Amid these sobering statistics, businesses have adopted Business Process Improvement as a systematic, analytical approach to understanding, prioritizing, and measuring the impact of how to make their operations run more efficiently.

³Saunders, Dave, “How Much is Inefficiency Costing Your Business”, (19 November 2020), online: Electronic Data

Capture, Mobile Data Collection – Array Survey App

Download the Full Whitepaper

Our teams have compiled insights and best practices in this practical and outcome focused whitepaper. Our learnings are based on numerous successful client engagements, research, and industry partners.

Business leaders seeking practical advice to advance their BPI capabilities will find value in the topics covered in the whitepaper. These include:

- A step-by-step approach on how to conduct Business Process Improvement within an enterprise operating environment

- Practical implications of using Business Process Improvement with Intelligent Automation

- Case Studies on the successful use of Business Process Improvement in mid-sized to enterprise organizations

From Chaos to Clarity

Authors:

“Our commitment is to evolve your business processes in a way that’s both data-driven and adaptable, fostering an environment where continuous improvement is the norm, and each step leads to a more effective and empowering operational experience.”

“In the race for growth, inefficiencies hold companies back. Success unfolds in continuous refinement—where processes evolve, innovation thrives, and excellence becomes ingrained.”

The Value of Speed: C.D. Howe Institute policy research quantifies the benefits of a modern payment ecosystem in Canada

The Value of Speed: C.D. Howe Institute policy research quantifies the benefits of a modern payment ecosystem in Canada

January 10, 2024

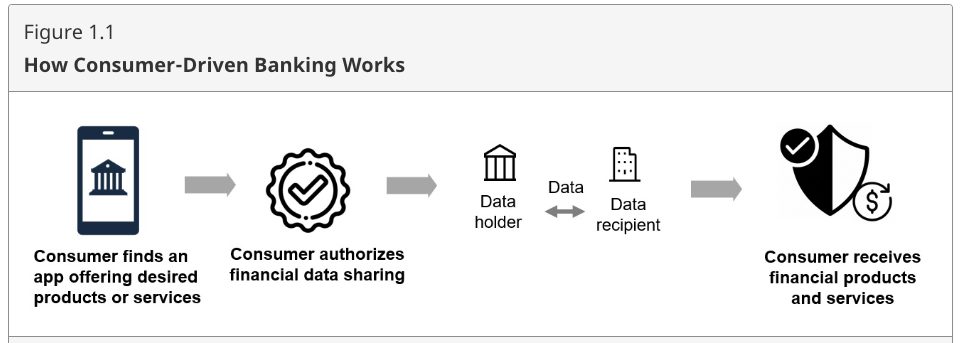

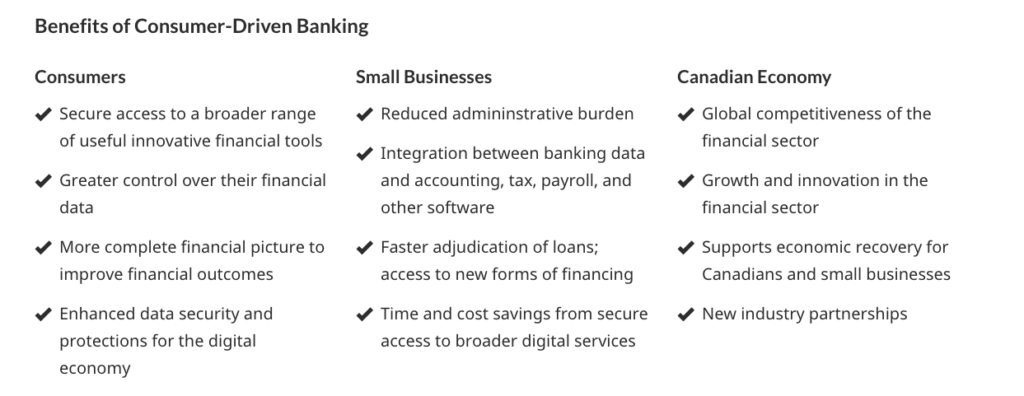

With Consumer Directed Banking back on track for 2025, there is perhaps cause for optimism that a long awaited evolution in Canada’s payments ecosystem could become a reality over the next few years.

In addition to providing a comprehensive summary of the benefits of a faster, more open and competitive payments ecosystem, the opportunity cost of not evolving our payments landscape to include real-time payments (RTR) has been well documented in a recent research paper by the C.D. Howe Institute. The paper also discusses specific actions that government and regulators can take to create a more innovative, competitive and fair payments ecosystem in Canada.

The full paper is available for download directly from the C.D. Howe Institutes website but it is worth highlighting several key themes/stats from the paper. Many of these themes are already reflected in our payment strategies and implementation approaches for our clients.

Our team is optimistic about a better future for Canadian payments and will be following developments in this space closely. As always, we look forward to working with ecosystem participants to learn more about their perspectives and how they view the considerable opportunity to win in our payments economy.

Anticipated Impact to CDN economy over 5 years.

Total Payment Transactions in 2022

Projected 5 year savings with RTR

RTR By The Numbers

The C.D. Howe Institute team provided some excellent analysis on the expected economic impact to Canada’s economy with a more competitive payments landscape enabled by RTR adoption.

Related Insights

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

5 Benefits of Open Banking APIs

Customer Centricity As The Essence Of Digital Transformation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

5 Benefits of Open Banking APIs

Customer Centricity As The Essence Of Digital Transformation

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

2023 Fall Economic Update on Consumer-Driven Banking 🥳

Blanc Labs provides their POV on the recent Open Banking Update by the Federal Government.

5 Benefits of Open Banking APIs

Customer Centricity As The Essence Of Digital Transformation

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

December 6, 2023

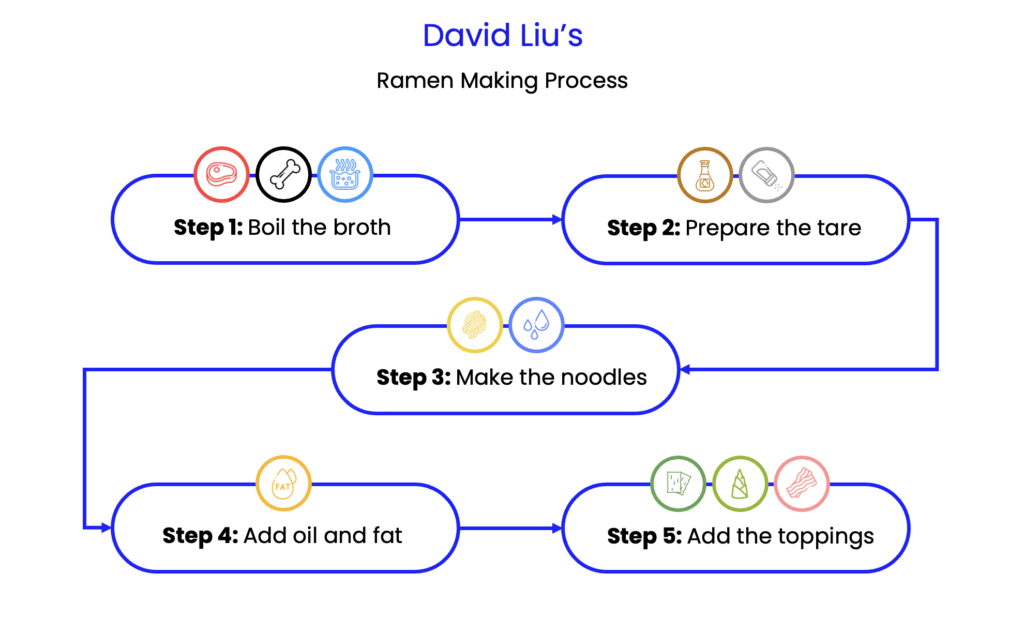

Say hello to David Liu, our new BPI CoE Lead! He’s the kind of guy who’s just as excited about diving into complex enterprise processes as he is about making a bowl of handmade ramen (his absolute favourite). His insatiable curiosity propels him to delve deep into the essence “why?”, and an expert at finding ways to enhance and elevate outcomes.

David’s been on quite a journey for the past three months, settling into his new life in Canada and shaking things up here at Blanc Labs. We sat down with him to find out more about his experience and discover what fuels his passion to understand the inner mechanisms of both professional landscapes and culinary delights.

Six Questions with David Liu

Welcome to Canada and to Blanc Labs! How have your first 90 days been?