The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

November 27, 2023

At this point, enterprise generative AI applications for software development, marketing, customer/employee service , and product design are proliferating as the standout use-cases early adopters are focusing on. From our position working with clients to develop and enable enterprise data + AI solutions, we’ve gained perspective on several of the foundational characteristics enterprises will need to develop to realize on the promise of this 3rd wave of the human-computer revolution.

But First, a Disclaimer

Blanc Labs focuses on the financial services and healthcare industries. We see both sectors as having massive potential in terms of the benefits offered through the application of these transformative technologies. Both healthcare and financial services are hugely complex, highly regulated, and depending on who you speak to, resistant to change. We believe the stage is set for a broader divergence of winners and losers: organizations that build capability and competency in adopting new tools and leverage the power of their enterprise data will stand to reap the benefits of their investments.

⛔️ Cloud Infrastructure Only ⛔️

Enterprise Platforms are a Lynchpin

If we consider that having completed a cloud migration or cloud native approach is table stakes for AI enablement within an organization, the next big question will be where your enterprise data resides. The organization’s technology infrastructure and enterprise platform ecosystem will in many ways determine what toolsets may be available to facilitate experimentation and development of AI enabled use cases.

If you are a CIO, CTO or CDO, start by taking stock of the platforms that house your enterprise data and evaluate the toolsets offered by these power technology-ecosystem juggernauts. Microsoft and AWS are emerging as clear leaders in terms of providing their customers powerful tools to apply ML and AI to their enterprise data, but Salesforce, SAP, Pega and OpenText – amongst many others will offer tooling to access, manage and apply AI to enterprise data.

It is impossible to predict who the big winners and losers of this space will be, partially because they are such massive and well entrenched players but keep an eye on this space over the next few years.

The 👿 is in the Data [Taxonomy]

Building an enterprise data model across a complicated operating environment like a bank is no small feat. Standardizing data definitions between different lines of business in a bank involves tackling the complexity of enterprise (+legacy) platforms used to store and handle data. This complexity extends to accommodating the diverse needs of various stakeholder groups with distinct preferences for accessing, manipulating, and analyzing data.

In many ways, risk is a unifying theme and responsibility within regulated industries like the banking sector. We see conformance to risk measurement and regulatory reporting requirements as a lightning rod for action amongst FI’s to get their “data house” in order but proactive approaches amongst banking and technology executives are few and far between.

In a recent interview with Tech Exec magazine, VP of Data and Adaptive Intelligence at Munich Re Canada Branch (Life), Lovell Hodge encapsulated the shift in how progressive organizations are thinking about their data:

“Over the years, there has been a realization that data has an inherent information value to the organization. As the years go by, we’re rapidly producing more data at an increasingly and somewhat alarming rate. So, what a lot of folks in the industry have realized is that there is not a huge space between theoretical concepts around information from data, and how they can use that information to simplify internal processes and also benefit clients.

So, you’re seeing that interdependence starting to mature. And because of that, many organizations are looking at their data not as just something they have to store, but as an asset they can leverage. And once you start thinking in that sort of way, then you start to formulate methods by which you can gain value from data, and it becomes an important part of your corporate strategy.”

App Design and Development Now Occurs ‘In the Data’

Historically, software design and development occurred in a sandbox that was devoid of enterprise data. In traditional dev environments we piped in dummy data to test parameters and during QA tested connectivity and security. But with the explosion of sophisticated ML and AI tools, application development will very much occur at the nexus of querying, manipulating, analyzing and visualizing proprietary data sets.

There is a tremendous amount of opportunity for these new tools to democratize data for business users through the use of conversational/natural language query tools to conduct analysis and derive insights from enterprise data sets.

Another big change will be the blurring of the lines between the role of developers and data scientists and in many cases, these resources will be working directly alongside each other. Technical resources will require access to live data sets to facilitate model training and to leverage powerful data analytics toolsets. This is going to require a significant shift (from reactive to proactive) in terms of access management and data security.

Firms that work with external partners will require them to adhere to an extremely high standard of data security protocols i.e., ISO and SOC 2 compliance certification with regular audits.

Specific sector, domain, and knowledge of business context has always counted for a lot but increasingly developers won’t be able to rely on detailed functional, technical and design requirements documentation to define the specs of what they are developing. It will require a much more experimental, test and learn approach. Toolsets are only going to get more user friendly to work with but developing high impact apps leveraging advanced AI/ML techniques will require a detailed and nuanced understanding of user needs, workflow, data inputs, command prompts, prompt modelling strategies, and a continuous improvement approach to get to a place of lasting and tangible impact for businesses and teams.

In Summary:

There is much still to be learned through this large-scale adoption of a suite of technologies that are evolving at such a rapid pace. This is by no means a complete list of the things business teams and leaders need to consider as they look to capture competitive advantage from these powerful new tools. At Blanc Labs, we are excited about the future and look forward to working with companies to develop their capabilities to create business value by harnessing the tremendous potential of their enterprise data.

About the Author

With over 15 years in technology consulting services, I am thrilled at how next-gen technologies will unlock a new wave of innovation and productivity for enterprises.

Related Insights

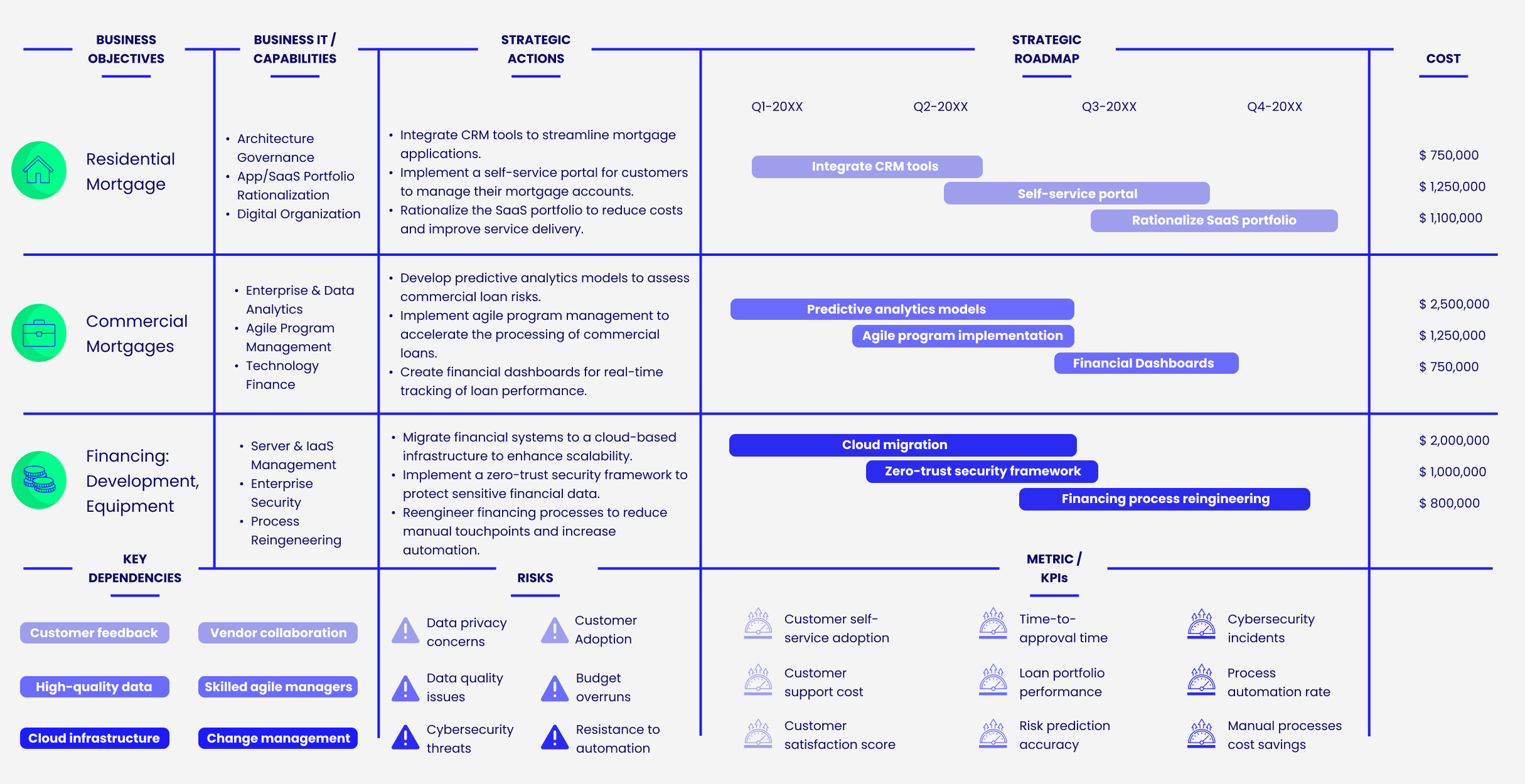

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.

Banking Automation: The Complete Guide

Three Reasons Financial Institutions Are Losing Out to FinTechs

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.

Banking Automation: The Complete Guide

Three Reasons Financial Institutions Are Losing Out to FinTechs

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Low-Code Tools and Automation Power Minor Ailments Program for Pharmacists

Blanc Labs teamed up with Daylight Automation (acquired by Quadient) to overhaul the process pharmacists use to assess and treat minor ailments, at a critical inflection point for Canadians to efficiently access healthcare services.