Lenders Transformation Playbook: Bridging Strategy and Execution

Introduction

The “Lenders Transformation Playbook” serves as a comprehensive guide for financial institutions embarking on digital and operational transformation. In an era of rapid technological change and evolving customer expectations, lenders face increasing pressure to innovate and align business strategies with technology capabilities. This document provides a structured approach for bridging the gap between strategy and execution, ensuring that transformation efforts are targeted, phased, and measurable for sustainable growth.

Executive Summary

- Strategic Alignment: The playbook outlines a transformation roadmap that integrates business objectives with technology capabilities, driving profitable growth, operational efficiency, and effective risk management.

- Phased Approach: A structured, phased strategy breaks transformation into manageable steps, minimizing risk while steadily building necessary capabilities.

- Detailed Initiatives and Costs: Each initiative is mapped out with its associated costs, dependencies, and timelines, enabling optimized resource allocation and ensuring maximum impact.

- Current State Assessment and Target Setting: The document emphasizes evaluating the current state to set a clear, achievable target, supported by KPIs for tracking progress and outcomes.

- Governance, Risk, and Compliance (GRC): GRC frameworks are integrated into the transformation process to align technology investments with regulatory compliance and business continuity.

- Prioritization Framework: Initiatives are ranked using a Feasibility vs. Business Value Matrix, focusing on strategic value, ROI, and feasibility for streamlined execution.

- Progress Measurement: A phased, metric-driven approach (Crawl, Walk, Run) measures success, with continuous stakeholder feedback for real-time adjustments and sustainable growth.

What Good Looks Like

A successful transformation roadmap provides a structured approach to achieving long-term business objectives. Key components include:

Clear alignment between business and technology strategies.

A phased approach to transformation, breaking down the journey into manageable initiatives.

A focus on prioritization, ensuring the highest impact projects are delivered first.

Phasing the transformation allows organizations to mitigate risks while steadily building capabilities. A good roadmap offers a structured sequence for initiatives based on their strategic relevance and feasibility, ensuring resources are optimized for maximum impact.

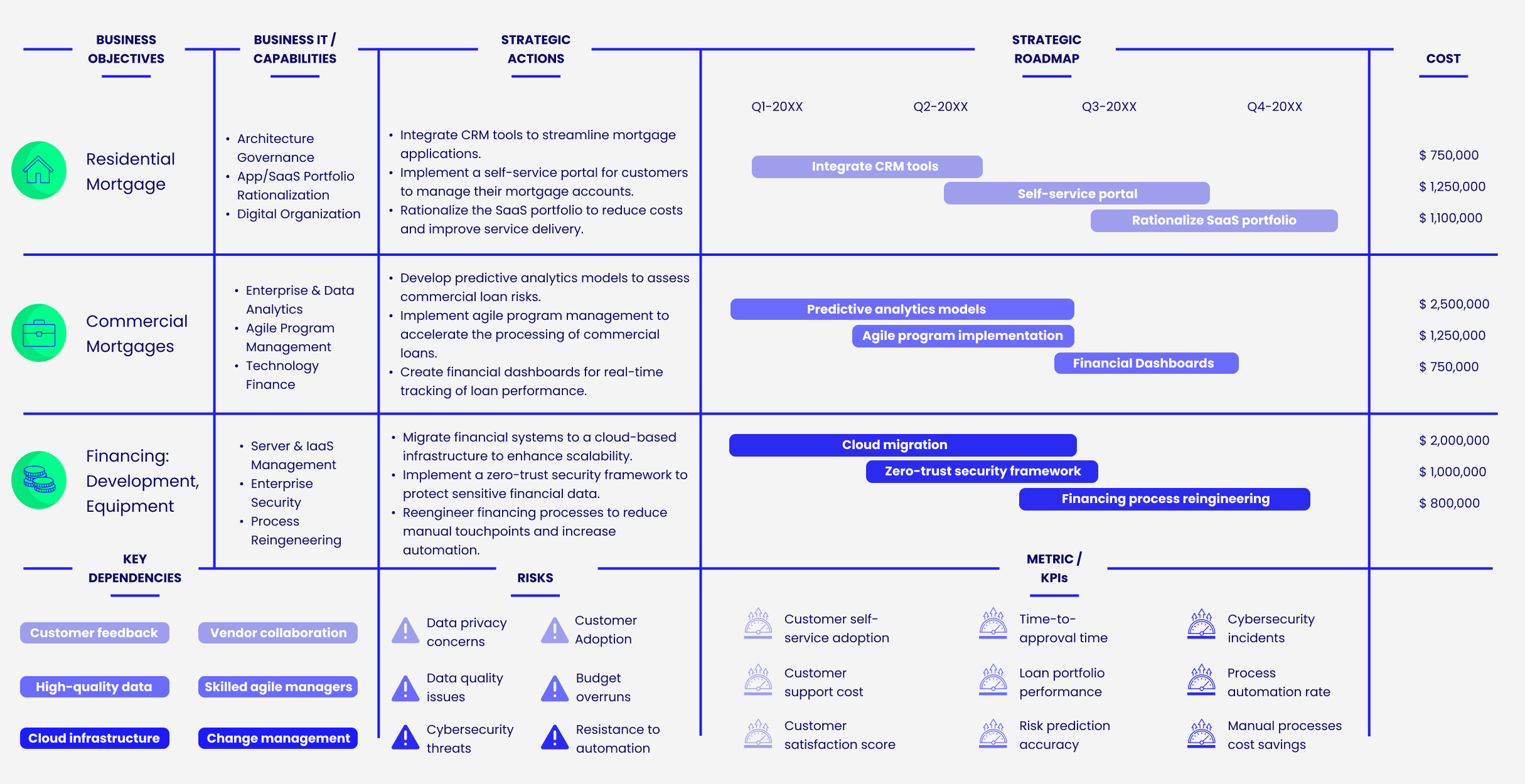

The strategic roadmap visually and functionally integrates these key elements:

- Business Objectives: These are high-level goals the organization aims to achieve, such as Profitable Growth, Operational Efficiency, and Compliance and Risk.

- Business IT / Capabilities: For each business objective, specific IT capabilities are identified that need to be developed or enhanced to achieve these objectives.

- Strategic Actions: Aligned with each capability are strategic actions. These are specific activities or projects that need to be undertaken to develop the capabilities necessary for achieving the business objectives.

- Strategic Roadmap: This section maps out the timing and sequence of initiatives derived from the strategic actions. It is presented in a timeline format across quarters or months. Each initiative is associated with a specific strategic action and is plotted against time to show when it will be initiated and its duration.

- Cost: Each initiative on the timeline has an associated cost, which helps in budgeting and resource allocation planning.

- Key Dependencies and Risks: Below the timeline, key dependencies and risks are illustrated. Dependencies show how certain initiatives are reliant on the completion of others, while identified risks might impact the execution of the initiatives.

- Metrics / KPIs: Corresponding to the initiatives are metrics or KPIs that will be used to measure the success of each initiative, ensuring that each step taken aligns with the strategic goals and delivers the intended outcomes.

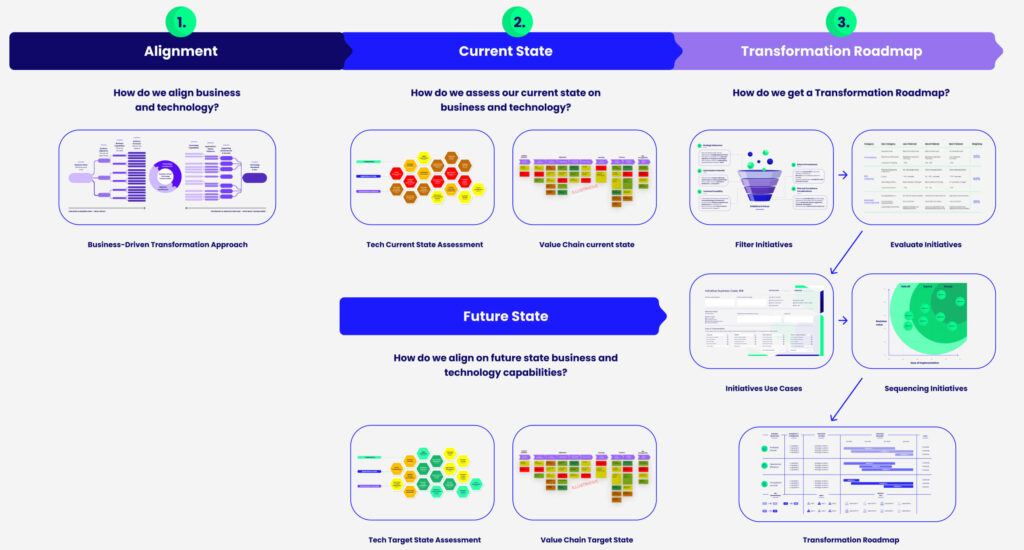

Three Steps Towards Creating a Transformation Roadmap

Developing a successful transformation roadmap requires a structured approach, ensuring that both business objectives and technology capabilities are fully aligned. This section outlines three critical steps to creating an effective roadmap, merging the analysis of the current state and the definition of the target state into a single step, as these are deeply interconnected processes.

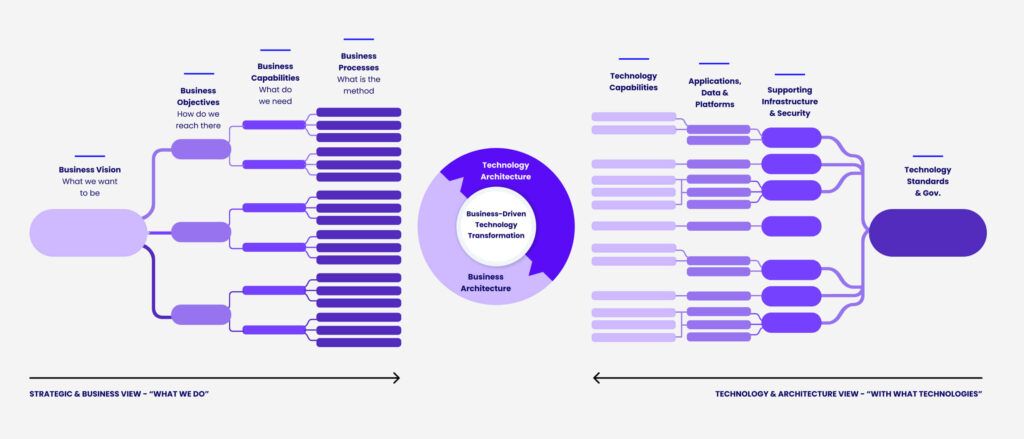

Aligning Business Objectives with Technology Capabilities

In large-scale transformations, aligning business objectives with technology capabilities is a critical step. The success of a transformation initiative hinges on whether your technology strategy is effectively calibrated to deliver business value. This alignment is more than just matching technology solutions to business needs—it’s about creating a cohesive strategy that considers business vision, processes, architecture, and execution plans.

Establishing Strategic Linkage Between Business and Technology

As shown in the diagram, lenders should align their technology investments with business strategy, ensuring each objective, whether focused on customer engagement, efficiency, or growth, is tied to relevant technology capabilities. By evaluating emerging technologies such as AI, cloud, and data analytics, lenders can ensure these investments are both strategically relevant and scalable, driving meaningful outcomes.

Translating Business Strategy into Operational Execution

A well-defined business strategy must translate into an executable plan, which is facilitated by enterprise architecture. The architecture serves as the “glue” that binds strategy with operational execution by guiding critical questions like:

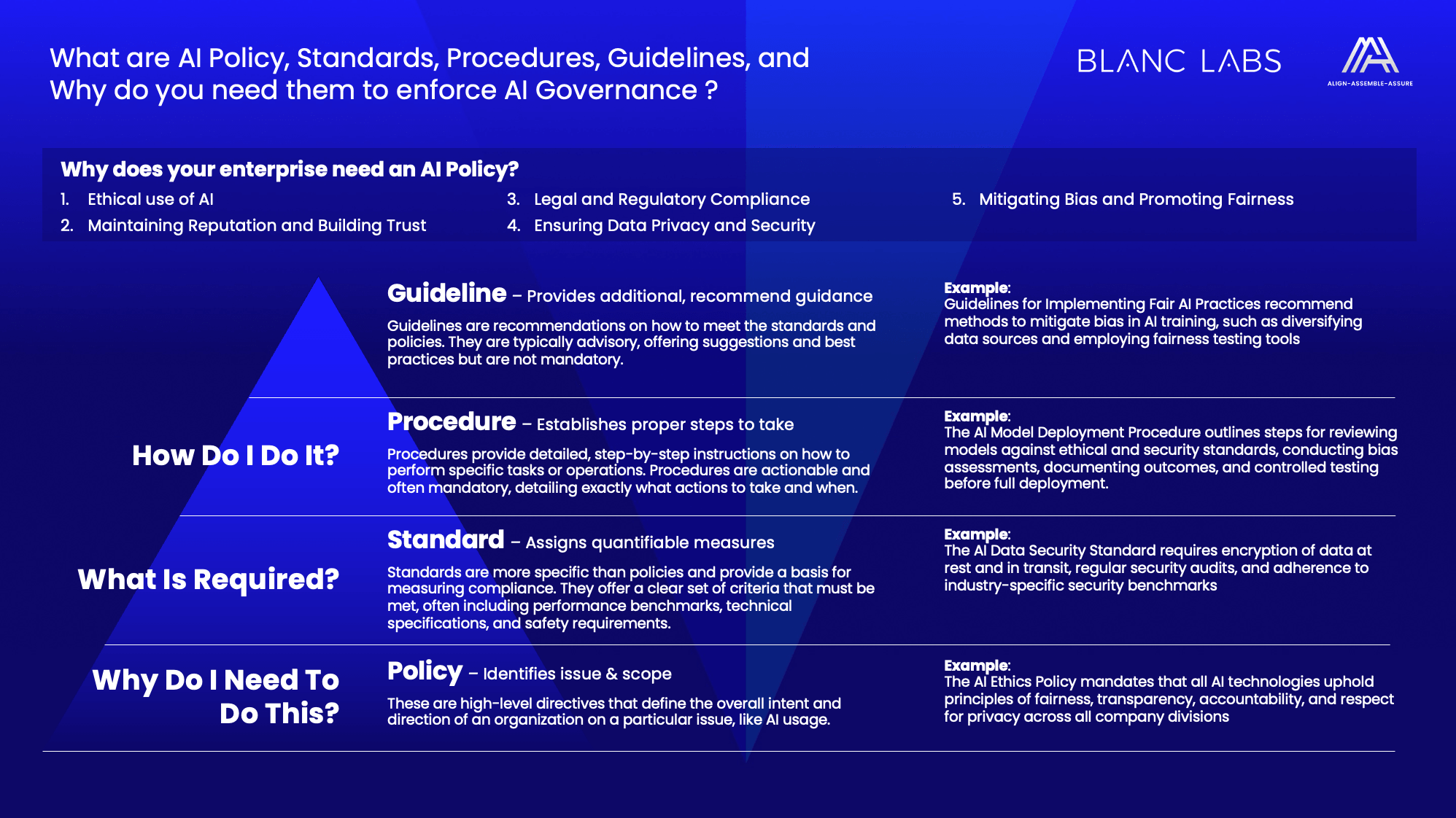

Governance, Risk and Compliance (GRC)

Governance, Risk, and Compliance (GRC) frameworks are crucial in aligning business objectives with technology capabilities in the highly regulated financial services industry. For lenders, GRC goes beyond regulatory compliance to enhance business continuity, risk mitigation, and operational integrity. GRC should be integral to the enterprise architecture, guiding technology selection and influencing architectural decisions to minimize vulnerabilities and ensure compliance from the outset.

Effective governance sets up processes, standards, and oversight to align technology investments with business goals, such as improving customer experience or boosting operational efficiency. By establishing clear roles and responsibilities through frameworks, it ensures accountability and facilitates informed decision-making and swift execution.

Risk management identifies and addresses threats like data breaches or system failures, crucial for safeguarding data privacy, transaction security, and service availability. Integrating risk management into technology planning helps lenders preempt regulatory risks and embed compliance into technology solutions from the start.

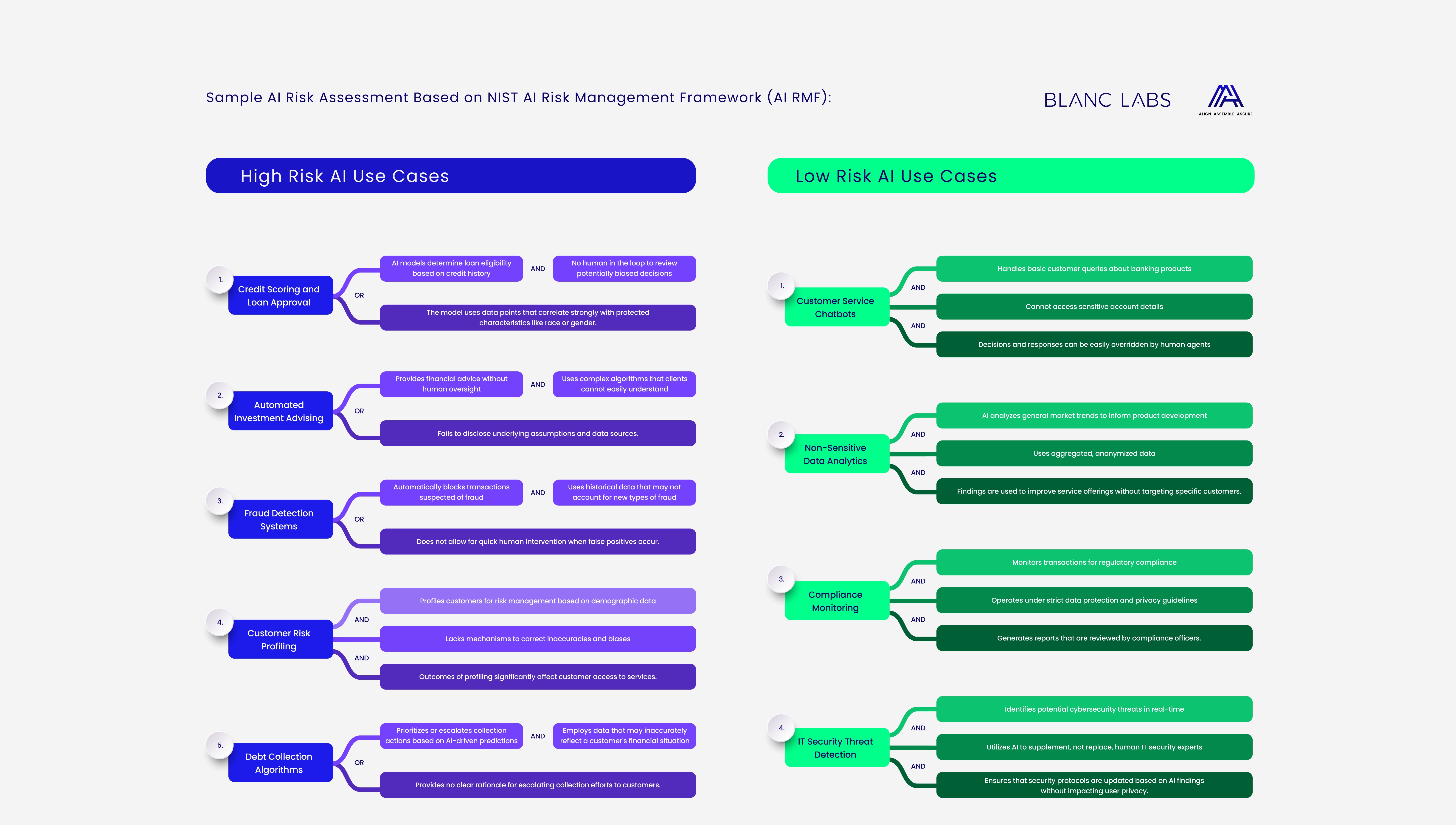

Compliance dictates specific technology adoptions, driving investments in data management and compliance-centric capabilities like automated reporting and audit trails. This ensures lenders meet regulatory demands efficiently and responsibly, particularly as they increasingly use AI and data analytics, adhering to privacy laws and ethical guidelines.

Assessing the Current State and Defining the Target State: Where We Are and Where We Want to Be

The transformation process begins by evaluating the current state of the organization’s technology capabilities and business alignment and setting a defined target state which the transformation aims to achieve. Utilizing tools like the Online Capability Maturity Assessment ensures that these assessments are thorough and accurately reflect the organization’s capability across various domains.

Assessing the Current State of Technology Capabilities

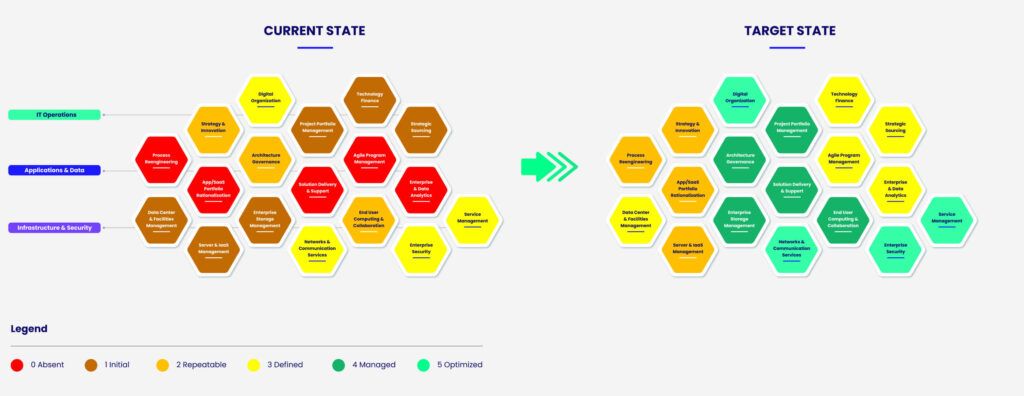

The first step is to gain a clear, objective understanding of where the organization stands today. This involves a thorough evaluation of current technology capabilities. The assessment phase serves as a diagnostic tool to identify existing gaps, inefficiencies, and misalignments that hinder the organization’s ability to achieve its goals. Capabilities will be organized into three domains:

The assessment incorporates detailed evaluations across these domains, utilizing metrics ranging from absent (0) to optimized (5), providing a clear picture of technology and business alignment.

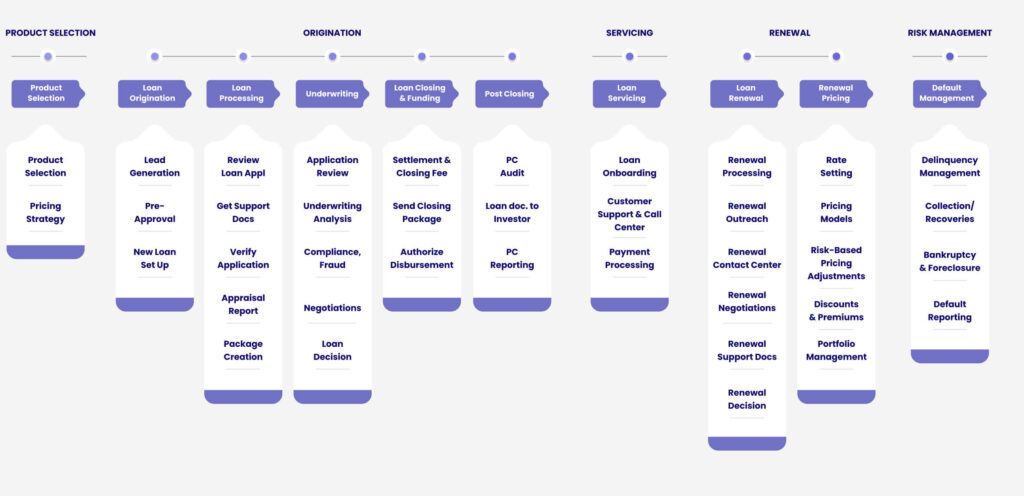

Assess the Current State of Business Capabilities

To thoroughly assess the current state of business capabilities, an enterprise must first construct and examine its value chain. This involves a detailed analysis of all processes within the value chain to ensure they effectively support the organization’s strategic objectives. This assessment is critical for identifying efficiency gaps, opportunities for enhancement, and areas where the business may be at risk of falling behind market demands or technological advancements.

The construction of the value chain involves mapping out all key activities involved in creating and delivering the product or service to the customer. This includes everything from inbound logistics, operations, and outbound logistics to marketing, sales, and service. Each segment of the value chain is scrutinized to understand how individual activities contribute to overall value creation and competitive advantage.

Each of these business capabilities, and processes should be guided by key value drivers that align with the organization’s broader business objectives. These value drivers might include:

- Cost Efficiency: Ensuring that processes are cost-effective and provide the best return on investment. Identifying areas where costs can be reduced without compromising quality is crucial.

- Quality Enhancement: Maintaining or improving the quality of outputs to meet or exceed customer expectations. Processes should be assessed for their ability to consistently produce high-quality results.

- Innovation and Adaptability: Gauging the organization’s capacity to innovate and adapt to changing market conditions. This includes the flexibility of processes to incorporate new technologies or methodologies.

- Risk Management: Evaluating how risks are managed within the business processes. This includes assessing the robustness of the process against internal and external shocks and compliance with relevant laws and regulations.

- Customer Satisfaction: Measuring how processes impact customer satisfaction and loyalty. This involves understanding customer needs and expectations and how well the business delivers on these.

Let’s take underwriting as an example:

To determine the maturity of the “Underwriting” business capability with regard to the key value drivers of cost efficiency and risk management, you can pose specific questions that probe the depth, effectiveness, and integration of current practices. These questions should help evaluate whether the underwriting processes are optimized to meet the organization’s goals and regulatory requirements effectively. Here’s a breakout of the questions can be asked for two key drivers:

Defining the Target State: Where We Want to Be

After the current state has been assessed, the next step is to define the target state—the future vision for both technology and business capabilities. The target state represents the desired end-goal of the transformation process, and it serves as a guide for building the roadmap that will take the organization from its current state to this future vision.

Aligning the Target State with Strategic Objectives:

- The future state should be directly aligned with the organization’s long-term business goals. Whether the objective is to drive revenue growth, improve customer satisfaction, or increase operational efficiency, every element of the target state should contribute to these outcomes.

- Key Performance Indicators (KPIs) should be established to measure success. Examples of KPIs include reducing operational costs by 20%, increasing the speed of customer onboarding by 30%, or improving customer retention by 15%. These metrics ensure that progress toward the target state is measurable and aligned with business priorities.

Here is an example of the evaluations of the current state and the projection of the target state of technology capabilities:

Also, here is an example of the evaluation of the Underwriting business capability, under Cost Efficiency and Risk Management key drivers, and the target state.

Strategic Steps to Achieve Target State:

To strategically achieve the target state, the organization should implement several key measures. First, establishing interim goals is crucial; these act as milestones that progressively enable the achievement of target capabilities. This phased approach not only facilitates continuous assessment but also allows for necessary adjustments along the transformation journey. Secondly, priority setting is essential. The organization must focus on areas identified in the maturity assessment as needing the most improvement—these are the domains where enhancements can drive significant business value. Finally, effective resource allocation is paramount. Resources should be strategically deployed to areas that demand immediate attention and have the potential to make the most significant impact on reaching the target state. Collectively, these strategies ensure a structured and effective progression towards the envisioned future capabilities.

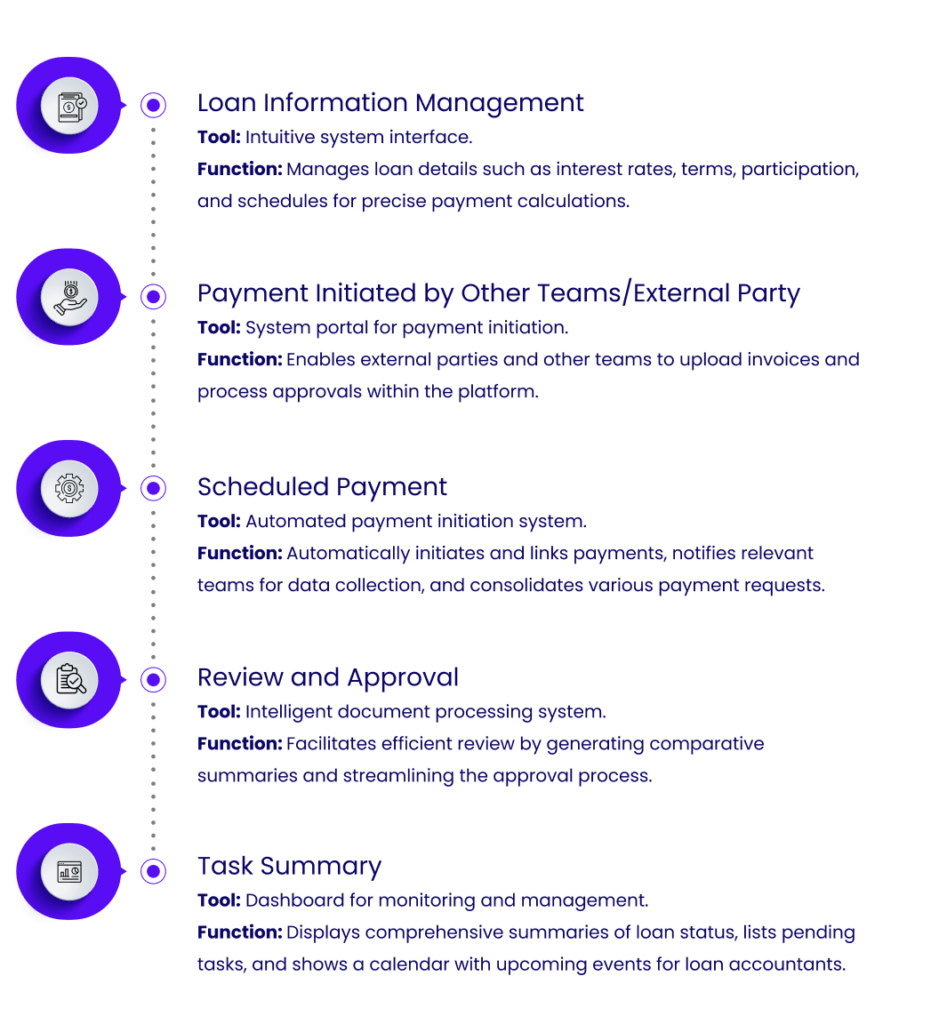

Sequencing initiatives based on Prioritization

In any large-scale transformation, successful execution depends heavily on the ability to effectively sequence initiatives. For lenders, this is particularly important given the complexities of aligning technology upgrades, process changes, regulatory requirements, and customer experience improvements. Developing a prioritization framework based on a feasibility versus business value matrix, along with other key factors, allows for focused and efficient execution of transformation efforts.

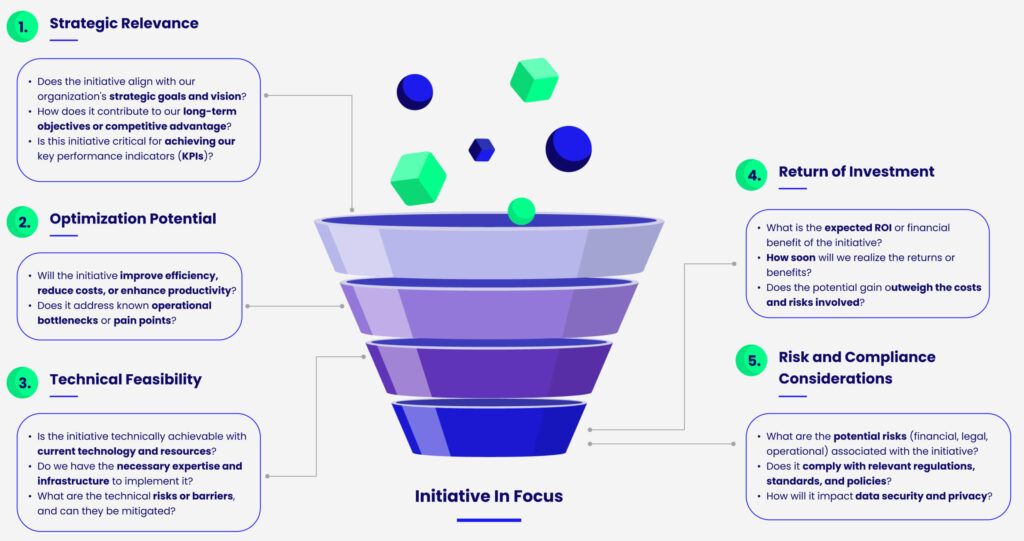

Feasibility vs. Business Value: A Practical Framework for Prioritization

Before delving into the detailed analysis with the Feasibility vs. Business Value Matrix, it’s crucial to first conduct a prefilter step. This preliminary assessment serves to screen initiatives by answering key questions related to their strategic alignment, optimization potential, technical feasibility, potential return on investment, and compliance considerations. By addressing these questions, we can effectively filter out initiatives that are misaligned with our strategic goals or lack viability, ensuring only the most promising initiatives proceed to the detailed evaluation phase. This streamlined approach helps prioritize resources efficiently and focus on initiatives that offer tangible benefits.

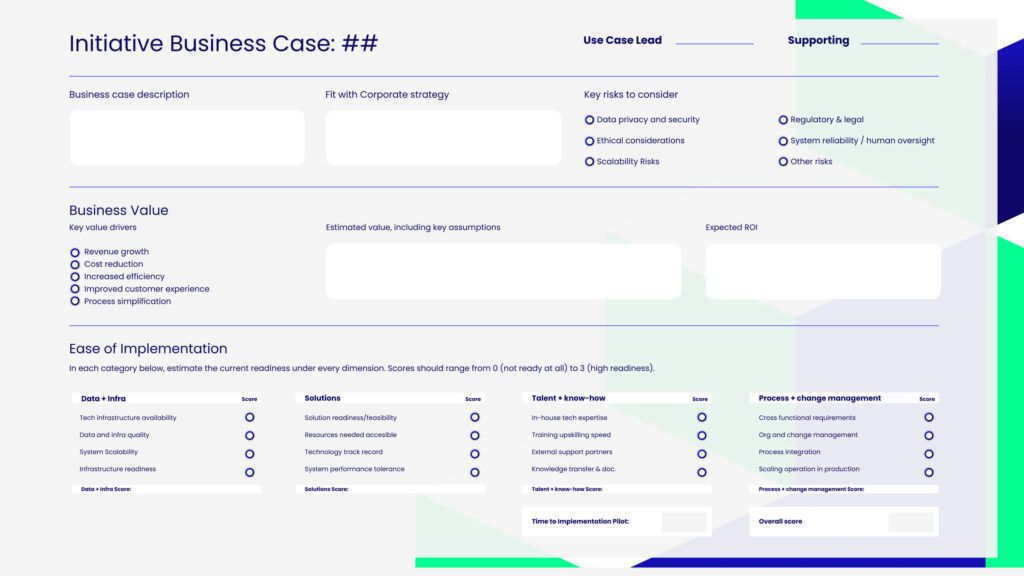

To effectively prioritize initiatives using the Feasibility vs. Business Value matrix, it is essential to assign specific weights to each factor within both the feasibility and business value dimensions. Not all factors carry the same importance for every organization. By assigning weights to each factor—such as technical complexity, resource availability, revenue impact, or customer experience enhancement—organizations can create a more nuanced and tailored evaluation. Once weights are established, each initiative can be assessed by scoring it against these weighted factors. This scoring process allows for a more objective comparison of initiatives, making it easier to identify which projects should be prioritized based on their overall feasibility and potential business value. This approach not only brings clarity to the decision-making process but also ensures that resources are allocated to initiatives that best align with strategic goals while considering practical constraints. Each of the initiatives will have a Business Case, where evaluation will be placed.

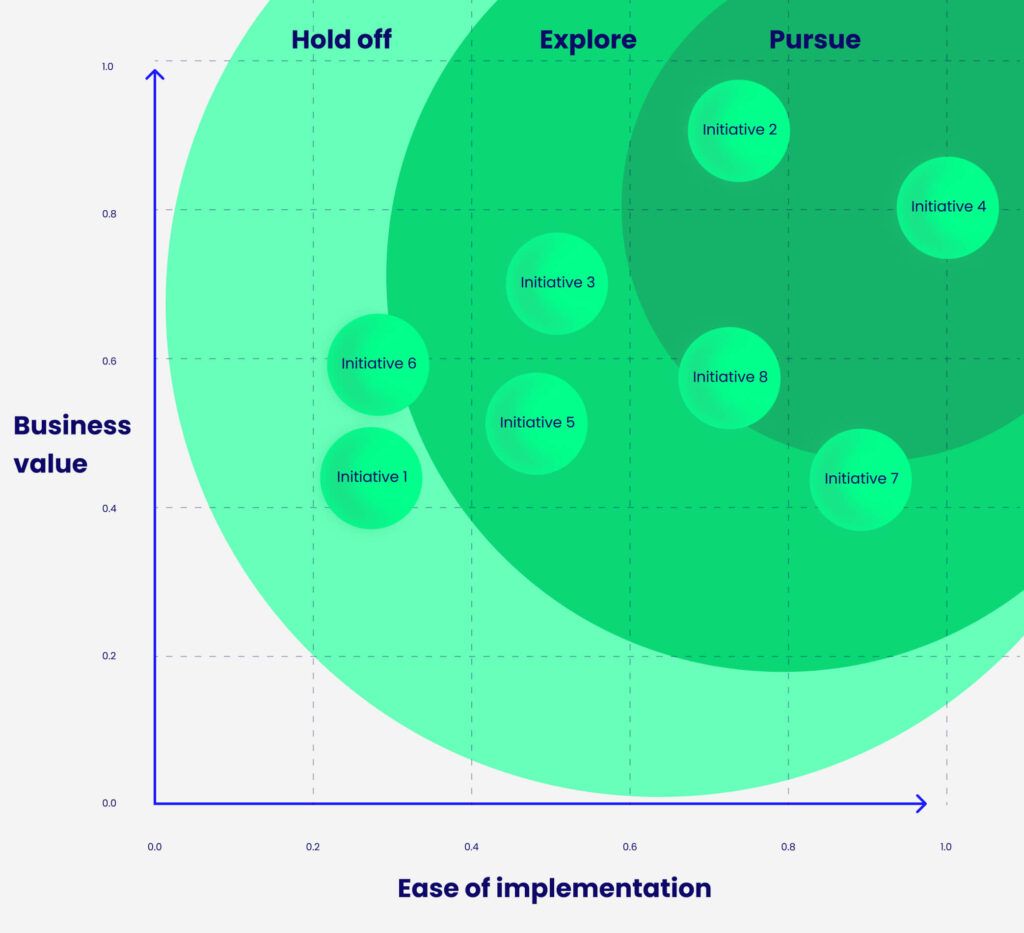

Once the initiatives are evaluated, they can be plotted in a scatter chart graph, where the initiatives will be classified into three zones:

Initiatives to Pursue, with high ease of implementation and high business value; Initiatives to Explore, with high ease of implementation OR high business value; and Initiatives to Hold Off, with low ease of implementation OR low business value. Using this matrix allows lenders to visually map and rank initiatives, ensuring that resources are directed toward efforts that provide the greatest return on investment (ROI) while aligning with strategic objectives.

Balancing Quick Wins with Strategic Priorities

While the matrix provides a clear view of where to start, balancing quick wins with strategic priorities is key to sustaining momentum throughout the transformation. Here’s how:

- Phased Approach: Start with quick wins that deliver early benefits. These successes build credibility and buy-in for the broader transformation, making it easier to secure resources and stakeholder support for more complex initiatives.

- Dependency Mapping: Before initiating any strategic priority, map dependencies to understand how one initiative impacts others. For example, deploying an integrated loan origination platform may depend on completing data integration projects first.

- Risk Management: Prioritize initiatives that mitigate risks early on, such as addressing regulatory compliance issues or upgrading outdated systems that could lead to business disruptions.

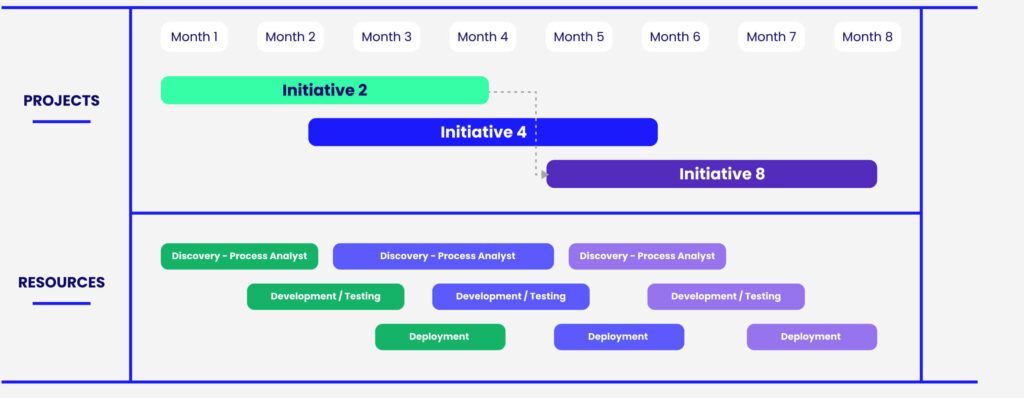

Creating a Transformation Roadmap: Sequencing and Milestones

Once initiatives are prioritized, a transformation roadmap can be developed to sequence the initiatives over time. The roadmap should include:

- Phases and Milestones: Break the transformation into phases, each with clear milestones. For example, Phase 1 might focus on foundational upgrades like data integration, while Phase 2 could introduce customer-facing digital services.

- Resource Allocation and Timeline Planning: Align resources, including personnel, technology, and budget, with the planned initiatives. Ensure timelines are realistic and consider potential delays or risks.

- Cross-Functional Coordination: Transformation often requires collaboration across different business units, including IT, operations, finance, and customer service. The roadmap should define how these units interact at each phase and clarify roles and responsibilities.

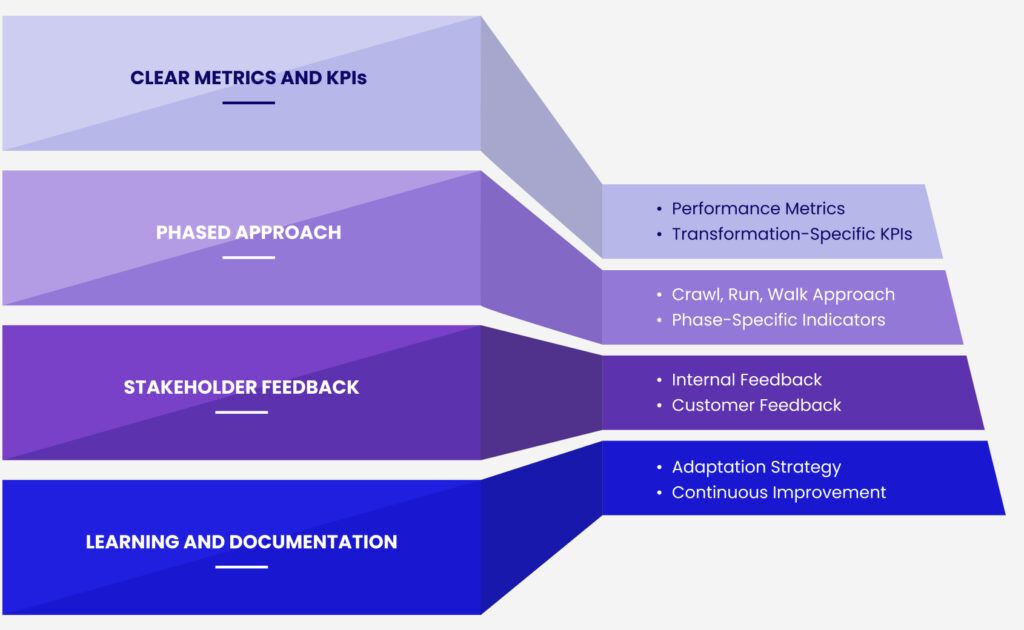

Measuring Progress – Tracking Success of Large-Scale Transformations

Measuring progress and tracking the success of large-scale transformations are critical to ensuring that the organization’s strategic changes yield the desired outcomes. Effective measurement and tracking not only provide a clear view of how well the transformation initiatives are performing but also help identify areas that need adjustment or further improvement.

Establishing Clear Metrics and KPIs

Establish specific, measurable, achievable, relevant, and time-bound (SMART) metrics that align with the strategic objectives of the transformation. These could include operational efficiency metrics, customer satisfaction scores, system uptime, and financial metrics like ROI and cost savings.

Develop KPIs that are tailored to the specific goals of each transformation initiative. For example, if a project aims to enhance digital customer interactions, relevant KPIs might include digital engagement rates and digital sales conversion rates.

Phased Measurement Approach

This structured approach details the progression of architectural and operational enhancements over a 24-month period, segmented into three phases: Crawl, Walk, and Run. Each phase is defined by specific metrics that track the maturity and effectiveness of initiatives, starting from basic compliance and engagement, advancing through process optimization and governance, and culminating in technological refinement and redundancy reduction. This method ensures that improvements are sustainable and strategically aligned, facilitating continuous advancement in both technology and business processes.

Stakeholder feedback

Stakeholder feedback plays a pivotal role in refining the transformation process. Gathering insights from internal stakeholders, including employees and management, provides a direct line of sight into the operational impacts and challenges of the transformation efforts. This internal feedback is critical for identifying unforeseen issues and areas needing improvement. Similarly, actively engaging with customers to obtain their perspectives on how changes affect their experience helps in adjusting strategies to better meet consumer demands, particularly for customer-facing innovations.

Learning, Adaptation and Documentation

Incorporating continuous learning and adaptation ensures the long-term success of transformations.

Regular data analysis allows for real-time adjustments and fine-tuning of strategies.

Transparent reporting and thorough documentation build trust and align stakeholders.

Sharing success stories reinforces the transformation’s value.

A structured framework to measure progress through ‘Crawl’, ‘Walk’, and ‘Run’ phases helps achieve immediate goals while supporting sustainable growth and adaptation.

Conclusion: Securing Success Through Strategic Transformation

Large-scale transformations require meticulous planning, execution, and continuous oversight, aimed not only at achieving short-term goals but at reshaping the organization for long-term success. A well-structured transformation roadmap helps align strategic actions with broader business objectives, ensuring each step contributes meaningfully. By adopting a phased approach—crawling before walking, and walking before running—organizations can manage the pace of change, solidifying capabilities before moving on to more complex initiatives, reducing risk, and enhancing the likelihood of success.

Continuous progress reviews, real-time monitoring, and stakeholder feedback are crucial for keeping the transformation relevant and responsive. Fostering a culture of learning and adaptation ensures that insights from each phase are integrated into future strategies. Transparent communication and documentation further support this adaptive approach, keeping stakeholders informed and engaged. Ultimately, transformation success lies not just in completing initiatives, but in positioning the organization to meet future challenges and seize new opportunities, ensuring sustainable growth and evolution.

Ruben is a technology strategist with a passion for turning complex challenges into streamlined solutions. With over 8 years of experience in process optimization and business intelligence, he has led automation, data analytics, digital innovation, and technology transformation projects across the Financial, Insurance, and Healthcare sectors, consistently delivering results that drive growth and efficiency.

Prithvi Srinivasan, the Managing Director for Advisory Services, brings extensive expertise in technology strategy and digital transformation to drive mission-critical programs and advance financial institutions with AI and automation. His ability to transform complex strategies into successful transformations underscores his commitment to innovation and client value.