As the old saying goes, “cash is king” and with 85% of business owners saying they’re looking for faster and easier access to capital, it seems like this is still truer than ever in today’s economy. Factors like high inflation and slow lending processes are making it harder for small businesses to access growth and operating capital, while needing to respond to challenges and opportunities in an ever-evolving business landscape. Open Banking can help address some of these challenges. In this guide, we discuss how.

What is Keeping Small Businesses From the Capital They Need?

To understand how open banking helps small businesses access capital faster, we need to look at the challenges they currently face.

Margins Under Pressure

Small businesses find accessing capital difficult when lenders tighten their belts or become risk-averse. An unfavorable credit market can result from multiple factors, such as high interest rates or a global financial crisis.

Inflation is a major contributor to tightening the credit market. It increases the cost of labor, raw materials, and operating expenses. In fact, 49% of respondents cited the cost of goods as the biggest inflation-related concern in an Equifax survey.

If small businesses can’t pass on the increased costs to customers because of competitive pressures or customer resistance, inflation can put pressure on profit margins. This translates to a lower net income percentage and cash generation—banks don’t like to see either when lending to a business.

Slow Lending Processes

Banks require applicants to submit tax returns, financial assets, a business plan, and various other documents. Excessive paperwork leaves room for errors and missing information. This is a major reason small businesses don’t get loan approval and are often hesitant to apply at all.

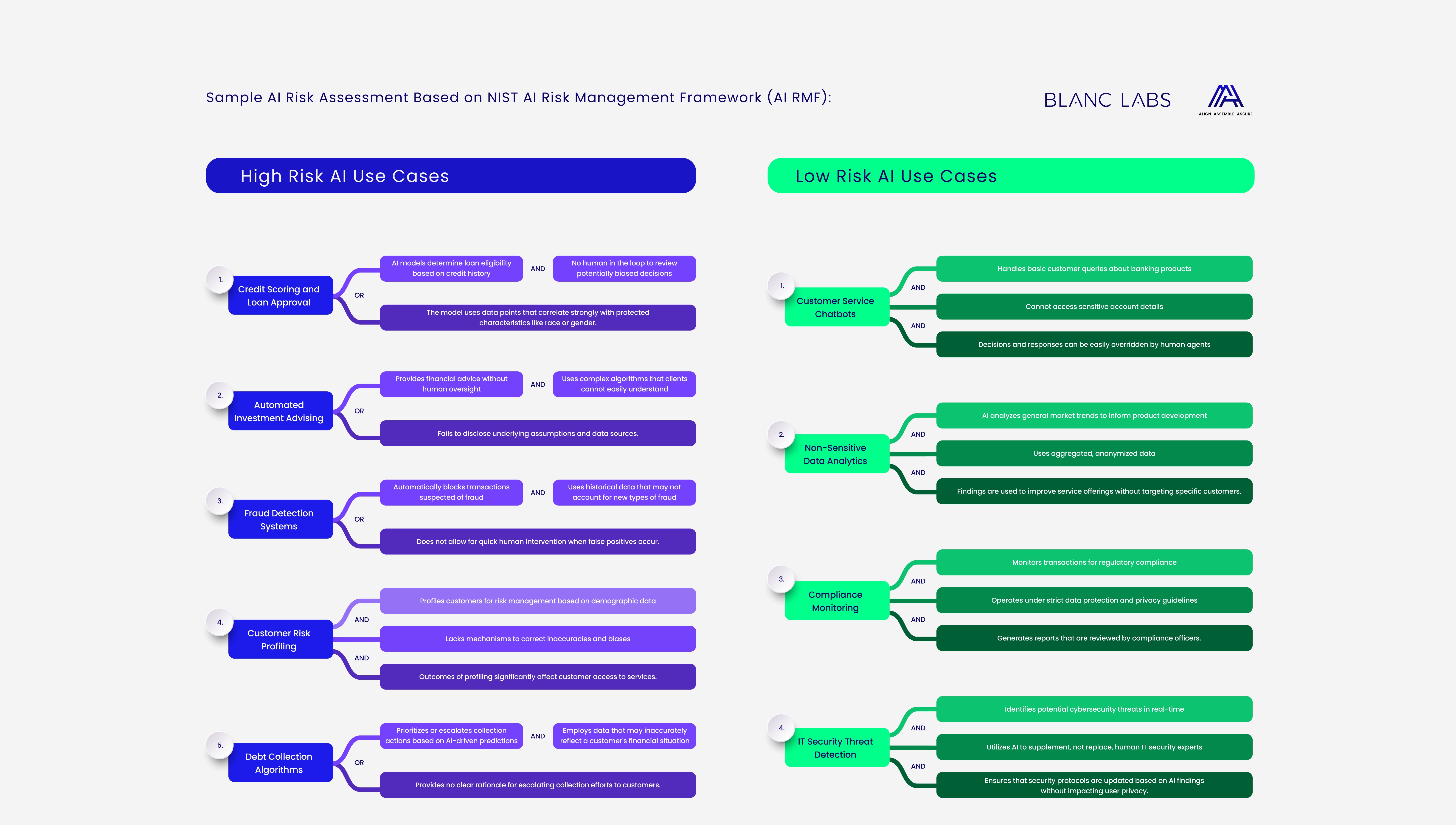

Stringent Know Your Customer (KYC) checks and rigorous anti-money laundering regulations significantly slow down loan approvals. Banks in Canada take risk assessment seriously. While there’s a good reason for it, analyzing credit history, projecting cash flows, and valuing collateral take time.

Even after going through the process, the number of small businesses that secure funding is often as low as 13.5%. Moreover, applicants who do make it through the approval phase might receive approval for an amount lower than requested.

Lack of Complete Information

Banks often don’t receive complete information from applicants. This can skew their decisions. For example, an applicant’s business might have changed significantly since they filed their last return.

Suppose your business recently secured a huge long-term contract with a multinational corporation. The bank might not see it on your previous return and won’t factor it into their assessment. That’s why banks need access to real-time data when making a lending decision.

Some banks rely on the borrower’s personal credit score to make lending decisions. This means you may find getting loan approval more difficult if you belong to Black or Hispanic communities where low credit scores and credit invisibility are common.

How will Open Banking Technology Transform the Lending Process?

Open banking, or “consumer-driven banking,” is about to revolutionize how small businesses secure debt capital. A whitepaper by Equifax explains:

“Two use cases stand out among those lenders already using Open Banking: payment initiation and more accurate consumer lending decisions. Not far behind, at 24%, are organizations that are using Open Banking to improve estimation or verification of consumer income.”

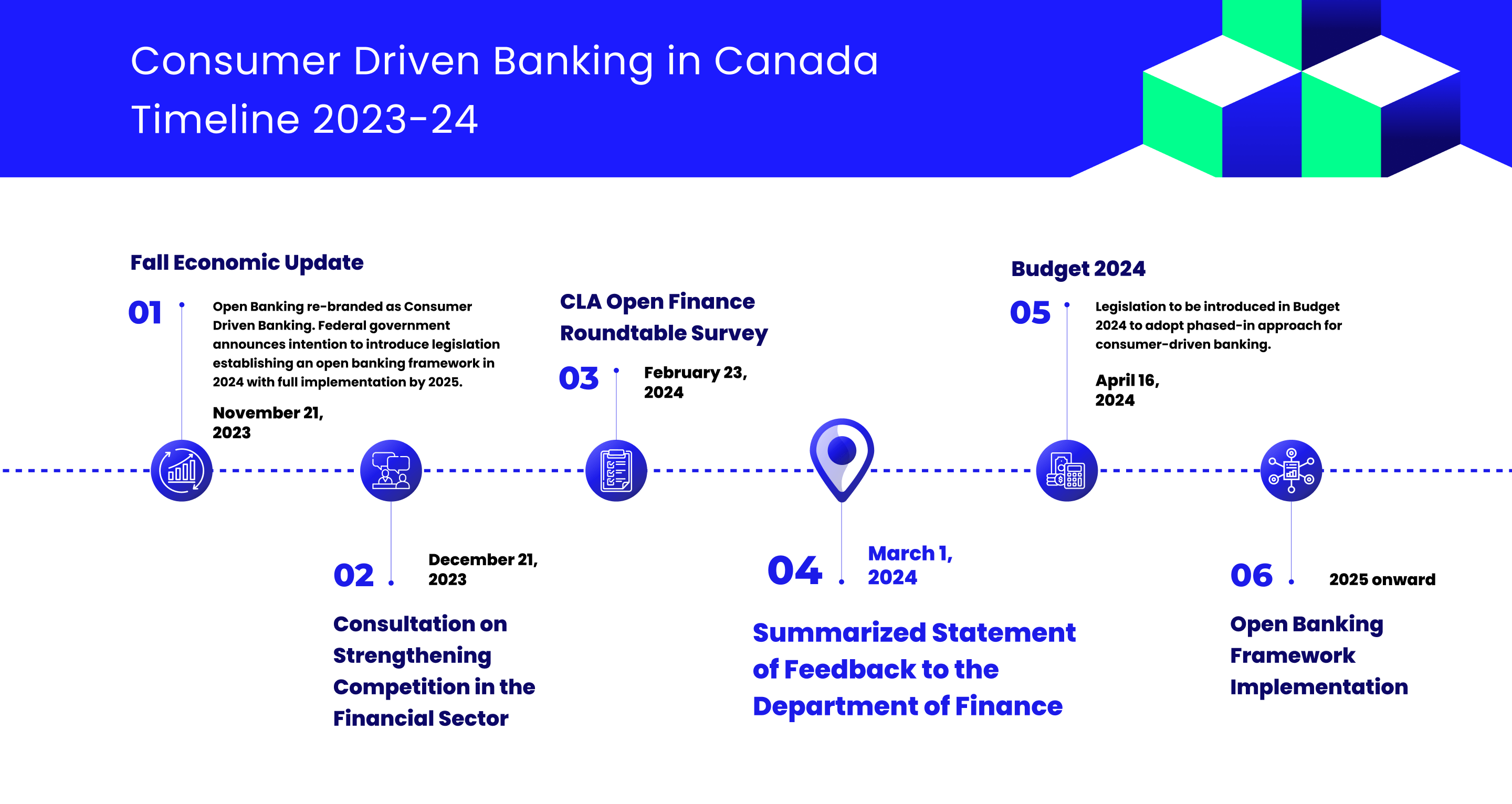

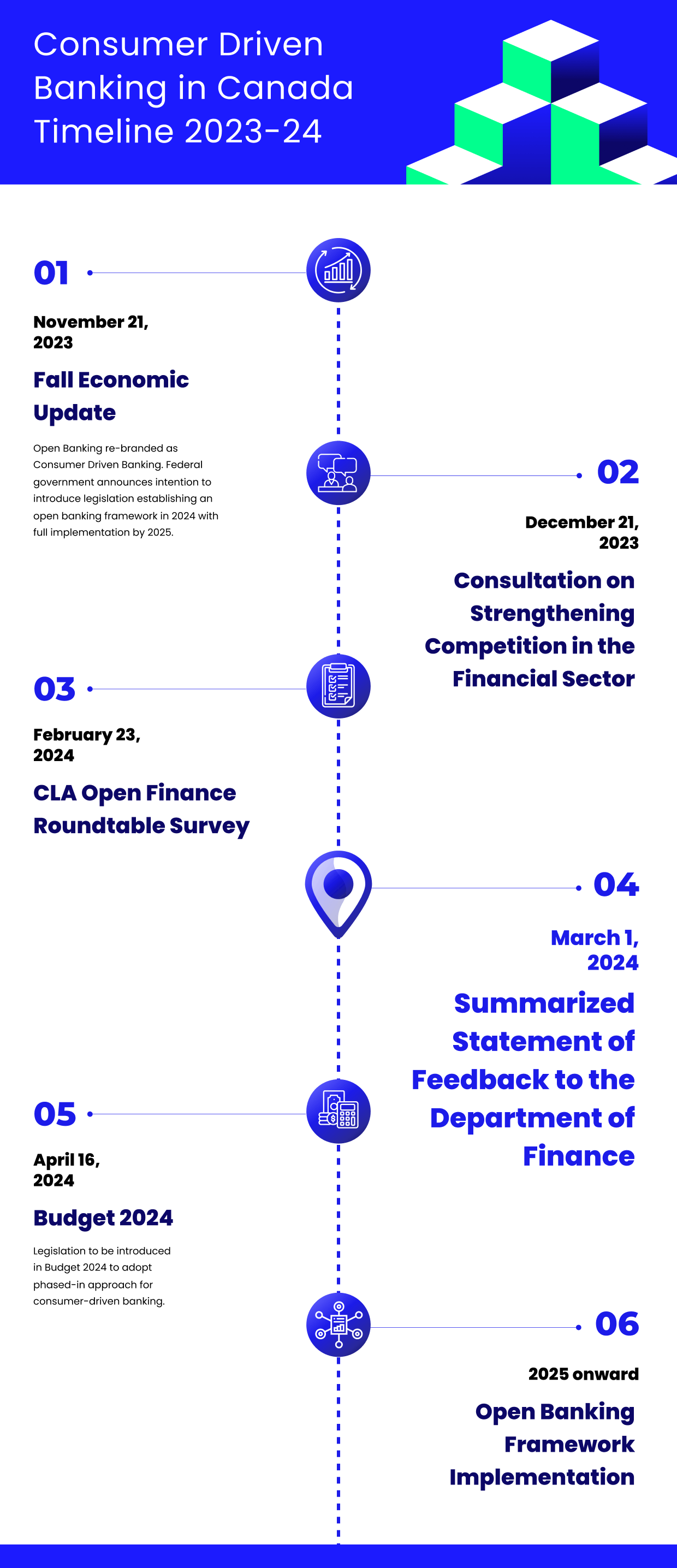

Open banking is not available in Canada yet, but work is underway to implement it as soon as possible. Open banking will transform the lending process in the following ways, making it easier for small businesses to access debt capital from financial institutions.

Easy Access to Data for Lenders and Small Businesses

Banks rely on financial data to make lending decisions. Open banking does a great job of mobilizing financial data, and here’s how it helps both small businesses and lenders:

Offers Banks a Thorough Credit Picture

Open banking technology connects small businesses and financial institutions via a third-party provider—usually fintech companies and alternative lenders. Third-party providers have access to a wealth of financial information, including transaction history, income, and the applicant’s creditworthiness. This gives lenders ample data to assess a loan application.

Third-party apps use application programming interfaces (APIs) to access real-time financial data from multiple sources, including the applicant’s bank account. This eliminates the need for manual documentation and verification, minimizes administrative load, and streamlines the lending process.

Drives Fairer Outcomes for Applicants With Low Credit Visibility

Access to more accurate data also drives fairer outcomes for a diverse range of applicants. This is especially important for Canada, where 12.2% of small business owners or primary decision-makers belong to a visible minority.

Many of these owners, especially those who recently migrated to Canada, don’t have enough financial history that banks can use to assess their creditworthiness. Open banking can help these applicants by enabling them to supplement loan credit checks with transaction data.

Enables Small Businesses to Seek Funding More Strategically

Open banking products give small businesses a holistic view of their financial position. For example, small businesses can monitor their cash flows and profitability during times of economic turmoil and apply for a loan once their financial statements project greater resilience.

In countries where open banking has already been implemented, businesses have realized various benefits, including greater visibility over cash flow. The UK’s Open Banking Implementation Entity interviewed 900 SMEs, of which 77% reported that open banking provided them with better visibility of their financial position.

Streamlined Application and Approval Process

Funding that doesn’t arrive on time is often futile. If you need access to quick cash during a high-growth phase or cash crunch, you probably don’t want to wait weeks until, and if, the lender approves your application. Not to mention, the loan application process itself could take up to a week, depending on the lender you’re dealing with.

Open banking automates various tasks in the lending process, such as:

Customer Data Aggregation

Open banking APIs enable applicants to share financial data with the lender via the open banking app. There’s no need for applicants to submit documents and statements manually. Once data flows in through the API, advanced data analytics tools and algorithms categorize, structure, and analyze the data to assess creditworthiness.

Cash Flow Analysis

Your cash flow statement may give lenders an idea of your business’s ability to generate cash. However, analyzing the sources and applications of cash using a cash flow statement requires manual work.

Instead of manually going through the cash flow statement, lenders can run the data through an algorithm or data analytics tool. They can apply advanced data analytics techniques to customer’s cash flow data sourced through open banking to understand the customer’s sources of income, recurring expenses, and spending habits.

Integration with Loan Origination Systems

Open banking enables seamless integration with the lenders’ loan origination systems, facilitating automated data transfer. This means underwriters, loan officers, and decision-makers have all the data they need readily available, resulting in faster approvals.

Greater Transparency and Competition

Here’s how open banking enhances transparency and competition:

Makes Shopping for Loans Easier

Open banking offers small businesses greater transparency over prevailing rates. With better data portabilitybusiness owners could use a third-party app to compare interest rates, terms, and features of a loan product across multiple lenders without having to approach them individually.

Increases Efficiency and Innovation

Open banking levels the playing field by lowering the entry barrier for new financial services startups. Open banking has been instrumental in facilitating new lending models like peer-to-peer (P2P) lending platforms and digital lending marketplaces where you can explore a wide range of financing options.

Open Banking for Small Businesses: Immediate and Long-Term Benefits

Here are some benefits of open banking for small businesses:

Faster Access to Capital

Small businesses often face various challenges when accessing traditional financing options like bank loans, thanks to stringent eligibility criteria and lengthy approval processes. According to Ellie Mae, the average time to close a loan from the day of application to the disbursement of funds is 52 days.

Open banking makes it easier for small businesses to access capital via alternative financing options. Countries that have already implemented open banking are seeing massive benefits. For example, Infosys built an open banking solution for a non-banking financial company (NBFC) in India. The solution helped the NBGC disburse funds faster while remaining 100% compliant.

Helps Build Long-Term Financial Fortitude

Financial prudence offers various long-term benefits. Many small businesses aren’t profitable and deal with cash flow challenges. Using open banking solutions to track financial data across multiple accounts can add financial fortitude to your business, which is critical to getting the best loan terms and quick approval.

Open banking software can even help reduce costs. A survey reveals that open banking helps businesses save up to 150 hours and 36 minutes each year—a little over four full working weeks. This translates to greater profitability and favorable changes in key metrics like the interest coverage ratio, eventually improving the odds of getting a loan approved.

Tailored Financial Products

Open banking offers personalized financial products and services that cater to a small business’s specific needs.

Suppose a small business uses an open banking app that monitors the business’s cash flow. The app keeps forecasting cash flows in real-time and alerts you when it sees a possible cash crunch coming.

It also recommends a working capital loan, a list of lenders offering great terms, and a repayment schedule so the business owner or decision-maker can understand the impact on cash flows.

Fosters Innovation and Competition

Greater access to financial data gives fintechs the ammunition to develop unique solutions and tailored offerings that address specific needs insmall business finance.

Mastercard is already making strides towards innovating unique solutions. The company has partnered with payments platform Dwolla to help users securely send funds without sharing account or routing numbers.

It’s also collaborating with the fintech company Jack Henry, which services small community and regional banks, to provide account holders with the ability to see all of their financial information across multiple accounts (including those outside their primary financial institution) in one place.

The UK has already seen a massive range of innovative solutions powered by open banking. For example, the UK has apps to help people easily pay tax—the UK government received over £10.5 billion in taxes through open banking payments, according to a report by the Joint Regulatory Oversight Committee published in February 2023.

Empowers Customers

One of the most significant aspects of open banking is customer empowerment. Open banking promotes transparency and accountability in the financial ecosystem by putting control of data into the customers’ hands and letting them decide whether they want to share their data with a third party. Customers can choose to share data with lenders that offer the most competitive loan terms, driving competition among lenders.