Why Banks and Credit Unions Should Pick Technology Vendors with SOC 2 Type II Certification

Are your technology vendors SOC 2 Type II compliant? If not, your bank or credit union could be another data breach case study in the making. Many financial institutions, including big ones like Bank of America, fall victim to data breaches every year because of a third party.

According to IBM’s Cost of a Data Breach Report, data breaches cost an average of $4.45 million. Partnering with SOC 2 Type II certified vendors can significantly minimize the risks of data breaches. In this guide, we explain how.

What is SOC 2 Type II Compliance?

SOC 2 Type II is a framework that assesses the effectiveness of internal controls used by a service organization to protect customer data. The American Institute of Certified Public Accountants (AICPA) established SOC (Service Organization Control) 2 standards based on five trust service criteria (TSC):

- Security: The systems must be protected against unauthorized physical and logical access using firewalls and authentication.

- Availability: The systems must be accessible as per service level agreements (SLAs). This includes, but is not limited to, monitoring network performance and availability, site failover, and security incident handling.

- Processing integrity: The right data must be delivered at the right price and time. Data processing must be complete, timely, validated, accurate, and authorized.

- Confidentiality: Access to data must be limited to authorized parties using encryption, firewalls, and access controls.

- Privacy: The system’s collection, use, retention, disclosure, and disposal of information must conform with the company’s privacy notice and the criteria set according to AICPA’s generally accepted accounting principles (GAAP).

The Difference Between SOC 2 Type I and Type II Compliance

SOC 2 Types I and II differ in terms of scope and duration of evaluation. Here’s how:

- SOC 2 Type I is like a snapshot of your organization’s controls at a specific point in time. It confirms that necessary systems and processes exist to meet the TSC, but doesn’t consider the effectiveness of those controls. Companies often use type I reports to show commitment to security and compliance at a specific point in time, such as during contract negotiations.

- SOC 2 Type II involves a more comprehensive audit conducted over six to 12 months. Since the audit spans over a longer time frame, it helps validate the effectiveness of controls rather than just verify their presence. Type II reports offer more value to companies that want to offer their customers ongoing assurance about the effectiveness of controls over time.

If you’re a bank or credit union, partner with SOC 2 Type II vendors. The longer testing window and the focus on the effectiveness of controls are vital to minimizing security and other risks.

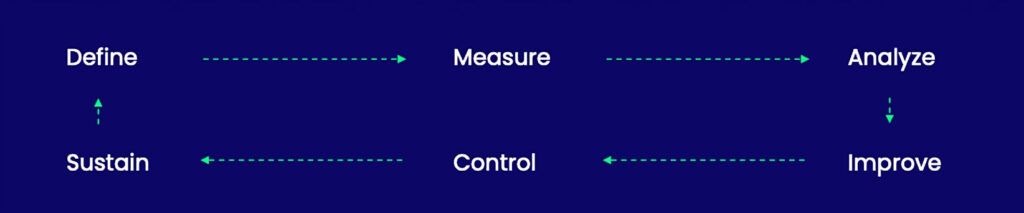

How SOC 2 Type II Certification is Achieved

To become SOC 2 Type II compliant, a business must implement controls, gather supporting evidence, and engage a CPA to conduct an audit. If the CPA is assured that the organization has complied with all the requirements based on the audit, they give the company an unqualified opinion. Of course, the process is easier said than done. Here’s a quick overview of what the process looks like:

Identify Gaps

The organization looking to get certified needs internal controls in one or more of the five TSC. Security is a mandatory TSC, but the organization can choose others if it makes sense for their business or customer needs. Next, they need to assess their current controls and processes against the TSC to find gaps. This gives them a starting point and a preview of the quantum of effort required for certification.

Design and Implement Controls

Each TSC has sub-criteria that require the organization to establish and test controls, and remediate where necessary. As simple as it may sound, designing controls and collecting evidence can be quite complex. That’s exactly why it’s best to assign the program to someone with adequate technical knowledge, such as a CTO.

The CTO must monitor the designing of controls and implement them across the organization. This involves training staff, updating IT systems, and reengineering or modifying processes to effectively support new controls. The organization must document all control activities, policies, and procedures in detail. These documents are crucial to demonstrating compliance during the audit.

After all controls are in place, the organization must conduct a pre-assessment to test the effectiveness of controls and fix any issues or deficiencies that come to light.

Select an Auditor

Once all the controls are in place, it’s time to engage an independent third-party auditor to perform the SOC 2 Type II audit. The company looking to get certified can hire one of the Big4 firms, a CPA firm, or an individual practicing CPA, but it’s important to choose a CPA who has experience with SOC 2 assessments and understands the company’s industry and compliance needs.

The CTO should work closely with the auditor throughout the process. The auditor will require a minimum of six months to assess the design and operational effectiveness of controls and verify compliance with TSC. If the auditor finds deficiencies during the audit, the organization must be prepared to promptly address them.

Obtain Certification

Once all issues have been identified and remediated and the audit is completed, the auditor will issue a SOC 2 Type II report. The report assures customers and stakeholders that the company’s controls are effectively designed and operating consistently over time. Beyond this point, the organization must continuously monitor and review controls, conduct periodic assessments, and stay updated with regulatory changes to maintain compliance.

The Importance of Working with a SOC 2 Type II Compliant Vendor

Banks and credit unions handle massive volumes of sensitive financial data every day. It’s critical to ensure this data’s security during day-to-day operations. SOC 2 Type II certification assures you and your customers that your vendors have the infrastructure and internal controls in place to securely process sensitive data. Let’s dive deeper into why banks and credit unions need to seek vendors with SOC 2 Type II certification:

Data Security

Data breaches at financial organizations can have serious repercussions—they can erode customer confidence and invite thousands of dollars in penalties. That’s why you should work with SOC 2 Type II compliant technology vendors—their compliance with SOC 2 standards assures that internal controls are in place to secure data.

Risk Mitigation

Partnering with SOC 2 Type II certified vendors minimizes the risk of data breaches, regulatory penalties, and damage to reputation. The number of cases of data violations jumped to 744 in 2023 from 138 in 2020—in a world where data breaches are a major risk, working with vendors that have adequate security can significantly lower the probability of mishaps.

Compliance Alignment

Many SOC 2 Type II requirements overlap with requirements of standards and regulations like PCI DSS (Payment Card Industry Data Security Standard) and GLBA (Gramm-Leach-Bliley Act), and guidelines from FFIEC (Federal Financial Institutions Examination Council).

Common compliance requirements include controls over areas such as data encryption, network security, and vulnerability management, as well as data protection measures like tokenization and secure transmission protocols.

Operational Resilience

SOC 2 Type II assesses the availability and processing integrity of the vendor’s systems. Certified vendors have robust measures in place to ensure uninterrupted access to critical systems and maintain the reliability and accuracy of data processing. This offers operational resilience and continuity and minimizes disruption, allowing banks to deliver frictionless services to customers.

Enhanced Trust and Reputation

Partnering with certified vendors shows your customers that you prioritize integrity, transparency, and accountability when looking for vendors. It makes customers feel more confident when sharing personal and sensitive data with your systems. Over time, this builds trust and enhances reputation among clients and the broader community.

Select Technology Vendors You Can Trust

Non-certified vendors pose a significant burden and risk to not just your bank or credit union but also to customers who choose to bring their business to you. Falling victim to a data breach can ruin your bank or credit union’s reputation and invite costly penalties from regulators.

The best way to safeguard your business, clients, and reputation is to only trust SOC 2 Type II certified vendors like Blanc Labs with your data. If you’re looking for help with designing, building, and integrating future-ready core banking systems, book a free consultation with us today.

We also explore technology best practices to make your Open Banking adoption journey a success.

We also explore technology best practices to make your Open Banking adoption journey a success.