What is the role of a Business Process Improvement Specialist?

February 16, 2024

What is the role of a Business Process Improvement Specialist in Canada?

Business process improvement (BPI) involves analyzing current processes, identifying room for improvement, and redesigning processes to make them more efficient. The problem? Analyzing processes, using data to find inefficiencies, and redesigning and implementing processes with minimal disruption requires skill and experience. That’s where a business process improvement specialist steps in.

You might tackle various challenges when working to improve your processes. According to Capgemini, the most prominent business process management challenges are functional silo culture and fragmented budgets.

Redesigning processes while tackling these challenges can be overwhelming, but specialists are equipped with the experience needed to make the transition smoother. In this guide, we discuss the business process improvement workflow and how a specialist can make things easier for you.

The Need for Business Process Improvement before Automation

You’re investing in automation to improve business processes. Before you put money on the table, it’s vital to learn how this investment will impact your business’s efficiency and bottom line.

At its core, business process improvement is about driving efficiency and improving performance through streamlined operations. A critical analysis of business processes and workflows enables you to identify bottlenecks and inefficiencies, allowing you to focus efforts on automating the right processes.

Business process improvement is undeniably mission-critical to make your business future-ready, but it’s also important to:

- Develop a competitive advantage: Prioritizing continuous improvement and standardizing processes can help build competitive advantages like cost leadership, differentiated products or services, better quality, scalability, and agility.

- Improve efficiency: Zeroing in on processes you can automate or streamline improves efficiency and output. For example, you can use technologies like intelligent document processing (IDP) to streamline invoice processing. This frees up your finance team to focus on more strategic tasks like cash flow analysis.

- Elevate customer experience: Modern customers have some ground rules. They want fast responses, consistent experiences, and personalized interactions. Modern lenders provide hassle-free digital experiences to SMB clients, where document collection is a single step and approvals take hours and not weeks.

“The fact is that consistency on the most common customer journeys is an important predictor of overall customer experience and loyalty. Banks, for example, saw an exceptionally strong correlation between consistency on key customer journeys and overall performance in customer experience.”

- Foster a culture of innovation: Striving for continuous improvement encourages critical thinking, offers your team a platform for experimentation, and rewards innovation. For example, if you’re a financial institution trying to automate your loan origination process, a culture of innovation would encourage employees to take charge of every step, from process analysis to pilot implementation.

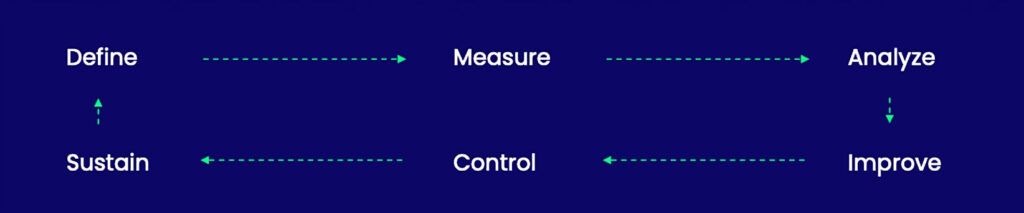

Business Process Improvement Workflow

Before you take the first step, see if you can get a business process improvement specialist on board.

Their experience and expertise go a long way in minimizing workflow disruption and efficiently designing and executing new workflows. With that in mind, let’s talk about how you can improve business processes.

Process Mapping

Process mapping involves creating a visual representation of your current business processes. You map every step, interaction, and decision point in your workflow from start to finish when mapping a process.

This map gives you a starting point to understand how the current process works. Identifying bottlenecks or ways to make a process more efficient is easier when you can view the process rather than just verbally discussing the steps in a process.

Root Cause Analysis

Time to play detective. Root cause analysis involves digging deeper into finding the underlying reasons behind a specific problem or inefficiency. For example, if you’re a financial company experiencing delays in processing customer payments, here’s what finding the root cause might look like:

- Why are employees encountering difficulties processing the payments? Probably because employees are spending time fixing errors in payment records.

- Why are there discrepancies in the payment records? Maybe the outdated system is causing technical problems or employees need more training.

- Why are we using outdated systems and not investing in training? Lack of budget.

This is how root cause analysis takes you to a problem’s roots. In the example above, the finance team could request additional funds in the next quarter to invest in a system upgrade and training to process customer payments faster.

Cause and Effect Analysis

Use techniques like fishbone or Ishikawa diagrams for a visual representation of the cause-and-effect relationship between factors impacting your business processes and problems.

Categorize problems into multiple buckets like people, processes, equipment, and external factors. This will help you gain insights into various elements that impact your business processes and prioritize the ones with the biggest positive impact.

Statistical Process Control

Numbers don’t lie — statistical process control (SPC) helps you understand your process through numbers. SPC enables you to identify trends, detect abnormalities in the process, and make data-driven decisions to improve your process.

Design of Experiments

Once you’ve identified a problem, you need a systematic and structured way to identify potential improvements and test them. Experimentation helps you do exactly that.

It’s the same as stress-testing your processes under various scenarios. You design an experiment, manipulate relevant variables, and measure their impact on the business process. This enables you to understand the impact of a change before you fully implement it, allowing you to minimize disruption.

How BPI and Intelligent Automation can improve the Borrowing Experience for Small Business Owners

A Frustrating Lending Experience

Alex applies for a loan with a traditional commercial lender to expand her cafe into a local chain. The onboarding process is frustrating and time-consuming, with lengthy paperwork and no guidance. The lender’s inaccurate reporting and static risk assessment results in conservative loan terms that fail to acknowledge her business’s recent growth and the positive trends in the local market. This jeopardizes Alex’s ability to secure an ideal property for her new location and erodes her confidence in the lender’s support for her business growth. Throughout the process, Alex experiences an impersonal service, devoid of the understanding and support crucial for an entrepreneur.

A Transformative Lending Experience

Six months later, Alex chooses a lender with a digital platform and automated loan decisioning for her next expansion. With streamlined onboarding, automated data extraction, and intelligent chatbot, the experience is transformative. Real-time updates, automated tracking, intelligent document processing, and dynamic risk assessment make loan processing efficient and user-friendly. Alex secures her loan promptly and finds the perfect location for her new café. The chatbot also offers personalized customer experience, making Alex feel valued.

The Role of a Business Process Improvement Specialist

Process mapping, analysis, and re-engineering require a specialist. A specialist has the knowledge and experience required to minimize workflow disruption and effectively realize process efficiencies. Here’s how a business process improvement specialist helps:

Pain Point Discovery

Think of business process improvement specialists as Sherlock Holmes. They come in, zoom into your processes, and find pain points that hinder efficiency.

They don’t just observe. They conduct interviews and surveys, ask the right questions, and listen attentively to discover areas that are inefficient, error-prone, and not aligned with organizational goals. The discovery phase is vital — it sets the stage for targeted improvements.

Process Analysis

When the specialist finds room for improvement in a process, they pull up their sleeves and start dissecting it.

They map every step, decision point, and interaction in your process and use techniques like value stream mapping, data analysis, and flowcharting to take a closer look at how the process currently operates and where bottlenecks and inefficiencies lie. This lays the groundwork for informed and data-backed decision-making and process design.

Opportunity Analysis

Insights from process analysis equip the specialist to shift focus to opportunity analysis. They consider the benefits of addressing a pain point and improving the process versus the cost — do the monetary benefits of redesigning the process justify (and exceed) the cost of making those improvements?

Cost-benefit analysis requires input from multiple experts. For example, if a process redesign could improve customer experience, what would be the benefit, in monetary terms, of improved customer experience? The specialist might need insights from multiple teams like sales and accounting to understand the monetary impact.

They also consider the risks of redesigning the process. Will the redesign require significant changes? How long will it take the employees to get through the learning curve and achieve full efficiency? The specialist understands these risks and identifies ways to mitigate them.

Implementation Design

After factoring in the costs and risks associated with redesigning a process and verifying the viability of a process redesign, the specialist transitions into creating and implementing a more efficient process design.

The redesigned process might involve one or multiple changes like a more efficient workflow, new technology, or a redesigned organizational structure. For example, the specialist might use enterprise automation solutions to automate repetitive tasks, potentially multiplying your team’s productivity or include GenAI to enable the next level of customer service.

The specialist develops a detailed implementation plan including the details of redesign, clear timelines, responsibilities, and performance metrics. They collaborate with stakeholders during this phase to ensure buy-in and alignment with organizational objectives.

CASE STUDY

Revolutionizing Payment Processes at Trez Capital

Trez Capital is a Vancouver-based diversified real estate investment firm that manages assets worth $5.3 billion. Accounting teams at Trez face challenges with the daily influx of numerous payment disbursement requests, delivered in varied data formats. This reliance on manual processes and email for document handling and approvals extends disbursement cycle times, affecting efficiency and customer satisfaction.

Trez Capital has partnered with Blanc Labs to enhance their payment disbursement workflow through Business Process Improvement (Phase I) and Intelligent Automation (Phase II), promising better operational efficiency and reduced incidents.

Business Process Improvement Integration

Process improvement isn’t a one-off activity. To truly reap the benefits of process improvement, the specialist must integrate the improvement initiatives into the organization’s culture.

The specialist can help you develop change management strategies to inculcate a culture rooted in continuous improvement; this is vital to engaging employees across the organization and encouraging them to contribute ideas that drive change.

For example, the specialist can train teams to build applications quickly using low-code platforms. This enables teams to solve problems independently and quickly. Of course, there are many ways to develop a culture of continuous improvement depending on factors like industry. For example, Bill Keen, CEO of Keen Wealth Advisors, explains:

“By owning mistakes and building processes to prevent the mistakes that do occur from happening again, you will build trust among your customers and a culture of continuous improvement among your staff.”

With training and efficient feedback mechanisms, you can sustain process improvements for a long time and ingrain them in your company’s DNA.

Business Process Improvement with Blanc Labs

We firmly believe that transformation happens over time and that process improvement is an ongoing journey. Our approach helps you practically redesign processes effectively and consistently, and in a way that fits your business’s unique needs.

Related Insights

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

Meet David Liu: COE Lead, Process Improver, and Ramen Aficionado

Meet our new BPI CoE Lead, David Liu! Learn about how he plans to craft efficient processes for enterprise customers and what inspires him to innovate.

The Keys to the Secret Garden: Unlocking the Potential of AI in the Enterprise

In this article, Dave Offierski explores the conditions to support enterprise AI adoption.