Our People are our Strongest Asset

We are a diverse team of individuals on a shared mission to create lasting value through the creative use of technology.

What we care about

Innovation, Talent and Impact—these three elements make up the foundation for Blanc Labs.

We are known for our ability to innovate and bring new products, services, or technologies to market. We encourage ideas on how to make things better.

Our success depends on the talent and skills of our employees. Our people are our superheroes.

We take pride in the fact that the impact of our work goes beyond the client and affects society at large. We improve lives.

We are passionate about tech.

In our view, the possibilities to solve business problems and deliver value through creative uses of technology are endless.

See below an overview of our core tech stack but know that we are always, exploring, learning, and adopting to an ever changing technology landscape.

Tech Stack Overview

With teams based in Toronto, New York, Bogota, and Buenos Aires, we are experts at delivering on the evolving needs of our clients.

67 Yonge Street, Suite 1501 Toronto, ON M5E 1J8, Canada

General Inquiries: info@blanclabs.com

Press: marketing@blanclabs.com

295 Madison Ave, 12th Floor

New York City, New York 10017,

United States

Calle 110 No. 9-25, Oficina 919 Torre Empresarial Pacific,

Bogotá, Colombia

Virtual operations

Everything we do starts with people

I’ve grown both professionally and personally during my time at Blanc Labs. The supportive leadership has been the driving force behind my achievements.

Blanc Labs has been so empowering for me: the learning, the certifications, the opportunity to work with clients, the teamwork – my work family, really.

I feel at home at Blanc Labs. Here, I am encouraged to learn, grow, and pursue new levels of excellence every day. The leadership has been instrumental as they have nurtured me to rise to new heights and for that, I am grateful.

The culture at Blanc Labs is built on respect, empowerment and teamwork. It is a great place to grow. You need to be a constant learner and a real team player to succeed. It’s always about helping each other to get the best possible result, not about who’s getting the credit.

Latest from Blanc Labs

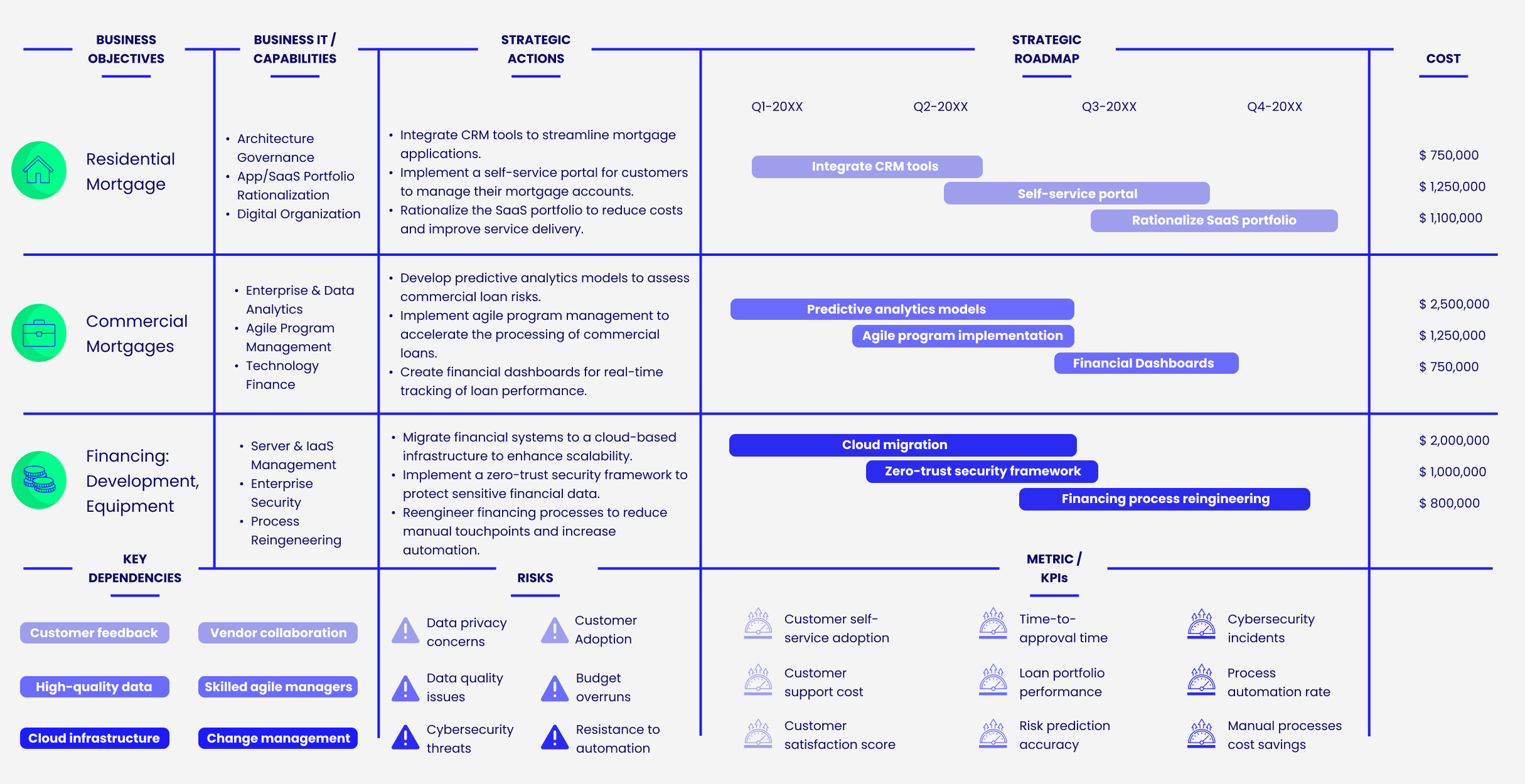

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Harnessing KMS Tools for Streamlined License Management

In the realm of software license management, KMS tools have emerged as indispensable assets. Efficiently handling software activations and ensuring compliance can be a daunting task for IT administrators. This article delves into the capabilities of kms tools and how they simplify the process of license management, enhancing operational efficiency while reducing administrative burdens. Understanding […]

Blanc Labs Welcomes Tom Purves as a Leader in Payments and Product Innovation

Blanc Labs has teamed up with industry expert, Tom Purves to bring leadership and expanded capabilities to our clients as developments in real-time payments capabilities evolve the market.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Harnessing KMS Tools for Streamlined License Management

In the realm of software license management, KMS tools have emerged as indispensable assets. Efficiently handling software activations and ensuring compliance can be a daunting task for IT administrators. This article delves into the capabilities of kms tools and how they simplify the process of license management, enhancing operational efficiency while reducing administrative burdens. Understanding […]

Blanc Labs Welcomes Tom Purves as a Leader in Payments and Product Innovation

Blanc Labs has teamed up with industry expert, Tom Purves to bring leadership and expanded capabilities to our clients as developments in real-time payments capabilities evolve the market.

Lenders Transformation Playbook: Bridging Strategy and Execution

AI’s Mid-Market Makeover in Financial Services

Mid-sized financial services institutions (FIs) are facing significant challenges during this period of rapid technological change, particularly with the rise of artificial intelligence (AI). As customer expectations grow, smaller banks and lenders must stay competitive and responsive. Canada’s largest financial institutions are already advancing in AI, while many others remain in ‘observer’ mode, hesitant to invest and experiment. Yet, mid-sized FIs that adopt the right strategy have unique agility, allowing them to adapt swiftly and efficiently to technological disruptions—even more so than their larger counterparts.

Process Improvement and Automation Support the Mission at Trez Capital 🚀

Trez distributes capital based on very specific criteria. But with over 300 investments in their portfolio, they process numerous payment requests and deal with documents in varied data formats. They saw an opportunity to enhance efficiency, improve task management, and better utilize data insights for strategic decision-making.

Align, Assemble, Assure: A Framework for AI Adoption

An in-depth guide for adopting and scaling AI in the enterprise using actionable and measurable steps.

Blanc Labs Welcomes Two New Leaders to Advance AI Innovation and Enhance Tech Advisory Services for Financial Institutions Across North America

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

Blanc Labs Partners with TCG Process to Integrate their Automation and Orchestration Platform and deliver Advanced Intelligent Workflow Automation to Financial Institutions

Blanc Labs and TCG Process have partnered to transform lending operations with innovative automation solutions, using the DocProStar platform to enhance efficiency, compliance, and customer satisfaction in the Canadian lending market.

BPI in Banking and Financial Services in the US & Canada

Banking and financial services are changing fast. Moving from old, paper methods to new, digital ones is key to staying in business. It’s important to think about how business process improvement (BPI) can help.

Business Process Improvement vs Business Process Reengineering

Business process improvement vs. reengineering is a tough choice. In this guide, we help you choose between the two based on four factors.

What is the role of a Business Process Improvement Specialist?

A business process improvement specialist identifies bottlenecks and inefficiencies in your workflows, allowing you to focus efforts on automating the right processes.

Open Banking Technology Architecture Whitepaper

We’ve developed this resource to help technical teams adopt an Open Banking approach by explaining a high-level solution architecture that is organization agnostic.

Winning the Open Banking Race: A Challenger’s Path to Entering the Ecosystem Economy

Learn about the steps you can take in forming an open banking strategy and executing on it.

Canadian IT services firms offer a strategic opportunity for US Banks and FIs

Discover the strategic advantage for U.S. banks embracing innovation with cost-effective Canadian nearshore IT support.

These are not your grandmother’s models: the impact of LLM’s on Document Processing

Explore the transformative influence of large language models (LLMs) on document processing in this insightful article. Discover how these cutting-edge models are reshaping traditional approaches, unlocking new possibilities in data analysis, and revolutionizing the way we interact with information.

From Chaos to Clarity: Achieving Operational Excellence through Business Process Improvement

Discover transformative insights and strategies to streamline operations, enhance efficiency, and drive success.

Harnessing KMS Tools for Streamlined License Management

In the realm of software license management, KMS tools have emerged as indispensable assets. Efficiently handling software activations and ensuring compliance can be a daunting task for IT administrators. This article delves into the capabilities of kms tools and how they simplify the process of license management, enhancing operational efficiency while reducing administrative burdens. Understanding […]

Blanc Labs Welcomes Tom Purves as a Leader in Payments and Product Innovation

Blanc Labs has teamed up with industry expert, Tom Purves to bring leadership and expanded capabilities to our clients as developments in real-time payments capabilities evolve the market.