Top Use Cases for Banking Automation

Did you know that the World Bank uses Banking Automation including robotic process automation (RPA) for many of its functions? That’s how powerful it is.

Modern businesses rely on automation to reduce costs and improve efficiency, but how can banks use automation? In this article, we explain the most common use cases of banking automation.

What is Banking Automation?

Banking automation involves handing over repetitive business processes in financial institutions like banks and credit unions to technologies like robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML).

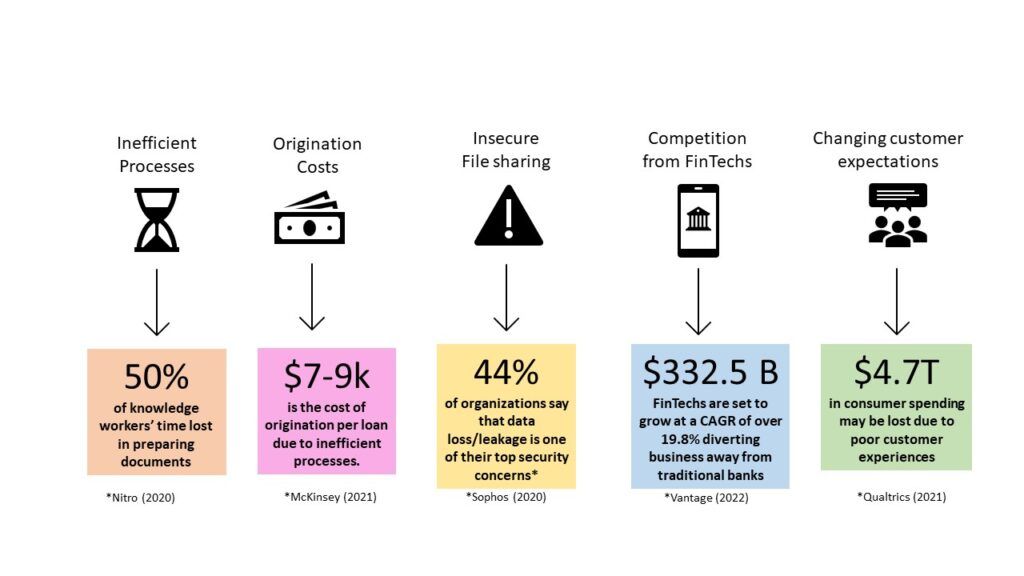

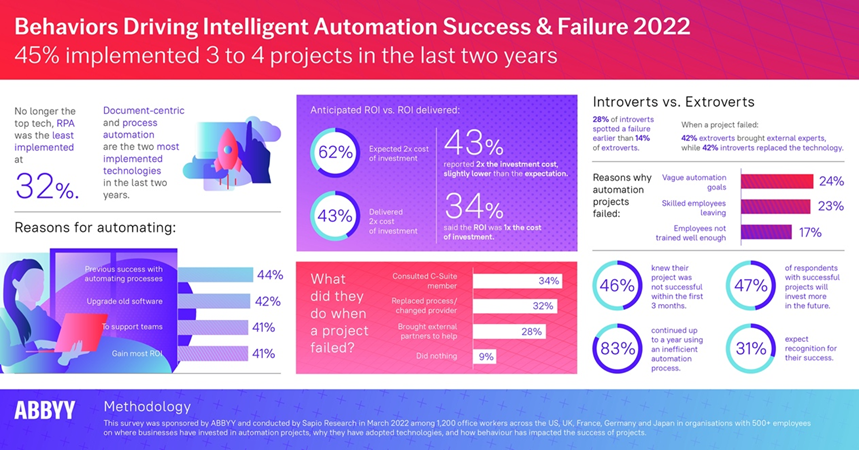

Why Banks Need Intelligent Automation

As a banking professional, you know that a good chunk of your daily tasks is repetitive and mundane. Banking automation eliminates the need for manual work, freeing up your time for tasks that require critical thinking.

Here are seven reasons why banks needs intelligent automation:

- Better Customer Experience

- Automated KYC

- Faster Mortgage Application Processing

- Accurate Report Generation

- Anti-Money Laundering Prevention

- Audits and Compliance

- Faster Decision Making

Below we dive deeper into banking automation use cases so you can get a closer look at how automation can transform your workflow.

1. Customer Experience

A robust Customer Experience has never been more important. As the world moves online, you’ll need to re-engineer your Customer Experience to make it friction free, faster and more efficient.

Consider a customer’s first experience with the customer onboarding process. If this isn’t a painless experience, you risk turning away a customer in the first interaction.

Sure, you might need to invest some money to improve the customer experience and make it seamless and efficient, but the potential ROI is excellent. Think about it. Automation will eliminate much of the manual and low-value in-person interaction, saving your sales reps plenty of time to focus on running effective sales campaigns.

Automating processes reduce the potential for errors, allowing you to onboard customers faster. Automation also reduces costs because it eliminates the manual labor and paperwork associated with customer onboarding.

Moreover, your customers will be able to use their accounts faster, which improves customer experience. As a McKinsey report explains:

“Automation and artificial intelligence, already an important part of consumer banking, will penetrate operations far more deeply in the coming years, delivering benefits not only for a bank’s cost structure, but for its customers.”

2. KYC

Most banks perform KYC (Know Your Customer) by manually verifying customer details. The problem? Manual verification can take plenty of hours.

The KYC process doesn’t end at verification. You must manage KYC documents for a long time to comply with regulatory requirements. Using automation in banking operations can help free up the hours you spend on manual verification.

Moreover, automation also eliminates the risk of human error. By eliminating room for error, automation ensures improved customer experience, increased quality assurance, and the number of cases processed each month, according to a McKinsey study.

3. Mortgage Application Processing

Mortgage application processing involves plenty of paperwork. Manually checking details on each document is time-consuming and leaves room for error. On the other hand, intelligent document processing (IDP) helps streamline document management.

Remember those desks full of paperwork? That’s a thing of the past. Modern banks use IDP to manage documents digitally. IDP helps automate the generation of customer risk profiles and mortgage document processing, reducing processing time to a few days.

An Accenture study found that 47% of customers prefer opening a new bank account online using a computer, while 37% prefer using the bank’s app or website.

The shifting consumer preferences point to a future where loan requests and processing are online and automated. Now is a great time to prepare your bank for that future.

4. Report Generation

All financial institutions need to generate reports for various purposes. For example, you might need to generate a report to show quarterly performance or transaction reports for a major client.

RPA can help generate reports automatically. The system can auto-fill details into a report and prepare an error-free report within seconds. An automated system can perform various other operations as well, such as extracting data from internal or external systems and fact-checking the reports.

5. Anti-Money Laundering (AML) Prevention

In Canada, banks need to ensure they are complying with the statutes of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, 2000. Depending on your location, compliance requirements might include ongoing risk-based assessment, customer due diligence, and educating staff and customers about AML laws.

A single AML investigation can take 30 minutes or more when assigned to an employee. However, automation can complete the same investigation much faster and minimize errors.

Using automation ensures you don’t spend too much money on AML investigations and stay compliant, so you don’t have to pay hefty fines.

6. Audits and Compliance

The cost of maintaining compliance can total up to $10,000 on average for large firms according to the Competitive Enterprise Institute.

Maintaining compliance is expensive but less so than being non-compliant. For example, banks must ensure data accuracy when producing loan facility letters. However, instead of requiring employees to spend time meticulously verifying customer data, you can use intelligent document processing to save time and guarantee data accuracy.

Banking automation can help you save a good amount of money you currently spend on maintaining compliance. With automation, you can create workflows that satisfy compliance requirements without much manual intervention. These workflows are designed to automatically create audit trails so you can track the effectiveness of automated workflows and have compliance data to show when needed.

For example, you can set up a system to auto-freeze compromised accounts. Once the account is frozen, RPA can automatically complete the steps in your fraud investigation process. The system also creates an audit trail in the process.

Unlike humans, RPA can be active 24/7. Using RPA in banking can help ensure the accuracy of compliance processes, ensuring you’re compliant at all times without investing a lot of human resources towards compliance.

7. Decision Making

Managers at financial institutions need to make decisions about marketing, operations, and sales, but relying on raw data or external research doesn’t provide full context. RPA can help compile and analyze internal data to track client spending patterns and preferences.

AI and RPA-powered automation can help make decisions about timing marketing campaigns, redesigning workflows, and tailor-making products for your target audience. As a result, you improve the campaign’s effectiveness, process efficiency, and customer experience.

For example, when introducing a mortgage loan product, you can use RPA’s data analysis capabilities to identify location-specific and borrower-specific risks. RPA can compile a summary of the risks on a document, allowing the credit manager to study risk profiles without the associated manual work.

Blanc Labs’ Banking Automation Solutions

Blanc Labs works with financial organizations like banks, credit unions, and Fintechs to automate their processes.

We can create tailor-made automation software solutions based on your banks’ needs to minimize manual work and improve process efficiency. Our team can help you automate one or multiple parts of your workflow using technologies like RPA, AI, and ML.

Book a discovery call with us to see first-hand how automation can transform your bank’s core operations. We’ll create an automation solution specifically for your organization that works in tandem with your current internal systems.