Finding the right API Management Platform

APIs are an integral part of today’s digital world. They are used for secure data exchange, integration, and content syndication. As APIs become more ubiquitous in enterprise businesses, it becomes necessary to manage them efficiently.

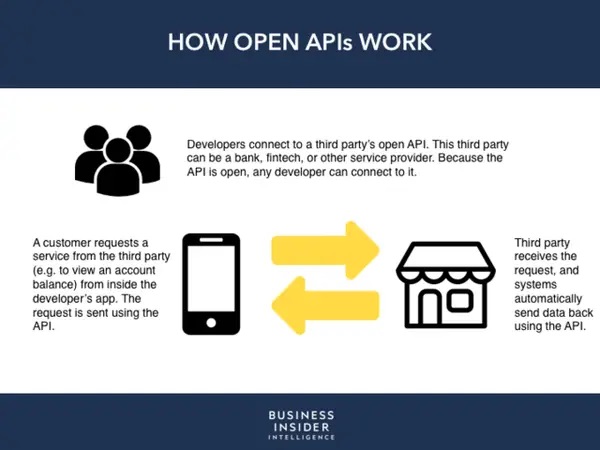

Banking and Payments ecosystems are converging with Open Banking and Finance. Whether regulatory or market driven, these digital interactions are happening already – and growing exponentially. Doing APIs and API Management right are central to the growing interdependence and interoperability between Fintechs, Banks and Consumers. Stakeholders are demanding secure access to financial data to drive better customer experiences. A key enabler to that end are the systems that surround APIs.

What is API Lifecycle Management?

API Lifecycle Management is the process of building, controlling, distributing, analyzing, and reusing APIs. It also can include capabilities around intelligent discovery; one pane of glass visible across multiple API gateways and API management systems; bringing to life the visionary end state of monetizing and marketing all these capabilities to external parties to operationalize the concept of “API as a product”. Thus, there are many API Management solutions in the market offering a variety of features. But at the very minimum, an API Manager should allow users to do the following:

Discover APIs

Before you can more effectively govern their lifecycle, you need a simple and configurable tool to find, filter and tag all your API assets into a centralized repository. Simplify complexity and/or get better visibility and facts to position your organization to “open itself up” to the new business realities and opportunities emerging.

Design, build, and Test APIs

The API Management tool should provide everyone, from developers to partners, the ability to create APIs under a unified catalog and test their performance.

Deploy APIs

API Management tools should also allow you to publish APIs on-premises, on the cloud or in a hybrid environment. Additionally, the API Manager may give you a choice between managing the API infrastructure in the tool itself or on your own.

Secure APIs

By providing a central point of control, most API Management tools will ensure that you have full visibility of all your APIs across environments so you can mitigate any vulnerabilities.

Manage APIs

API Management tools should give you a central plane of visibility into APIs, events, and microservices. Most API management tools will allow you to govern APIs across all environments (on-premise, hybrid, cloud) and also allow you to integrate with other infrastructures, including AWS, Azure, and Mulesoft. A good API management tool should also provide multiple predefined policy filters to accelerate policy configuration.

Analyze APIs

An API Manager should give you real time metrics in a unified catalog. By providing data on the business performance or operations across your APIs, you can make better decisions leading to improved business results.

Extend and Reuse APIs

By giving you a single, unified catalog, an API Manager can eliminate duplication and extend the life of APIs through reuse.

The need for API Management

API management centralizes control of your API program—including analytics, access control, monetization, and developer workflows. It provides dependability, flexibility (to adapt to shifting needs), quality, and speed. To achieve these goals, an API Manager should, at the minimum, offer rate limits, access control, and usage policies.

Essential features of an API Manager tool

1. API Gateways

A gateway is the single entry point for all clients and is the most critical aspect of API management. An API gateway handles all the data routing requests and protocol translations between third-party providers (TPP) and the client. Gateways are equally important when securing API connections by deploying authentication and enforcement protocols.

2. Developer Portal

The primary use of the developer portal is to provide a hub, specifically for developers, to access and share API documentation. It is an essential part of streamlining communications between teams. Typically, developer portals are built on content management systems (CMS), allowing developers to explore, read, and test APIs. Other features of a developer portal could include chat forums for the internal and external developer community and FAQs.

3. API Lifecycle Management

As the name suggests, API Lifecycle Management provides an end-to-end view of how to manage APIs. API Lifecycle Management is a means to create a secure ecosystem for building, deploying, testing and monetizing and marketing APIs.

4. Analytics engine

The analytics engine identifies usage patterns, analyzes historical data, and creates tests for API performance to detect integration issues and assist in troubleshooting. The information gathered by the analytics engine can be used by business owners and technology teams to optimize their API offerings and improve them over time.

5. API monetization and marketing

API management tools can provide a framework for pricing and packaging APIs for partners and developers. Monetizing APIs involves generating revenue and keeping the API operational for consumers. Through usage contracts, you can monetize the microservices behind APIs. An API management tool will offer templatized usage contracts based on predefined metrics, including the number of API calls. This empowers innovative external players to help drive your business in ways you have not dreamed up yet – and still do it securely.

How successful is your API management?

Now that we know the features of an ideal API management software, how do you evaluate its success for your API efforts? Here are a few ways to track your progress:

Speed

How rapidly can you launch your APIs to meet your business goals? Latency and throughput are ways to measure the speed of deployment. Other areas to measure speed would be onboarding and upgrading APIs.

Flexibility

Flexibility is the breadth of options available to developers when adopting APIs. The greater the flexibility, the higher the cost and effort to manage the API.

Dependability

How available your APIs are to developers. One way to measure dependability is downtime. Quota is another way to restrict how many API calls can be made by a developer within a certain timeframe. Enforcing quotas makes API management more predictable and protects the API from abuse.

Quality

Stable APIs with consistent performance reflect higher quality. It is a way to measure a developer’s satisfaction with the API.

Cost

The above four factors contribute to cost. If your API management software provides a better view of all your APIs, it will reduce duplication and costs. Reuse of APIs is another way that you can save costs.

How are you managing API complexity?

If you are a business leader concerned about how to meet market demand through the creation and deployment of APIs, or you would like to monetize and reuse your existing APIs and reduce costs, then you need structured API management.

In partnership with Axway, Blanc Labs offers a way to manage your APIs to bring maximum business value. Axway’s API Management Platform enables enterprises to manage and govern their APIs for developing and applying their digital services.

Book a discovery call with Blanc Labs to learn more.