The Transformative Power of Banking Automation

McKinsey expects machines to be responsible for up to 10% to 25% of a bank’s functions. The reasons? Banking automation minimizes the need for your team to work on repetitive tasks, allowing them to focus on high-profile and strategic aspects of the business.

Automation also improves accuracy, which can save you a ton of money — a major reason why 80% of finance leaders have implemented or plan to implement Automation (including Robotic Process Automation).

Curious about how banking automation can help? We explain everything you need to know about how automating your banking workflow can help reduce costs and improve efficiency.

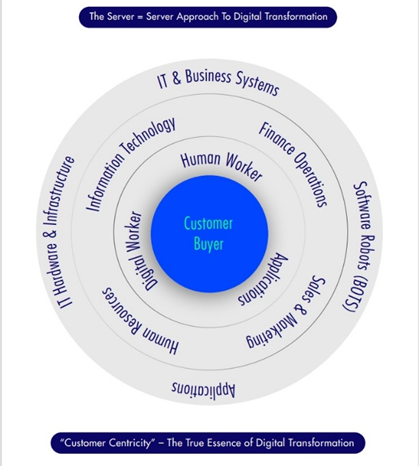

What is Banking Automation?

Banking automation involves using software powered by multiple technologies like AI (artificial intelligence) and ML (machine learning) to automate repetitive tasks. Automation has three primary benefits:

- Frees up your team’s time for more strategic tasks

- Improves process accuracy

- Improves the Customer Experience (CX) and the Employee Experience (EX)

For example, you can automate your account opening process. A customer requests a new account via the chatbot on your website. The chatbot provides an application form. The applicant fills out the form, and it’s sent to your RPA robot. The robot performs the basic procedures, including checking the credit score and KYC verification.

Next, the robot scans the applicant’s documents using OCR (optical character recognition) for data extraction. The robot matches the information in the documents and the application form. It flags any details that don’t match and sends them for manual approval.

The robot continues to validate uploaded documents using NLP (natural language processing). It finds key data points in the document’s free text, categorizes them, and uses them in the automated process.

The robot then updates the bank’s backend system to create a new business account, provided the customer’s data meets the bank policy. Once approved, the customer receives an automated welcome email.

Why Banks Need Banking Automation

Banks need automation to compete in the modern banking environment. Now, that’s a broad statement, so here are specific reasons why a modern bank needs automation:

- Allowing employees to focus on tasks that require a human touch: Most banks were set up long ago. Manual forms and workflows were a foundational pillar for legacy banks, and as a result, employees spend countless hours on things like data entry and account verification. Automation allows employees to “hand over” repetitive tasks to software, freeing up their time for high-profile tasks that require a human touch.

- Record management: RPA can generate and check expense records for compliance. It auto-logs all transactions and prepares the necessary financial records to get an overview of your business’s financial performance and position.

- Meeting customer expectations: The need for speed is a key driver of a modern customer’s experience. If you’re taking too long for basic operations like opening a bank account, you’ll lose customers fast. Automation can help speed up your processes and help deliver on your customer’s expectations.

- Faster customer support: Your customers hate waiting hours to get an answer. Automating your support using RPA helps you respond faster. You can answer customers’ questions at scale using a chatbot. Also, you can use an AI-powered chatbot to answer questions you haven’t added as an FAQ.

These factors make automation more of a necessity than a nice-to-have — you need automation to compete neck-and-neck with other banks.

How Banking Automation Can Transform Your Bank

Transforming your bank’s value network with automation offers many benefits in various business aspects, including finance, legal, and customer experience. Here are the benefits of using RPA in banking:

Banking Automation Leads to Efficiency

You can improve productivity by up to 80%, especially if you identify the most impactful productivity levers. The efficiency improvement is a result of two factors:

- Low manual effort: Employees have more time available once they hand over repetitive tasks to software. They can do more in the same amount of time, helping you scale your operations.

- Improved accuracy: Errors are expensive because you spend time and resources on correcting the errors. Fewer errors = improved productivity.

A great example of efficiency is automated document processing. As a banker, you probably spend a good number of hours reading documents and inserting relevant data into your systems, depending on your role at the bank. However, you don’t have to spend all those hours manually entering data if you use intelligent document processing.

Better Customer Experience

An average company takes over 12 hours to respond to customer service requests. That’s a recipe for dissatisfied customers, especially if you’re a financial institution.

Your customers expect their money to be in the hands of a reliable entity, and guess what you communicate when you don’t answer customers for over 12 hours?

Using RPA to automate your customer support helps minimize response times. In most cases, the chatbot can provide real-time answers to the most commonly asked questions.

Speed is also critical for other client-side processes. For example, you want to be as fast as possible in opening accounts, processing personal investment requests, or enabling additional services for an account. Automating these processes (while ensuring accuracy) helps improve customer experience.

Compliance and Risk Reporting

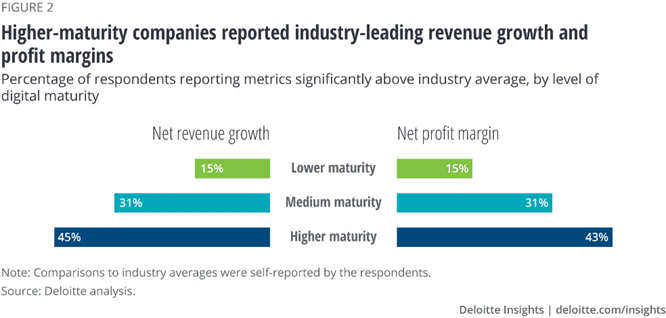

According to Deloitte, the cost of compliance for retail and corporate banks has increased by over 60% since the pre-financial crisis spending levels. Non-compliance is even more expensive, but automation can help lower your spending on compliance.

RPA builds compliance into your processes. Automating compliance ensures you’re always meeting regulatory requirements without requiring teams to spend extra time double-checking for compliance.

Automation also creates an audit trail and automatically generates risk reports that give you added insights. The system can identify and flag suspicious activities so that you can investigate them.

Reduced Costs

It’s easy to see how banking automation using RPA can reduce costs. Reduced administrative load, saving time on repetitive tasks, and speeding up processes all yield dividends.

For example, Radius financial group reduced loan processing costs by 70% by using AI to automate their process.

Banking automation also removes human error, so you’ll spend less on fixing those mistakes.

Without automation, you’d need to invest a large amount of money in building more teams as you scale. However, automation empowers you to scale faster. You can continue investing in training current teams and save on costs you’d incur to accommodate a larger workforce.

Automation and Adaptability

Banking automation helps banks adapt faster to a client’s needs or the business environment.

For example, the increasing popularity of Fintech is one of the most significant concerns for banks. Fintechs are quickly gaining market share at the expense of legacy banks. Customers appreciate how a fintech offers better, faster services.

Fintechs aren’t the only factor banks need to consider, though. Your bank might want to integrate banking solutions with a new partner’s ecosystem to offer additional services like tax consulting. Or your bank needs to process offshore transactions faster, especially when the transaction is subject to jurisdictional restrictions on the amount of transfer allowed.

Adaptability is critical for banks to succeed, and automation can make adapting to changes seamless. Implementing an automation solution will improve your adaptability to changes and allow you to quickly catch up with your modern competitors.

The Bottom Line

Over the past five decades, banking has gone from paper-based to almost entirely digital. Next up? Automation.

Automation makes banking frictionless for both internal and external stakeholders — it’s a win-win. The only problem banks face with automation is the lack of a reliable partner who can guide them through the transformation journey. Book a discovery call with us, and we’ll answer all your banking automation questions.