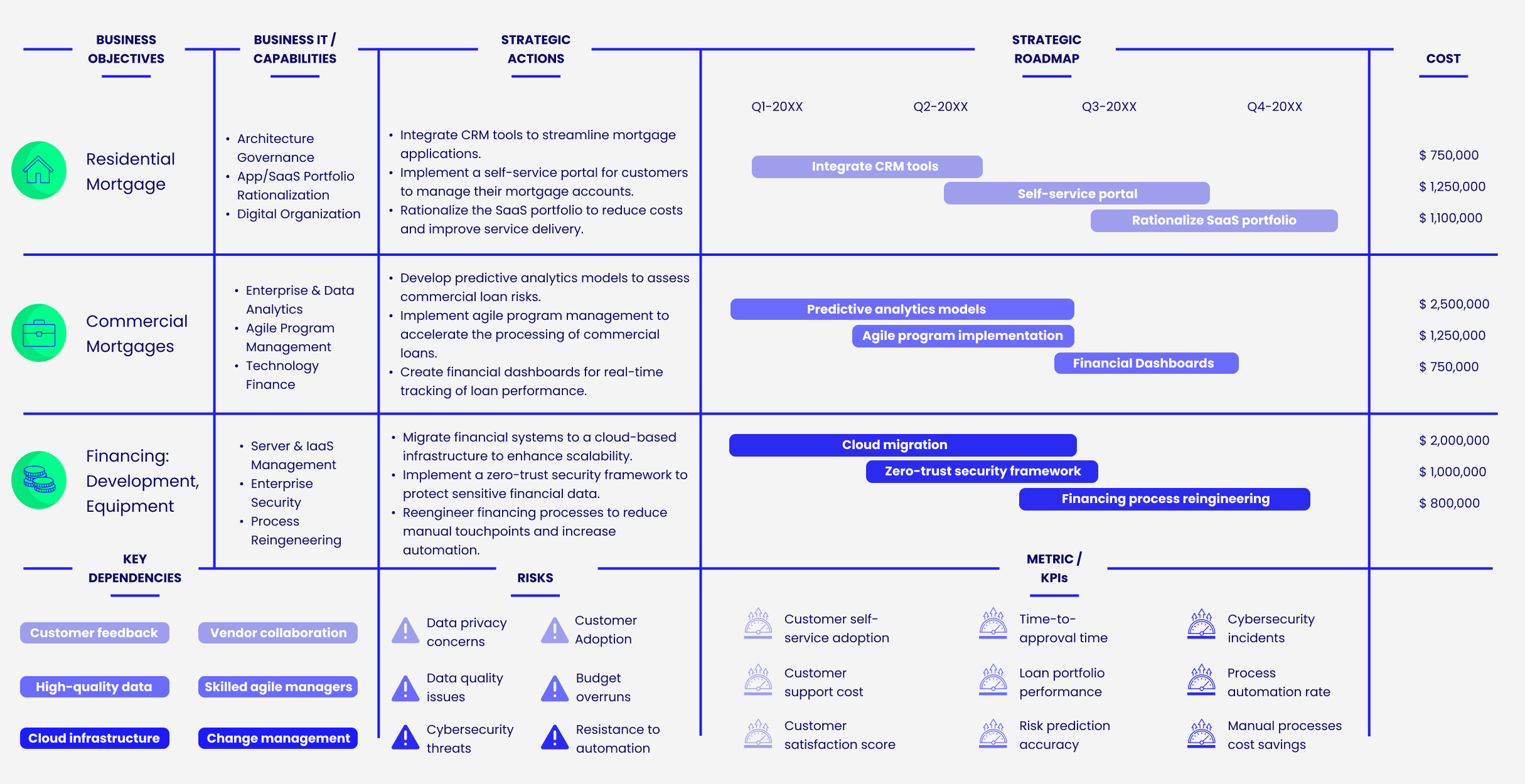

IDP SOLUTIONS

The Future of Document Processing Is Here.

With over five years of IDP experience, we are experts at collecting, classifying, and extracting data from semi-structured and unstructured documents. Paired with best-in-class document management solutions, we help companies streamline and automate time-consuming and manual processes to improve customer experiences and deliver operational efficiency.

BENEFITS

Introducing Kapti for Lenders

Deliver an enhanced customer experience and streamline your business operations with our powerful, flexible, and scalable solution. Kapti coordinates tasks between different channels, systems and business functions.

- Low Code/No Code Workflow Orchestration

- Powerful Intelligent Document Processing Capabilities

- Secure Document Storage and Management

Unlock Enterprise Efficiency with IDP

Intelligent document processing is the next generation of automation, able to capture, extract, and process structured data and unstructured data from a variety of document formats using a combination of technologies, including natural language processing, optical character recognition, computer vision, and machine learning.

Whether it’s mortgage origination or claims, intelligent document processing can easily extract unstructured data from scanned documents or physical documents. Once the data is extracted, you can effortlessly retrieve the data anytime, anywhere, through a dedicated cloud repository.

IDP has the dual advantage of improving customer service and boosting employee productivity by saving time and increasing accuracy. That means more applications are processed quicker. Customers can enjoy faster turn-around times, and employees can be freed up to focus on strategic tasks.

Unlock Business Benefits with Advanced IDP Solutions

AI-Enabled Extraction

Traditional OCR alone may fall short in achieving optimal extraction accuracy with unstructured documents. Blanc Labs addresses this challenge by integrating AI technologies into your existing platform or developing an AI-native platform specifically designed for document extraction that suits your enterprise process best.

Through seamless integration of natural language processing, deep learning, computer vision, and machine learning, an AI-enabled platform excels in extracting data from unstructured documents.

Document Classification

Categorizing documents prior to data extraction is a crucial step, but manual classification can be time-consuming and resource-intensive. Our IDP solution can effortlessly split a multi-document PDF into separate files or extract specific pages from documents as needed.

With our robust classification capabilities, your operations team can upload a file containing a variety of documents, allowing the system to automatically separate and classify documents with precision and efficiency. By automating classification, you can improve processing speed, reduce cost and minimize errors.

Unstructured Data Processing

Blanc Labs’ IDP solution is designed to cater to all your data processing needs, whether it is structured data, such as Excel sheets and forms, or unstructured data, like images, emails, and open-ended forms.

By leveraging automation, our IDP solution ensures the accurate handling of a wide range of business documents, resulting in fewer documents requiring manual correction. This significantly reduces staff workload and brings you closer to achieving straight-through processing, optimizing your operational efficiency.

IDP as a Service

We offer IDP as a Service, allowing clients to leverage our secure cloud-hosted IDP APIs. Our comprehensive solution supports both standard and custom document types. Hosted on Blanc Labs’ SOC2-compliant cloud infrastructure, our IDP platform guarantees exceptional performance, robust security measures, high uptime, and reliable support. Supported services include classification, extraction, and redaction.

Our IDP Engagement Model

Document Processing Use Cases

Mortgage Underwriting

Whether you offer a digital direct or broker-based mortgage channel, automating your origination and underwriting workflow will allow you to eliminate the need for manual data entry, allowing you to scale through periods of high-deal flow and, most importantly, dramatically improve mortgage underwriting speeds.

KYC Process Automation

Implementing IDP ensures accuracy, safeguarding your reputation, and preventing fines resulting from non-compliance with Know-Your-Customer (KYC) regulations. By embracing end-to-end automation of the KYC process, your organization can benefit from enhanced quality assurance, improved customer experience (by reducing frequent customer outreach), and an increased number of cases processed per month.

Insurance Claims Processing

Managing the claims processing workflow can be intricate, especially considering the diverse formats in which claims data is received—ranging from Word files and PDFs to images. Additionally, data arrives through multiple channels, including email, scanned documents, and physical documents, further adding to the complexity.

An IDP solution built with artificial intelligence and machine learning can make claims processing workflow more efficient by routing the necessary information to the appropriate enterprise systems while surfacing the most critical information for human-in-the-loop decisions.

Customer Onboarding

Customer onboarding plays a crucial role in setting the tone for your relationship with clients. During the onboarding process, customers are often required to upload diverse document types, such as credit reports and tax returns.

IDP tools are designed to handle a variety of document formats and types seamlessly. By implementing IDP, you can reduce onboarding costs and free up your staff from manual document processing, ultimately streamlining the entire onboarding process and providing a compelling customer experience at a critical phase in the customer journey..

Intelligent Document Processing Insights

What is an intelligent document processing solution?

An intelligent document processing solution automatically extracts data and processes it from various documents/sources using AI techniques, OCR, machine learning, and computer vision, eliminating manual data entry, reducing errors, and enhancing operational efficiency.

How does intelligent document processing work?

Using advanced technologies such as AI, natural language processing, OCR, machine learning, and computer vision, IDP automates the extraction and processing of data from documents, capturing, classifying, extracting, validating, integrating, and learning from them.

What is the difference between OCR and intelligent document processing?

OCR converts scanned or printed text into a machine-readable format, while IDP combines OCR with other AI technologies to extract meaningful information from documents and offers a more comprehensive solution with advanced capabilities for data interpretation and analysis.