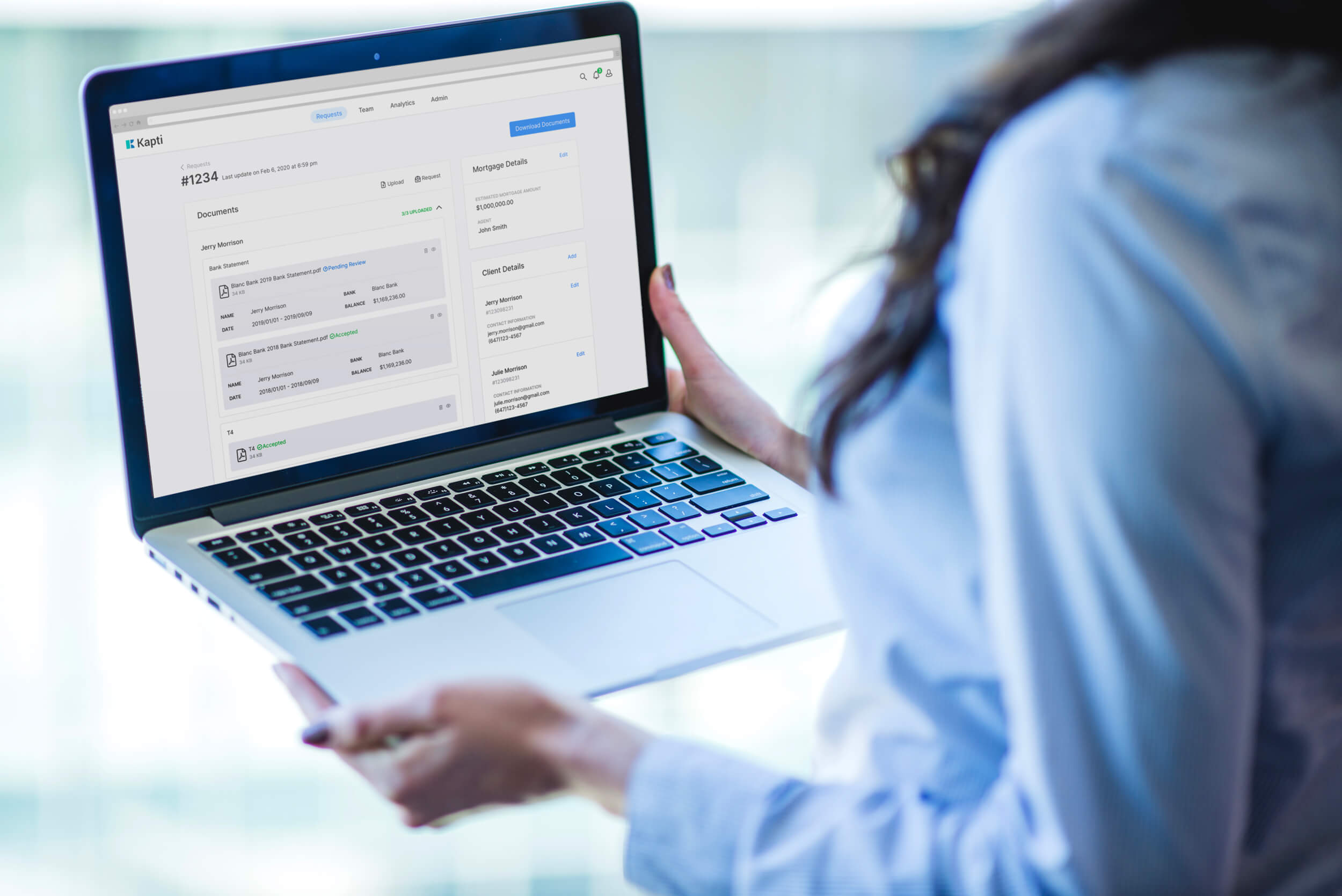

Transform your organization’s loan processing experience today

Kapti is an AI-powered document management solution designed to streamline loan origination and underwriting workflows for brokers, lenders, and financial institutions. By automating document capture, data extraction, and validation for critical documents like employment letters, bank statements, and payroll receipts, Kapti speeds up loan processing and enhances accuracy. The platform offers intuitive dashboards, real-time alerts, and deep analytics, helping users make informed decisions, maintain compliance, and optimize business insights, all while reducing resource use and improving customer experience.

1. Map to your Existing Processes

◉ Powerful low-code tools enable quick mapping of existing workflows.

◉ We integrate with existing systems across all channels, including email.

◉ This becomes the jump off point for ingesting documents, coordinating & automating tasks, and integrating third party data.

2. Say goodbye to broken and manual processes

◉ Streamline processes and automate manual tasks to enable business scalability and efficient operations.

◉ Apply AI enabled document understanding, classification and extraction and integrate with core systems.

◉ Kapti has pre-trained models for all lending documentation.

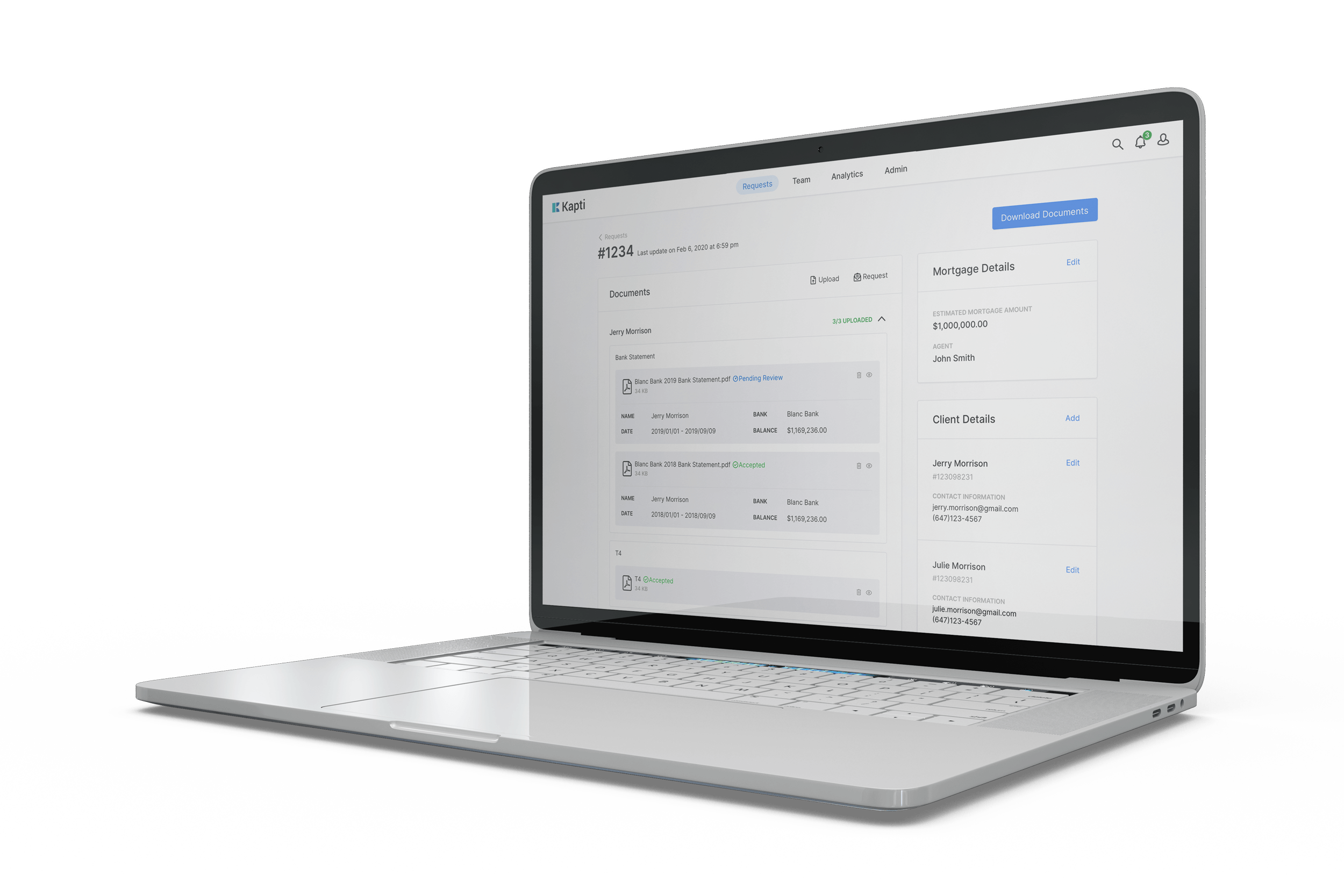

3. Document Management & Secure Storage

◉ Documents are automatically classified, labelled, sorted and stored in a secure infrastructure.

◉ Manage permissions to user access and the ability to allow customers to self-manage their documents

◉ Integrate with existing enterprise tools: CRM, LOS, LMS, DXP etc.

◉ Secure document storage satisfies compliance requirements

Kapti automates the tedious process of document capture, data extraction, and validation, reducing the need for manual input. This streamlines loan origination and underwriting workflows, enabling teams to process more applications faster, with fewer errors, while significantly reducing turnaround times and operational costs.

Kapti’s user-friendly interface and real-time alerts create a smoother experience for both customers and employees. Borrowers benefit from faster approvals and reduced paperwork, while employees can focus on higher-value tasks rather than manual data processing, leading to increased satisfaction on both sides.

By leveraging AI-powered data extraction and validation, Kapti minimizes the risk of human error, ensuring accurate data collection from critical documents. This leads to more reliable decision-making in underwriting and compliance processes, ultimately reducing the risk of costly mistakes.

Kapti seamlessly integrates with existing loan origination systems, CRM platforms, and other financial technology stacks. This allows organizations to centralize data and workflows across multiple systems, enhancing collaboration, data sharing, and operational visibility without disrupting existing infrastructure.

Kapti ensures that all captured data meets industry-specific regulations and standards, such as AML and KYC. Automated document validation and audit trails help institutions stay compliant, minimizing the risk of non-compliance and costly penalties.