Key Insights on Consumer Driven Banking in Canada

Insights Summary

Insights Summary

Open Banking matters to a diverse group of stakeholders

The questionnaire responses came from a broad cross section of participants showing a diversity of perspectives related to Open Banking.

The largest groups of respondents identified as FinTechs and Federally Regulated Financial Institutions.

We also heard from Commercial and Alternative Lenders, Payments Services Providers, Technology Services Providers and Consulting /Law Firms.

This group is bullish on Open Banking, and ready for it

63% were Positive to Very Positive in their reaction to Consumer Directed Banking being highlighted as a priority in the Federal Government 2023 Fall Economic Update.

87.5% believe Consumer Driven Finance/Open Banking will be Impactful or Very Impactful to their core business offerings, customer experience and growth strategy.

Just under 75% of respondents said they are strategically ready for open banking.

From a technology readiness perspective, 68% said they are Ready or Very Ready to move forward with Open Banking. This could include having adopted Open API Standards, working with an Open Banking Utility like Flinks, and building products and services that promote financial data portability.

Interested in learning more about Open Banking readiness from a technology perspective? Blanc Labs has created a free resource on Open Banking Technology Architecture.

Open Banking will deliver on its core promises

Benefit Banking Customers

90% believe that Open Banking will allow Canadians to have greater access to innovative products & services and help them achieve better financial outcomes.

Promote Competition

90% agree or strongly agree that consumer driven banking will enhance competition within the financial sector.

Consumer Driven Banking is bigger than Open Banking

97% of respondents said Payments Modernization is an important component to realize the positive impacts of a Consumer Driven Banking. Initiatives such as adopting Real-Time Payments and making changes to our payments landscape cannot take a backseat to Open Banking.

Fair Access and Transparency are ‘Must Haves’

Over ½ of respondents said Fair Access to Financial Infrastructure is the most important factor to promote a level playing field amongst ecosystem participants.

78% feel that it is important to have regular Public Reporting on Concentration and Competition in terms of how Consumer Driven Banking initiatives get rolled out in Canada.

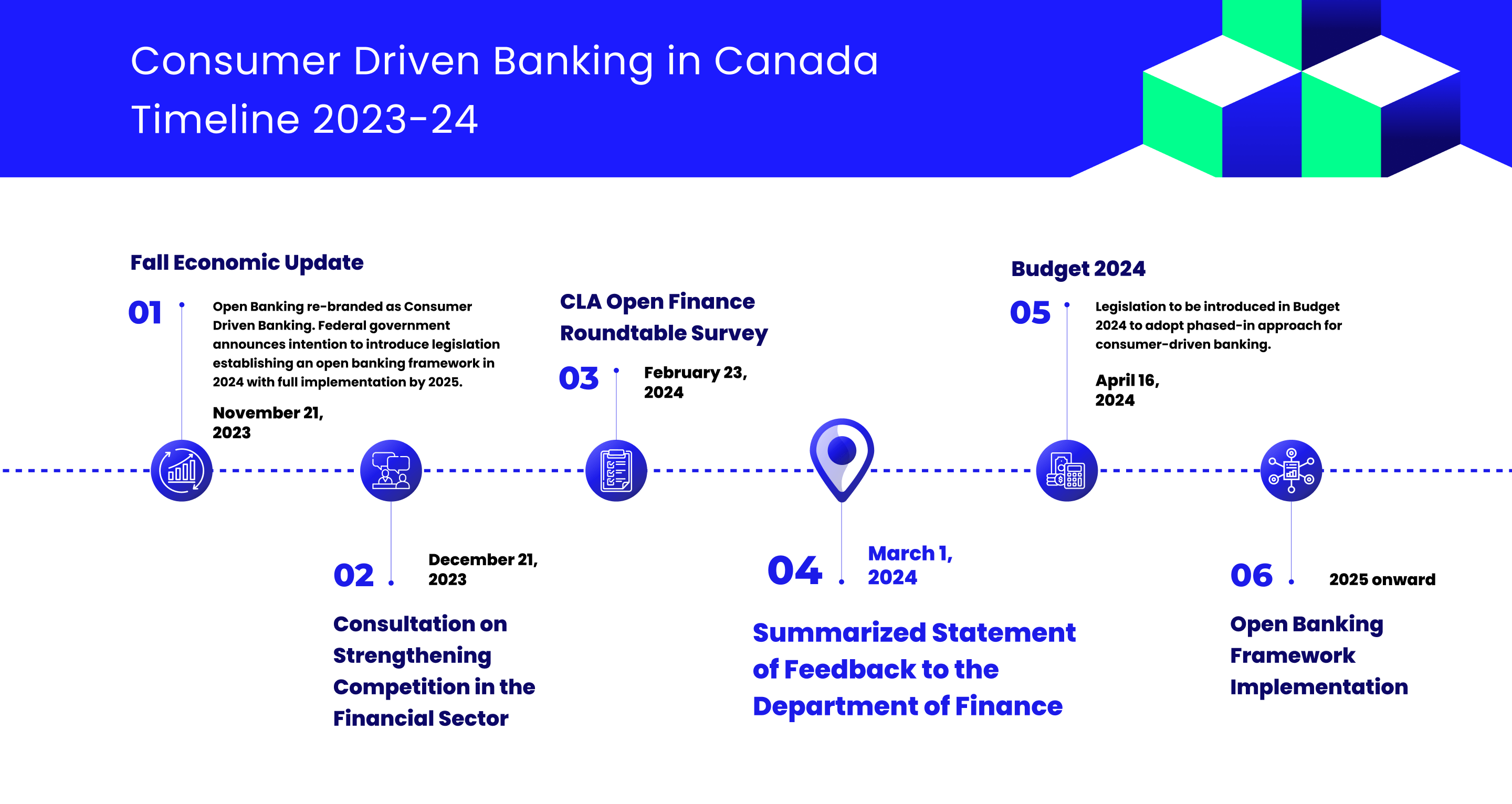

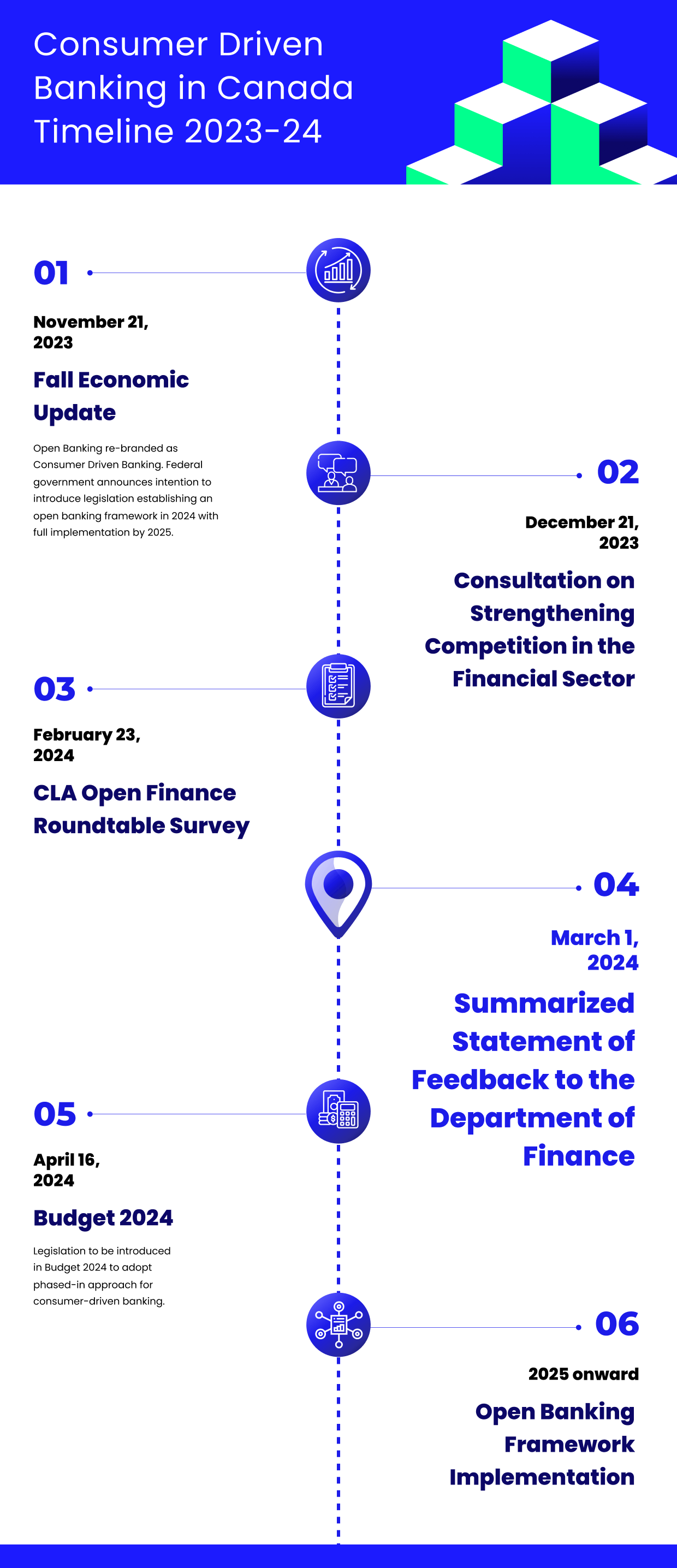

Open Banking in Canada in 2024 and Beyond

Findings from the Blanc Labs x Canadian Lenders Association (CLA) survey underscores the enthusiasm and readiness of a diverse range of industry stakeholders towards the adoption of open banking, as well as a collective recognition of the potential benefits it holds for consumers and businesses alike.

With a majority expressing confidence in the impact of open banking on their core business offerings and growth strategies, coupled with a strong belief in the industry’s ability to deliver safer access to innovative financial products and services, the stage is set for a transformative shift in Canada’s financial landscape.