Why Banks Need Intelligent Document Processing

By Charles Payne and Donald Geerts

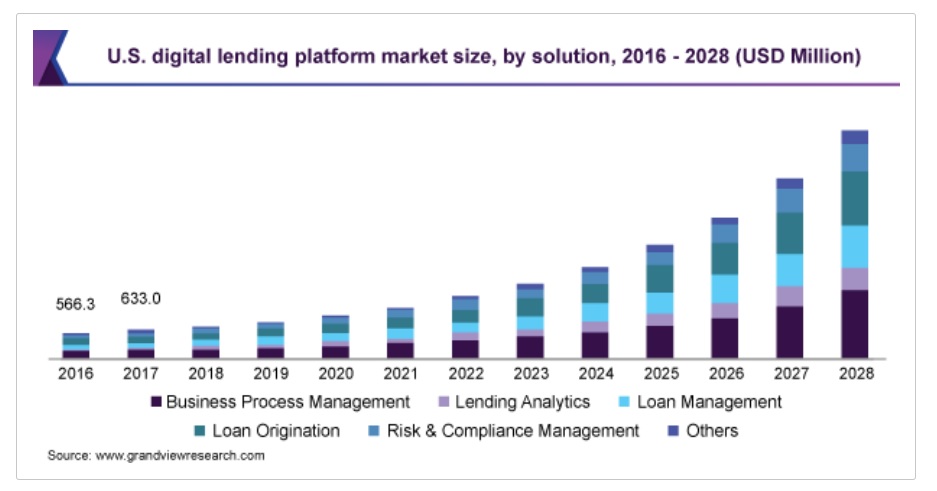

In the last two years, we have witnessed a consumer engagement revolution. The pandemic has seen a rush toward digital channels in all facets of life, including the banking industry. The need for instant gratification and round-the-clock support means that lenders must process customer or broker requests faster while balancing security, compliance, and risk management. Data released by the Canada Mortgage and Housing Corporation (CMHC) suggests that in the first half of 2021, the mortgage industry in Canada saw its fastest growth in the last 10 years. Given the rising demand of the market, the “need for speed” in the loan origination and decisioning process is at the top of the list.

Staying ahead of the competition requires a digital transformation that often begins with intelligent document processing as the first step. Financial institutions must partner with the right intelligent document processing (IDP) solution provider that will deliver both speed and accuracy to meet consumer expectations.

Tedious and time-consuming processes

The process of mortgage approval or renewal involves many, many documents. Before a mortgage is even approved, a mobile mortgage lender must collect and organize documents (sometimes handwritten), send them to various personnel in the financial organization to be vetted, and finally return to the customer with a yes or no—a process that can take up days or weeks. If a bank takes too long to respond to a borrower, they may turn to offers from other lenders. Such a situation is easily avoided with the help of intelligent document processing. Once a document is received, the right IDP program can classify it, extract data from the document, and store the data in a way that is accessible around the clock, not just to employees of the lender but to RPA (robotic process automation) processes as well. If additional documents are required, the RPA process can notify the mortgage agent or borrower. If the application is complete, then the RPA can send the data ahead for auto-decisioning. Using IDP in combination with RPA can ensure a quick turnaround on an application without consuming too much time.

Organizations with no digital document processing reported 10x more at-risk customers and 2x more at-risk revenue compared to other companies. (Forrester, 2020)

Inability to scale

One way to address the growing demand for mortgages is to hire, train and retain more employees. However, increasing the size of the team may result in a higher time to value (as new employees will take time to ramp up to desired levels of efficiency) and increased costs too. Lenders can benefit from IDP solutions that may be scaled up quickly with a marginal infrastructure cost.

Just digitization isn’t enough

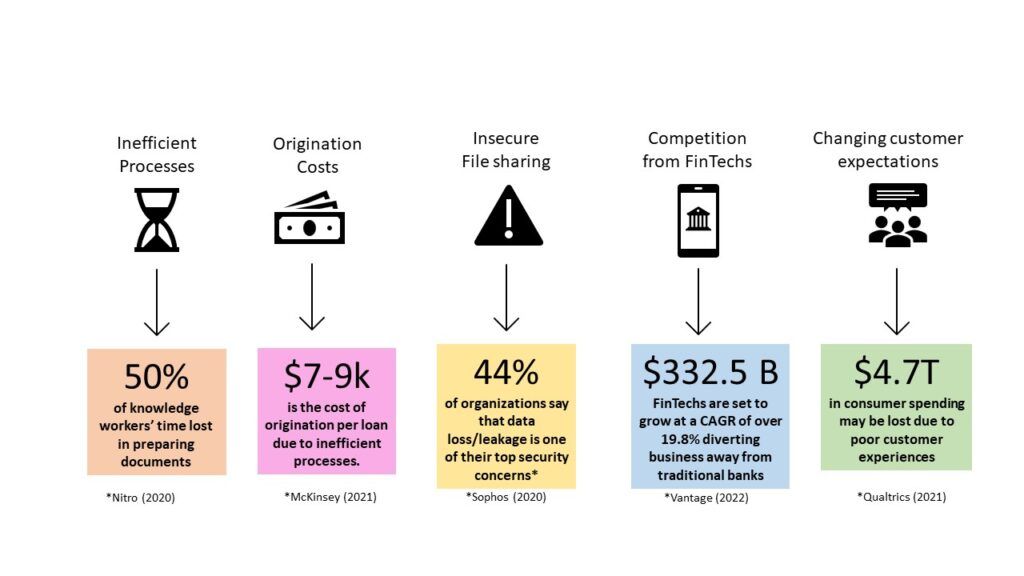

Many lenders today receive applications through mortgage portals. While the first step of digitization of documents is taken care of, banks do not follow through to ensure the proper classification, extraction, and storage of these documents. As a result, an employee must still go through the documents to verify and authenticate their contents to ensure they are adequate for an application. It is no surprise that knowledge workers lose 50% of their time preparing documents and therefore, experience a 21% loss in productivity because of document issues.

Security and risks

Worldwide, the digital fraud attempt rate grew by 52.2% in 2021 compared to two years earlier. Banks or financial institutions that do not have intelligent document processing capabilities may be caught off guard or may not be able to respond in time to stop transactions. IDP, on the other hand, can reduce the incidence of fraudulent transactions by assessing large volumes of historical data accurately and in real-time. By identifying the patterns, an automated system can immediately flag a suspicious transaction and stop it if necessary.

KYC is another area where IDP software can help by minimizing human error. The IDP program can read submitted documents, verify the identity and details of the customer by searching through data repositories and even assign them a risk score, thereby helping the lenders meet regulatory standards.

Unaligned with consumer demands

Unsatisfactory products and fees, slow response to problem resolution, and a lack of convenience are some of the top reasons why financial institutions are are losing out to FinTechs and digital-only banks. One of the biggest contributions IDP can make is to automate repetitive manual tasks and free up lenders employees’ time in activities that will increase customer satisfaction—building trust & rapport and enhancing product offerings.

Automate document processing with Blanc Labs

There are many reasons why banks need intelligent document processing, and Blanc Labs provides a 360-degree IDP solution that can:

- Automate workflows for document collection, digitization and analysis

- Replace manual effort through intelligent data capture

- Connect with third party data providers for analysis and insights

- Analyze document data, provide status alerts, and flag fraudulent entries

- Secure documents in a drop box

- Deploy on premises, in the cloud or as a hybrid model

Book a demo or discovery session with Blanc Labs to learn about the impact of our IDP solutions for banking.