Now, more than ever, banks are looking at ways to modernize their core technology to meet customer demands for speed, personalization, and seamless digital experiences. For the banks, a large part of that involves securely exposing customer data to third-party systems and consuming data from them. A simple example of this is using your bank credit card to pay with an app such as Google Pay or Apple Pay. For this data exchange to take place, banks build their own application programming interfaces (APIs) or use third-party APIs to interact with other systems. From a digital transformation viewpoint, APIs are indispensable in making banking services more open.

A study on APIs in banking by McKinsey found that nearly 70% of the surveyed banks planned to double the number of internal and third-party APIs and triple the use of public APIs. However, not all API integrations are successful. Close to 40% of the banks mentioned above did not have an API strategy or were still evaluating APIs. Mismanagement of APIs only increases operational issues, decreases productivity, pulls up costs, and delivers incremental results at best. Here we explore five API integration challenges and how to overcome them.

API Integration Challenges

Put simply, APIs are supposed to make it easy for disparate systems to work together. But poor integration can have the opposite effect, leading to silos, duplication of efforts, and rising costs. Some of the API integration challenges include:

- Technological Complexity

- High Costs

- Security Risks

- Time Consumption

- Varying systems

Technological Complexity

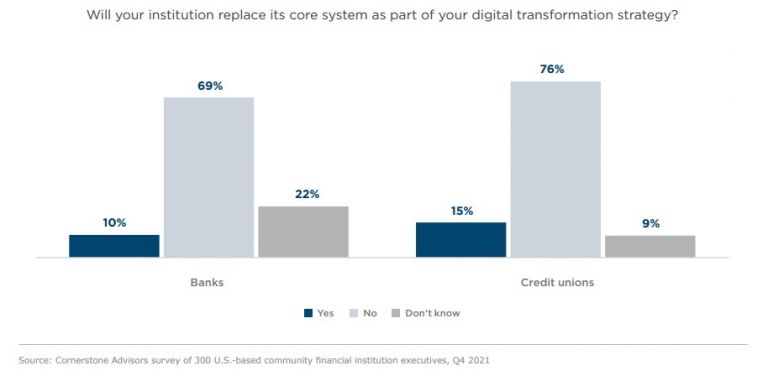

API integration is not an easy process. In fact, of all the digital transformation initiatives, API integration may be the most daunting. The reason for this is that integrating APIs requires an overhaul of the bank’s core systems. Understandably, many banks and credit unions are reluctant to change their core systems in one go as seen in the chart below. Yet, 75% of banks state that the number one reason for focusing their corporate banking strategy on APIs is “improving internal corporate banking processes, workflows and product management.”

To carefully integrate APIs while upgrading core systems at a pace that is suited to the bank requires a team of experts including highly skilled developers that come with a heavy price tag.

High Costs

Hiring a team of experts to execute APIs is only one part of the cost of integrating APIs. The question for many financial institutions is one of build or buy as this requires significant financial resources, a dependable developer ecosystem, as well as a strategy to monetize these APIs so current costs may be justified. Building a single API can cost upwards of $10,000 (as of 2020) depending on the complexity of the integration and the times it takes developers to build it. Buying APIs may come at a lower cost. Either way, there is no getting around the expense of building APIs and integrating them with core systems.

Security Risks

In Canada, the number of stolen records went up by 4,379% between 2015 and 2020. A data breach in Canada costs approximately $6.35M CAD. The use of APIs is reliant on web-based applications, which means that they are more open to threats from hackers and ransomware. Add to this the fact that a data breach can severely damage the reputation of an organization. API integration projects require hiring a team of security experts as well as updated security protocols.

Time Consumption

Setting up an API connection and integration module can take anywhere from a few weeks to months. This is the time when the development team will learn the logic and architecture of your platform and work to reduce bugs, among other things. Financial institutions that choose the wrong API solution may find that they are losing out to the competition by coming in last.

Varying systems

Within APIs and API systems, there are all kinds of architectures and software. Every system has its own logic and therefore each integration has its unique challenges. With every new system that developers work with, they need time and expertise to integrate APIs with those systems. Therefore, with multiple integrations, the process does not get faster and only becomes more complex

How to overcome API integration challenges

API integrations are a necessity as we move towards an open banking system. Financial institutions must have a clear strategy on how they want to implement, govern, monetize and market APIs to avoid high costs, duplications, and incremental gains.

Blanc Labs has partnered with Axway to provide specialized solutions that make API integrations more efficient and cost effective. Benefits of our unified API platform include:

- Increased productivity, as developers are easily able to find and repurpose APIs instead of duplicating efforts or wasting time searching for them.

- Less technical complexity by unifying and simplifying API services across the organization

- Better security through a unified view of all APIs

- Faster upgrades of legacy systems through an API-first layer allowing you to add new services more easily

- More robust governance through centralized documentation that multiple teams of developers can reference

Book a demo or discovery session with Blanc Labs to learn about the impact of our API solutions for banking.