…And How to Keep Up with Digital Natives

by Bob Paajanen and Charles Payne

The way we bank has changed forever. While FinTechs have the latest technology innovations, what they don’t have is decades-worth of relationships with customers and large swaths of Big Data. Financial institutions need to recognize this advantage, leverage their data, streamline processes, and thereby empower their relationship managers if they want to compete with their new-age rivals.

Mismanagement of Data

Most financial institutions have multiple customer-facing systems that operate in their own silos. As many as 50% of banks and credit unions state that they have trouble accessing their internal data. Without a single unified view of their customer, banks and credit unions are unable to collect, process, or indeed deploy insights that will enable them to cross-sell products and services to their customers.

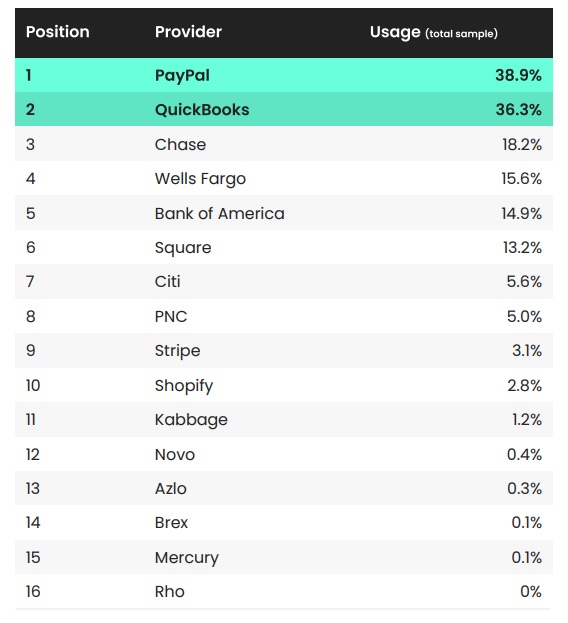

The services gap left by financial institutions is especially felt in commercial banking where FinTechs are sweeping up SMBs with targeted products and quicker access to funds. A prominent example of this trend is Shopify, which started out as an e-commerce platform, but is now the tenth-largest provider of financial services to SMBs. Another example is Stripe, which has created an end-to-end lending API (application program interface) as its next offer to SMBs.

Paper-heavy processes, and disparate data management systems are some of the major causes of this issue. As the finance industry moves toward open banking, it is imperative that financial institutions unlock the value of their data and translate it into actionable insights so they can improve their languishing businesses.

Lack of Efficiency

A 2019 Gartner report estimated that process automation, including document processing, could save financial institutions 25,000 hours of avoidable work per year. With advances in technology in the last three years, it is not hard to imagine that this number may have gone up even further.

Most of the productivity loss mentioned above has been attributed to human error. This is hardly surprising when many financial institutions continue to use paper-heavy loan origination models. Without automation, document processing is rife with efficiency and security issues including document mishandling, collaboration on email (generating multiple copies of the same document), versioning issues, loss of time to find the documents when required, a lack of compliance, and a lack of remote access.

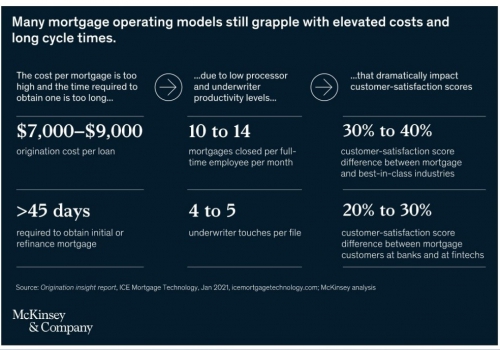

Since the pandemic, consumer expectations have changed dramatically. Close to 60% of customers today are open to completing their mortgage applications entirely online without support on the phone or in person. Even more pressing than the platform, is the need for speed, with customer satisfaction falling 15 percentage points for approvals that take longer than 10 days.

With unprecedented demand for mortgages, financial institutions must speed up intake, underwriting and decisioning processes faster if they want to keep the customer’s business.

Costs

Inefficient loan origination processes lead to rising costs. On average, loan origination costs $7-9k per application. That is over and above the cost of productivity loss, estimated to be $878,000 (for 25,000 hours lost per year) for a company with a 40-person finance team. This cost is invariably passed on to the customer who may end up paying higher fees and charges compared to what they might pay if they opted for a non-banking entity.

The FinTechs Are Coming… And how to slow them down

As a result of service gaps and inefficiencies, customers from both commercial and retail banking have been veering towards nonbanking entities for loans. 50% of Canadian SMBs in 2021 felt that they couldn’t maintain their growth strategies “due to a lack of capital.” Today, nonbanking entities, account for more than 70% of total originations. By using automated processes and digital interfaces, non-banking entities or FinTechs are 25% cheaper than the industry average and can deliver a decision 30% faster compared to other financial entities.

In the age of Open Banking, it is important that financial institutions update their legacy processes and unlock the potential of their data if they want to survive.

The automation journey begins with intelligent document processing. Blanc Labs provides a 360-degree IDP (Intelligent Document Processing) solution that can:

- Automate workflows for document collection, digitization, and analysis

- Replace manual effort through intelligent data capture

- Connect with third party data providers for analysis and insights

- Analyze document data, provide status alerts, and flag fraudulent entries

- Secure documents in a drop box

- Deploy on-premises, in the cloud, or as a hybrid model

Book a demo or discovery session with Blanc Labs to learn about the impact of our IDP solutions for banking.